Markets edge higher on better China – US trade rhetoric (FMG, SM1, ISX)

WHAT MATTERED TODAY

The market was set to open around ~20pts higher this morning thanks to positive leads overseas, however that move was out played when US Futures put on another ~0.50% underpinning a +45pt move for our market on open. News breaking from both China and the US that implied a more conciliatory tone for the upcoming trade negotiations underpinned the move, China saying they may allow companies to resume purchases of U.S. agricultural products in a show of goodwill ahead of the talks while President Trump said he was postponing the imposition of 5% extra tariffs on Chinese goods by two weeks.

That sets up a more positive backdrop (for now at least) to this round of negotiations at a time when President Trump’s approval rating has fallen below 40% amid growing concerns about the US economy - around 60% of Americans now believe a recession is very likely hence the volatile President needs to resolve US – China trade sooner rather than later to kick start his 2020 election campaign. I would have thought the positive backdrop today would have seen our market higher than it was – it struggled to rally on good news implying it’s losing steam.

The other obvious influence on our market today came from the Aussie Dollar which traded up to a 6 week high setting around US68.81c. A resolution of the China/US trade spat should be positive for the local currency. We remain controversy bullish the AUD at current levels believing the consensus / crowded short AUD trade has seen its best days.

Aussie Dollar Chart

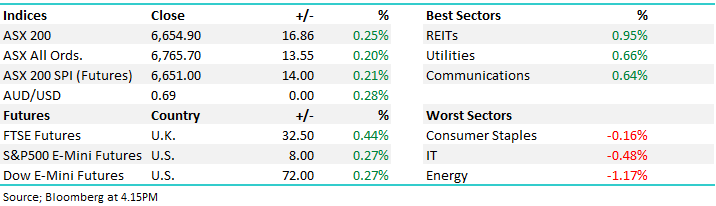

Overall, the ASX 200 was up +16pts today or 0.25% to 6654, Dow Futures are now trading up +88pts/0.33%.

ASX 200 Chart – a weak performance overall today

ASX 200 Chart

CATCHING OUR EYE;+

Fortescue Metals (FMG) +2.74%: Traded up through the $9 handle today as Iron Ore prices edged higher, although FMG the big outperformer in the sector when considering RIO +0.63% and BHP +0.14%, although the latter was weighed down by its Oil exposure.

Fortescue Metals (FMG) Chart

Synlait Milk (SM1) -11.99%; the New Zealand based dairy processing and products company, a new addition to the S&P/ASX 300 index, has seen its shares tumble today on a soft full year report that missed at the profit line by more than 6%. A small miss on the revenue line was exacerbated at the bottom line as margins were compressed on both sides of the equation. Costs moved higher, with overheads up over 14% as the company focusses on R&D and increase headcount ahead of new facilities coming online. On the price received side, the average milk price per kgMS fell 3% in the year and would have been worse if not for an increase in incentive payments.

The outlook statements for SM1 were behind consensus as well. The company is looking for “profitability increasing at least at a similar rate to that of FY19” which suggests at least 10% profit growth to get $NZ 90.4m, well below current FY20 expectations of $NZ 104m. The company is doing reasonably well in an effort to drive growth. They have a new facility that is set to open in a matter of weeks while launching a few new products late in FY19. Milk prices have also recovered, with spot prices above last year’s average, closer to $7/kgMS. Still we see more pain before a recovery here.

Synlait (SM1) Chart

Isignthis (ISX) -34.04%: Hit hard today on what we hear is the issuance of a substantial number of performance rights. This has been a momentum favourite and today it took a massive hit as momentum players scrambled for the exits. No news from the company today however expect the ASX to ask the question about today’s move…more to come on this one no doubt.

Isignthis (ISX) Chart

Broker moves;

· EVN AU: Evolution Upgraded to Neutral at Citi

· NCM AU: Newcrest Upgraded to Neutral at Citi

· NST AU: Northern Star Upgraded to Buy at Citi

· OGC CN: OceanaGold Upgraded to Buy at Citi

· RRL AU: Regis Resources Upgraded to Neutral at Citi

· SAR AU: Saracen Mineral Raised to Outperform at RBC; Price Target A$3.75; Upgraded to Neutral at Citi

· SBM AU: St Barbara Upgraded to Neutral at Citi

OUR CALLS

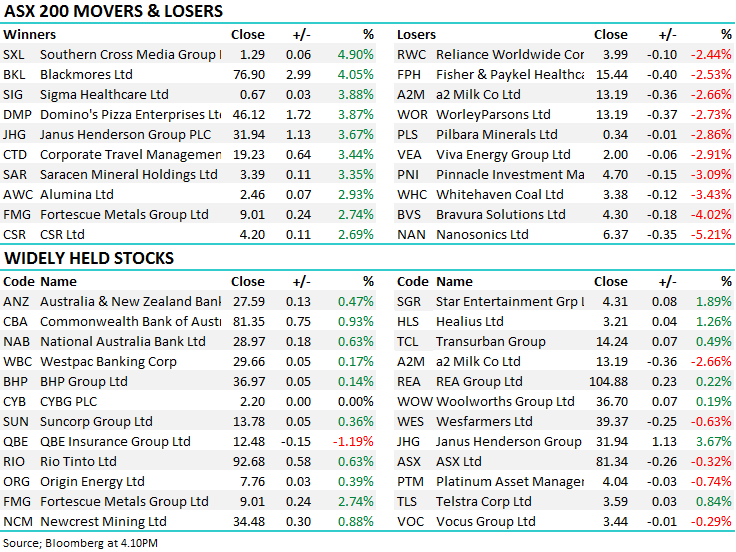

No changes today, although some good moves in portfolio stocks including JHG +3.67%, DMP +3.87%, CSR +2.69% and FMG +2.74%

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.