RBA comments send the Aussie higher and the market lower…again (SBM)

WHAT MATTERED TODAY

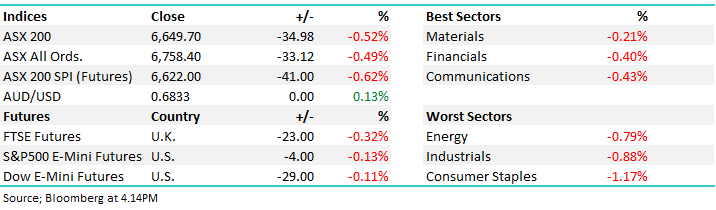

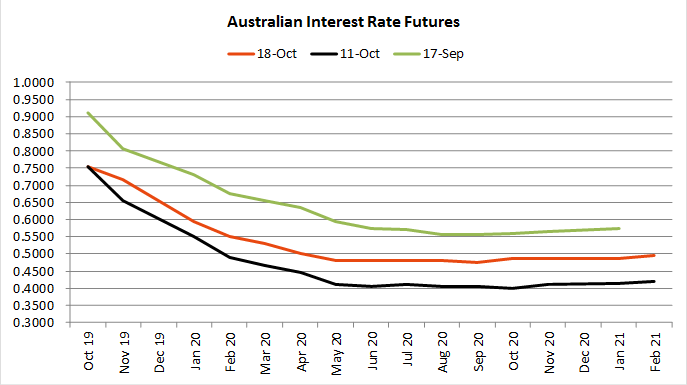

The local market tracked lower again today with the Aussie battler rallying dragging on the local equity market. RBA Governor Philip Lowe was speaking in Washington early this morning and his comments suggests the RBA is close to the end of the cutting cycle. Lowe said it is very unlikely we will see negative rates here in Australia given the momentum seen in the economy through terms of trade and housing data. Interest rate futures have moved higher as a result of the recent data:

Source; Shaw & Partners

Key China data was also out today with industrial production beating estimates but GDP data coming in slightly behind forecasts. The market saw buying pick up briefly after the print, in particular iron ore names saw some money come in before it was quickly reversed 30 minutes later.

China Data

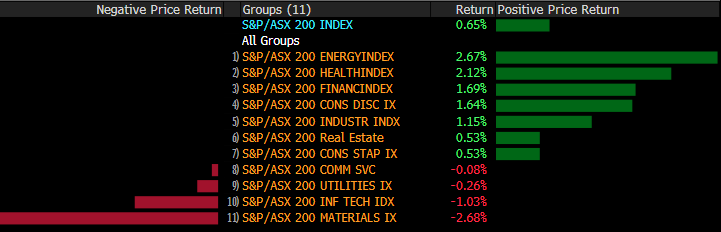

All sectors finished in the red today with the defensive consumer staples sector the worst hit. Financials held up well, supported by IOOF (IFL) and Challenger (CGF) continuing the rally while materials were the best of a bad bunch thanks to some support seen in iron ore markets. UK facing stocks once again rose against the grain today with a BREXIT deal set to be tabled to the UK parliament tonight. PM Boris Johnson was confident his deal would get the support of the house despite Northern Ireland DUP set to vote against it.

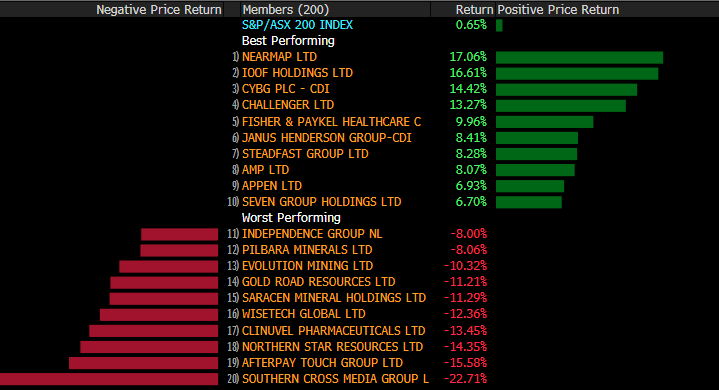

Despite the weakness of the last two sessions the market managed to finish 43 points higher this week, adding around 0.65%.

