ASX 200 rallies to end a tough month for stocks

WHAT MATTERED TODAY

I was at fathers day breakfast this morning and a picture of Boris Johnson flicked up….my 8 eight year old asked if that was Donald Trumps son! Classic call. Happy Fathers day to all the dads out there…

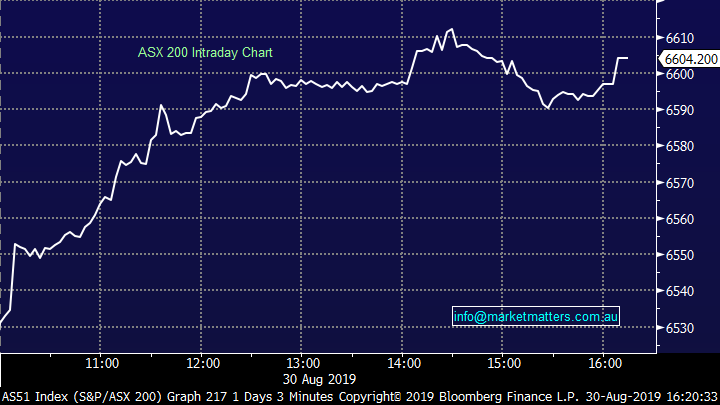

The final trading day of August and the market put on a strong performance to finish up on the day, the week but not the month.

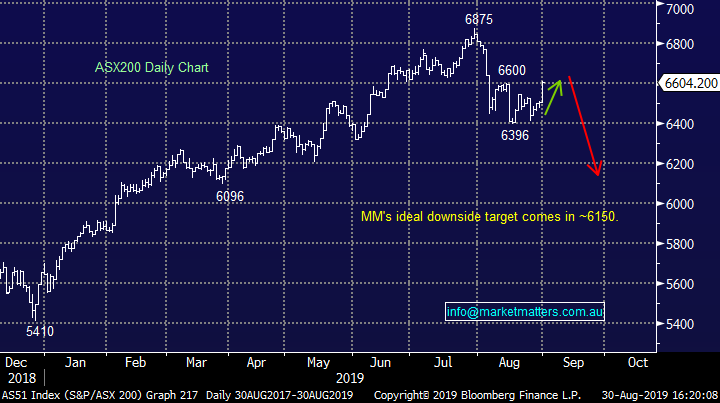

At the index level, the market did finish around mid range after hitting a 6396 low, before closing today at 6604.

Stocks in Asia were also strong today while US Futures were only marginally higher during our time zone – Iron Ore Futures rallied providing a decent backdrop for stocks locally. Comments from the Chinese Trade Minster saying that conflict won’t benefit either side in these trade talks seemed to do the trick – its amazing what happens when calmer heads prevail!

On the economic front today, building approvals were weak both month on month and year on year which put pressure on the Aussie Dollar + its supportive of lower rates, which the market liked hence the buying accelerated post this release.

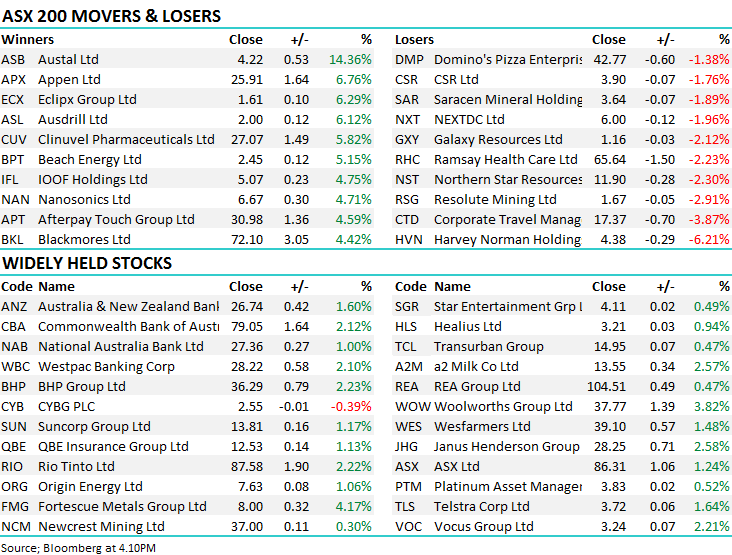

Harvey Norman (HVN) reported today, the last cap off the rank and while the trends in the business actually seemed to be improving, particularly the growth in the international operation, shares closed down -6.21% after a strong run up in recent months.

