GDP Growth Anaemic (PLS, OSH)

WHAT MATTERED TODAY

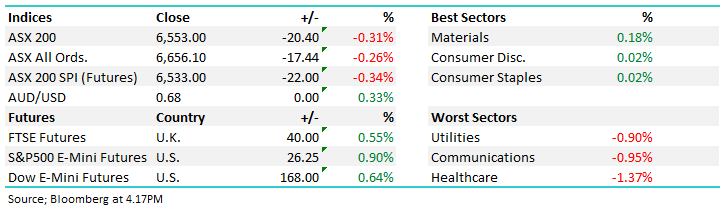

The local market traded lower from the get go today with the US market’s soft lead flowing through to the ASX. It was the manufacturing data last night that saw the market lower, US Manufacturing ISM PMI came in at 49.1, the lowest level in three years economic data starts to show the pain of the trade war. Locally we saw GDP data out mid-morning which was bang in line with expectations, although expectations were particularly weak. The yoy growth of 1.4% is the slowest since 2009 but many economists in the market were fearing a weaker number heading into the print.

The local data didn’t really move the dial in terms of a market move however we did see decent buying around the China PMI print that was out just before midday. The Caixin Services PMI was up to 52.1 against the backdrop of expectations for a fall to 51.6.

There were some oddities from a sector level. The usual safe havens of communications and healthcare were sold off while the cyclical materials and consumer groups did better. Iron ore names rallied against the grain and energy stocks were mixed given some external forces noted below.

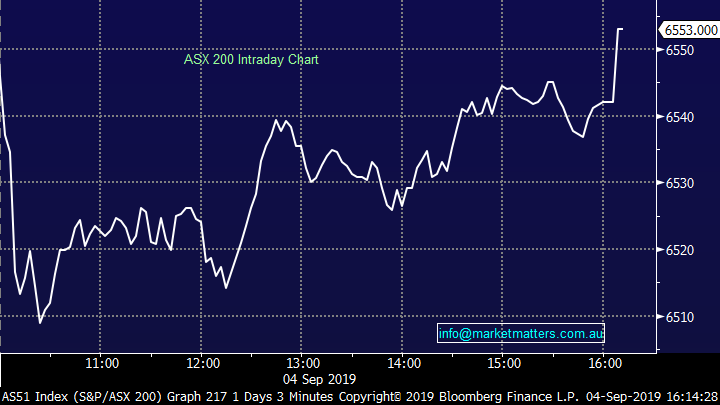

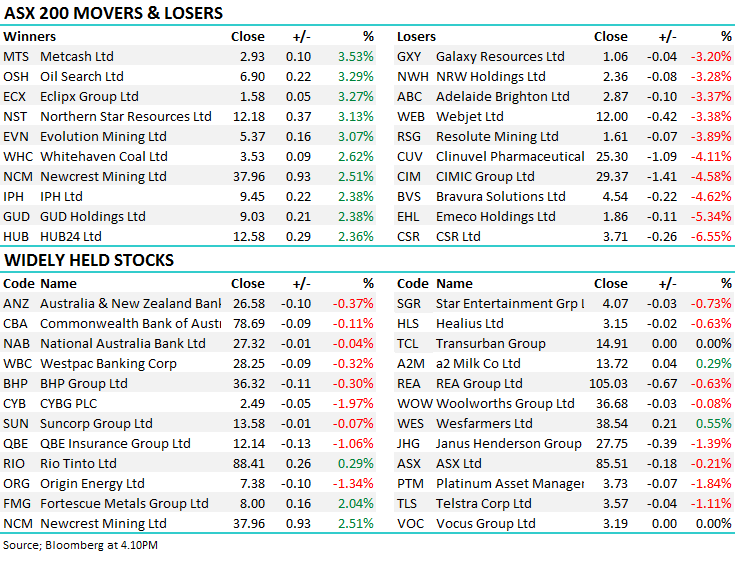

Overall, the ASX 200 lost -20pts today or -0.31% to 6553, Dow Futures are now trading up 168pts /0.64%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Pilbara Minerals (PLS); the lithium miner remained in a trading halt today, for the 5th session running however news coming through today suggests shares will soon be trading again. PLS was running tight on money and looked to raise money last week before delaying its return to the market on Monday, appearing to struggle to get institutional money on board. Today it announced the raise was completed with the help of Chinese battery manufacturer CATL which will fill about 2 thirds of the $91.5m raise at 30c a share, a 14% discount to the last traded price of 35c and a level PLS hasn’t seen since early 2016. Pilbara clearly needed some money after entering a joint venture to build out a processing facility in South Korea as well as failing to find partners to help develop its Pilgangoora project. The cash balance for PLS fell to as low as $35m on the back of lower lithium prices and a high cost base which the company has been working on. The raise gives the company breathing room for now, however lithium looks likely to remain in surplus for years to come. Hopefully having a large potential customer on board will support any production. We sold our holding in Orocobre (ORE) yesterday, with the lithium names seeing some selling today as funds free up cash for the raise.

Pilbara (PLS) Chart

Oil Search (OSH) +3.29%; shares traded higher in the face of energy names which are usually sold off in the face of slow global growth. Oil Search got a kicker from the PNG Government to help shares higher, with news out last night that they are set to honour the previous royalties deal struck with French group Total which is working with oil Search on the LNG project. There remains a long runway before the project will see any cash flow, however the comments made last month by the PNG Government around issues with the development terms had created some nerves that it would not go ahead.

Oil Search (OSH) Chart

Broker moves; CSR, which we hold in the Income Portfolio, fell -6.55% today on the back of JP Morgans downgrade. We are yet to see what the analyst had to say, however the price target was cut by 8% and bumped the stock down to underweight. More to come when we know more.

· Wesfarmers Upgraded to Neutral at Goldman; PT A$34.10

· Metcash Upgraded to Buy at Goldman; Price Target A$3.07

· Vista Group Downgraded to Neutral at Macquarie; PT NZ$4.12

· Myer Upgraded to Overweight at JPMorgan; PT A$0.70

· CSR Downgraded to Underweight at JPMorgan; PT A$3.50

· Santos Upgraded to Positive at Evans & Partners; PT A$8

· Rio Tinto Raised to Outperform at BMO; Price Target 47.50 Pounds

OUR CALLS

No changes to the portfolios today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.