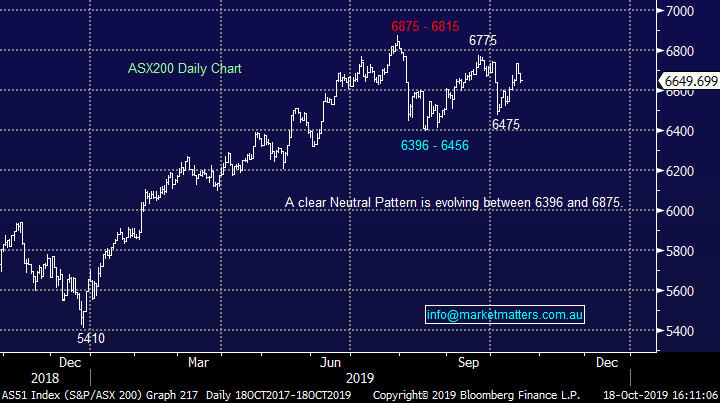

Overall, the ASX 200 closed lower today, off -35pts or -0.52% to 6649, Dow Futures are trading down -29pts/-0.11%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

St Barbara (SBM) –8.99%; hit hard today on a downgrade to production numbers and an increase in cost guidance – hit from both sides. The companies Gwalia mine saw its forecast output 10% lower than previously guided while costs are expected to sky rocket, up 12.5% to $A1,390 - $A1,450/oz, only a little wiggle room here before SBM sees negative FCF even while gold trades at elevated levels. The issues come from the mines extension project with the new parts of the mine competing for limited resources. As a result, the company has moved to increase growth capex while guiding sustaining capex send to the higher end of expectations. All-in-all SBM is struggling to handle the extension to their biggest mine and will need to work on cost control once the extension is up and running in full.

St Barbara (SBM) Chart

Sectors this week:

Stocks this week: a rally of the dogs this week, the bulk of the top 10 have been some of the worst performers over the past few months.

BROKER MOVES; brokers chasing IFL higher at the moment with many analysts caught on the wrong side of the trade here.

The market is still awaiting Wisetech’s (WTC) response to the short paper published yesterday but the stock did find an ally in broker Evans & Partners which moved to calm investor nerves ahead of the company’s response due Monday. Read our piece on the paper in yesterday’s report here. The broker justified the founder’s sell downs as a necessity to liquidity requirements, noting that his stake is currently worth over $4b while calling the paper’s data meaningless. Shares remained in a trading halt today.

· Northern Star Raised to Hold at Baillieu Ltd; PT A$11

· Bank of Queensland Cut to Sell at Citi; PT A$8.50

· Bank of Queensland Rated New Underperform at Jefferies; PT A$8

· IOOF Holdings Raised to Neutral at Citi; PT A$7.30

· IOOF Holdings Raised to Outperform at Credit Suisse; PT A$8.45

· ARB Raised to Overweight at Wilsons; PT A$18.75

· Fortescue Raised to Hold at Morningstar

· Steadfast Raised to Outperform at Credit Suisse; PT A$4

· Insurance Australia Raised to Neutral at Credit Suisse; PT A$8

· Altura Cut to Sell at Canaccord; PT 4 Australian cents

· Rio Tinto ADRs Raised to Sell at ICBC Research; PT $37.44

OUR CALLS

No changes to the portfolios today.

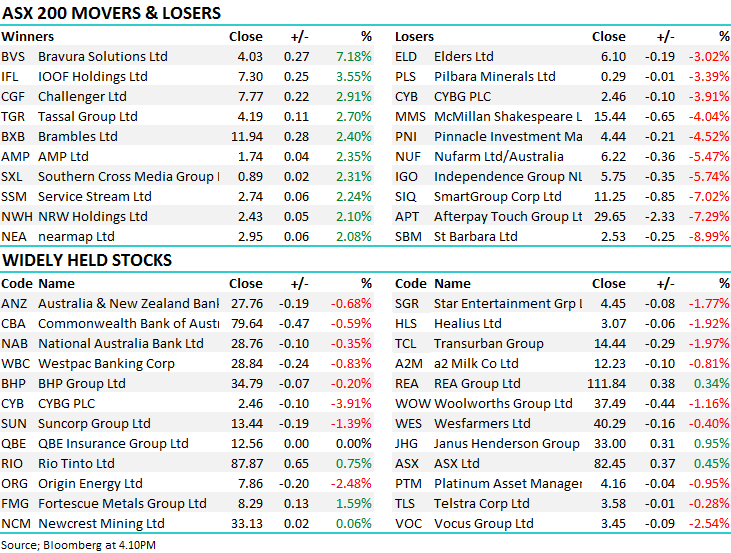

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.