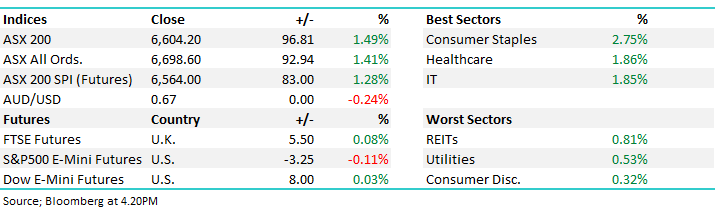

Overall, the ASX 200 added +96pts today or +1.49% to 6604, Dow Futures are now trading up +8pts /+0.03%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Monthly Performance – Sectors

The healthcare stocks provided most support in August, strong results from some of the majors headlined by CSL which is such an influential member of the sector composition while it also accounts for more than 5% of the broader ASX 200. Real

Estate stocks were also strong while the sectors exposed to global growth, namely the materials & energy sectors were sharply lower – we used this weakness in resources to add BHP, RIO & FMG to the MM Growth Portfolio.

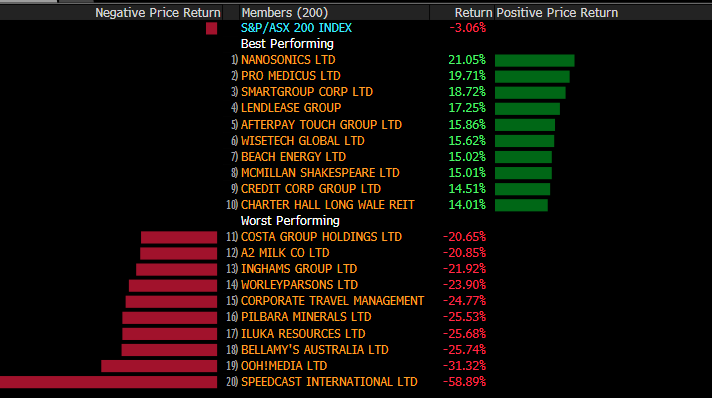

Monthly Performance – Stocks

Some big stock volatility during August with Speedcast (SDA) the main casualty, although ~20% moves seemed to be fairly customary during the period at various stages. Nanosonics (NAN) took the gong as top pick adding +21%.

Broker moves;

• Ausdrill Upgraded to Buy at Moelis & Company; PT A$2.33

• Appen Upgraded to Buy at UBS; PT A$30

• Appen Downgraded to Hold at Canaccord; PT A$26

• Appen Upgraded to Buy at Bell Potter; PT A$27.50

• Independence Group Downgraded to Sell at Citi; PT Set to A$5

• Link Administration Upgraded to Buy at Citi; PT A$6.20

• Link Administration Cut to Neutral at Credit Suisse; PT A$5.75

• Vista Group Downgraded to Hold at Deutsche Bank; PT Set to NZ$4

• GTN Ltd Downgraded to Neutral at Macquarie; PT A$0.86

• Crown Resorts Downgraded to Neutral at Macquarie; PT A$11.25

• Autosports Upgraded to Outperform at Macquarie; PT A$1.76

• Atlas Arteria Cut to Neutral at Macquarie; Price Target A$8.12

• NextDC Upgraded to Outperform at Macquarie; PT A$7.75

• Australian Vintage Cut to Hold at Morgans Financial; PT A$0.52

OUR CALLS

No changes today although the market has traded up into our 6600 handle so we’ll look to tweak some holdings next week. T

Major Movers Today

Have a great Weekend – Go the Sea Eagles!

James and the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.