OPEC Hope sends energy higher on a down day (SYR, WHC)

WHAT MATTERED TODAY

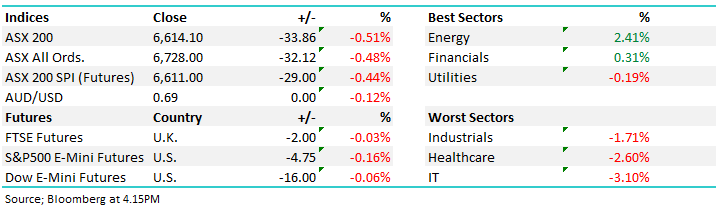

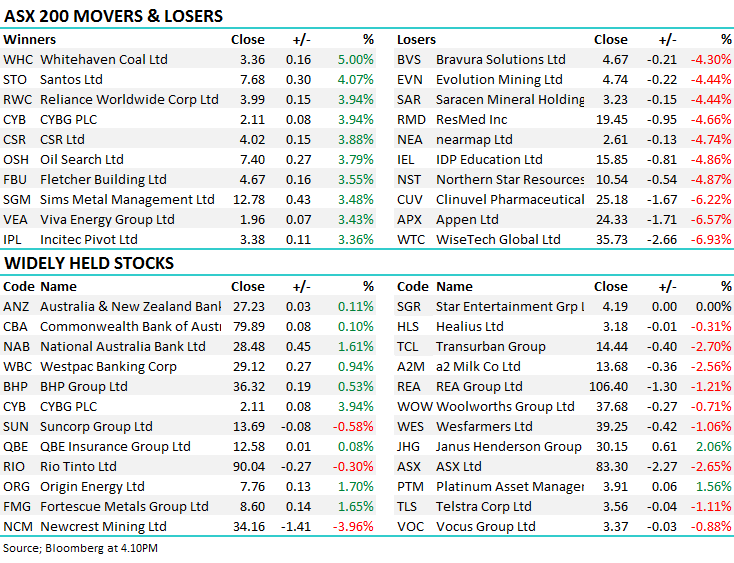

Early support for the market faded as the day rolled on with sellers slowly grinding the buyers down. The banks were all up today, and reasonably so which is rare for a day where the market falls. Much of the buying here came on the back of yesterday’s credit numbers which showed signs of some growth for the first time in a long time. Along with financials, energy was the only other sector to finish in the green. Oil has seen some buying with the commodity heading higher on reports OPEC will be curbing production sending Santos (STO) to a 4 year high.

Healthcare was once again dragged by heavyweight CSL which went ex-dividend today – the stock did fall $6.55 on a $1.48/sh dividend as it continues to pull back from all-time highs. Tech also went the wrong way today. Tech has seen reasonable selling of late as money appears to be cycling out of momentum and into value. Wisetech (WTC), the biggest tech stock on in the ASX, was off nearly 7% although it did close at all-time highs yesterday. Similarly, the NASDAQ was lower last night despite the broader S&P500 closing flat.

Overall, the ASX 200 fell 33pts today or -0.51% to 6614, Dow Futures are now trading down -16ts /-0.06%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Syrah Resources (SYR) -33.33%; Graphite miner and processor Syrah has taken a big hit today on the back of a company update regarding spot prices of their product in China. The company recently dipped out of the ASX200 index at the June rebalance and seems to be going out the back door with this update. Prices received have dropped around 12% in the current quarter versus what the company was receiving the Q2, down to $US400/t, blaming the fall on a falling Chinese Yuan as well as concerns around inventory levels saying “supply growth has outpaced demand” despite China becoming a net importer at the start of the year. To put this in context, the feasibility study the company undertook prior to the development in 2015 used a long term price of $1,000/t…

In response, Syrah has moved to cut production and review cost levels at their Balama facility as well as flagging an impairment charge of up to $US70m and writing down inventory levels. The company talked up its cash levels despite the disappointing prices. The asset has a long mine life and high grade, so not all is bad however their all in costs are well above the spot price – so if the company can remain solvent, the long term outlook is positive for SYR. Not one for us yet though

Syrah (SYR) Chart

Broker moves; Whitehaven Coal (WHC) +5%, was the best on ground for the top 200 today on the back of a note from UBS. Whitehaven have an investor day on Thursday – a first for WHC – and UBS expects them to outline how they plan to develop new sites to replace the falling reserve levels, as well as further detail on the cost cutting including autonomous vehicles. We own WHC in the income portfolio and are looking for a reasonable exit price from the position.

Whitehaven Coal (WHC) Chart

· Ramsay Health Upgraded to Buy at Citi; Price Target A$74

· BHP Upgraded to Buy at Goldman; PT A$41.90

· Vicinity Centres Cut to Underperform at Macquarie; PT A$2.34

OUR CALLS

No changes to the portfolios today.

Major Movers Today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.