Defensive sectors take the index from strength to strength (RIO, OZL, CGF)

WHAT MATTERED TODAY

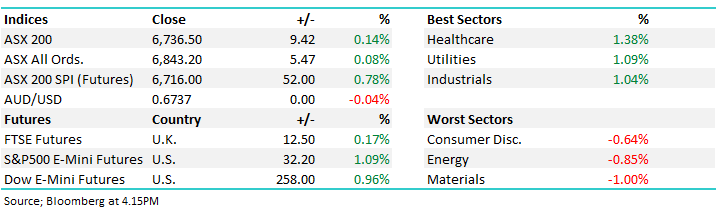

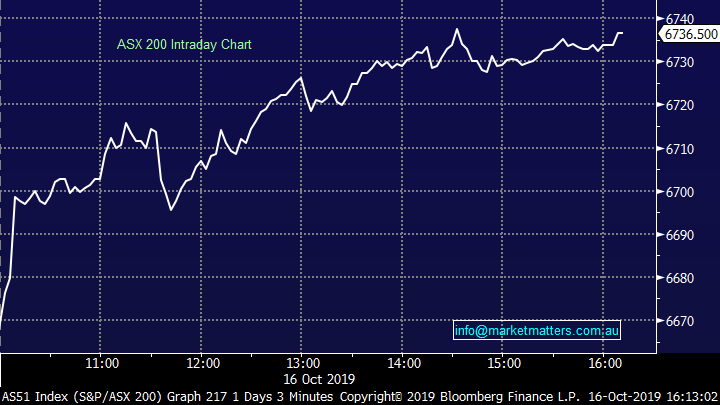

A solid day from an index point of view today but underneath there were some odd cross currents not often seen in a market that rallies 75+pts. We rallied early on thanks to a strong lead from US markets which traded higher on a decent start to 3rd quarter earnings season. Buying sustained throughout the session with traders selling early missing out on about half of the rally which closed just 1pt off the day’s high.

European facing stocks were some of the better performers. Clydesdale (CYB), +7.23%, in particular has caught our eye after rallying from last weeks $1.86 low to close at $2.52 today. BREXIT is the driver here – with the deadline set for the end of the month Boris appears to have stepped up the urgency and reports suggest the latest round of talks with the EU overnight were productive. Boris was optimistic that a deal could be mustered with the EU this week but he will still have to push it through parliament before all is said and done.

As we mentioned in the today’s Income Report, despite the market rallying the risk on sectors of consumer discretionary, tech and resources were sold off or underperforming, while the defensive healthcare, utilities and consumer staples were among the better performers.

Overall, the ASX 200 closed higher today, up +84pts or +1.27% to 6652, Dow Futures are trading up +258pts/+0.96%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

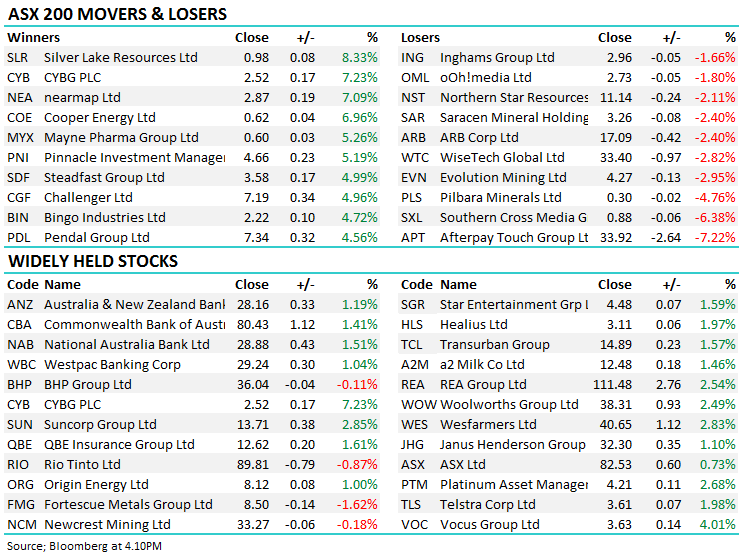

Rio Tinto (RIO) –0.87%; was out with their 3Q production report today which was in line with expectations with iron ore shipments flat on the JQ while copper production was up 40% it came with a lower grade quality. They did lower guidance for two of their smaller units in bauxite and alumina by 6-7% which is not a huge concern. Shares traded only slightly worse than peers.

Rio Tinto (RIO) Chart

Oz Minerals (OZL) +1.25%; also out with their quarterly today with shares outperforming peers thanks to progress at their Carrapateena project. The company expects saleable copper concentrate to be out the door next month after stockpiling ~180kt of development ore. The Prominent Hill mine saw cost guidance lowered which has been a rarity in miners in recent years. With cash on balance sheet, the new project coming online with no hiccups so far and a commodity tailwind, we like OZL.

We added OZL to the Growth Portfolio this week.

Oz Minerals (OZL) Chart

Challenger Group Financial (CGF) +4.96%; out this morning with a quarterly sales update which the market seemed to cheer, or at least the headlines were strong enough to prompt some short covering. This is a stock where shorts have been rising for a while, now 8% of the register is short sold or 2.4m shares. We initially wrote in the income note today that given this bearish positioning, the market might run this one further however digging deeper, the numbers were less impressive. While they saw increased inflows, particularly in Japan where flows were $218M in 1Q20, up from $38M in 4Q19, we wouldn’t expect this flow to continue given it largely related to a reinsurance arrangement. In Australia annuity sales were lower falling from $702M in 4Q19 to $624M in 1Q20 meaning on a net basis they saw positive flows of +2M in 1Q20, hardly inspiring. On the positive side, CGF maintained its guidance for net profit before tax for the full year of $500M to $550M with consensus currently sitting at $535m. The issue for CGF remains margin pressure, and we saw little discussion on that today.

Challenger (CGF) Chart

BROKER MOVES; the two big BNPL names were initiated on by UBS with two sells put on the stock – certainly not the market’s consensus at the moment. The analysts negativity stems from increasing regulation taking the view that customers of Zip and Afterpay are already heavily indebted and will attract further regulatory oversight which is not currently being priced in by the market. Z1P was off -3.87% today, while Afterpay was hit harder, down -7.22%.

· Zip Co. Rated New Sell at UBS; PT A$4.80

· Afterpay Touch Rated New Sell at UBS; PT A$17.25

· Nick Scali Raised to Buy at Citi; PT A$6.90

· Southern Cross Media Cut to Hold at Canaccord; PT A$1

· Southern Cross Media Cut to Neutral at Macquarie; PT A$1.05

· Perpetual Raised to Neutral at Macquarie; PT A$32

· HT&E Cut to Underperform at Macquarie; PT A$1.55

· CSL Cut to Sell at Morningstar

· Metcash Raised to Hold at Morningstar

· Arena REIT Rated New Neutral at Credit Suisse; PT A$2.65

· Alliance Aviation Raised to Outperform at Credit Suisse

· Evolution Raised to Hold at Canaccord; PT A$4.40

OUR CALLS

No changes today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.