The runway for the BNPL Sector – see video (CTD, PYPL US, Z1P, APT)

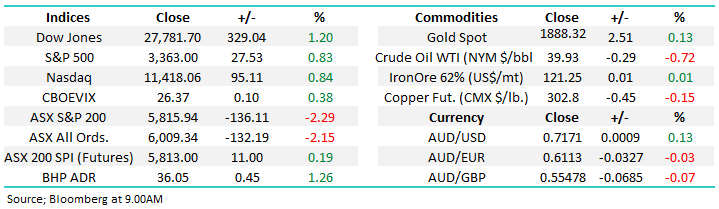

The ASX200 was smacked yesterday as the US Presidential Debate unfolded, I’m going to deliberately avoid voicing any “nitty-gritty” thoughts on event following a number of subscriber emails with strong opinions from both side of the fence – fortunately we are a stock market not politics business. However, there were 3 undeniable takeout’s which as I sit at my desk this morning, I believe provide some insight to equities moving forward:

1 - The initial market reaction was to aggressively sell-off stocks as Biden firmed at the bookies i.e. he’s now a clearer favourite following the debate.

2 – However during their time zone US stocks shrugged off the election circus and focused on the next wave of stimulus, the S&P500 recovered well over 2% from its low.

3 – Even as US stocks rallied strongly the SPI futures only recovered 10-points implying yet again that there are plenty of sellers of Australian stocks into strength.

Refreshingly stimulus appears more important than politics at this stage and I feel a Biden victory must already largely be priced into stocks, although not a clean sweep of Senate and House. Hence, we see no reason to change our outlook for global equities into October – we are bullish but expect elevated levels of volatility.

MM remains bullish stocks short-term.

ASX200 Index Chart

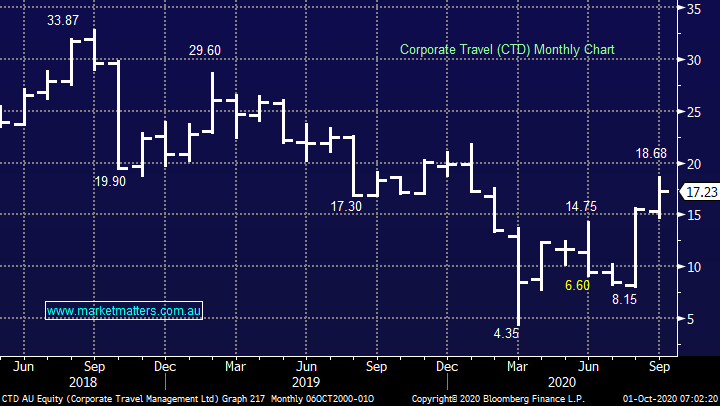

On the stock level Corporate Travel (CTD) sprang out of its trading halt yesterday after raising $375m to buy Omaha based Travel & Transport. My initial feeling was “what a great time to buy acquiring businesses in this sector” looks to have been echoed across the market with the stock rallying almost 10% post the raise.

As we said before the synergy in the takeover looks to be solid as the US company provides business customers with travel management services plus, we love seeing an Australian company on the front foot in the M&A space. Any dip following yesterday’s rally should provide an opportunity into this now leveraged recovery stock – watch this space.

MM likes CTD at into any weakness.

Corporate Travel (CTD) Chart

Overseas Indices & markets

Overnight US stocks recovered strongly from the spike lower during the Presidential Debate which could easily have just been called an argument. Remember our comments yesterday around the record short position in the NASDAQ, these players would have expected to be count their winnings this morning not licking their wounds, MM is still expecting an aggressive squeeze higher in November.

MM still believes that US stocks have found a low.

US NASDAQ Index Chart

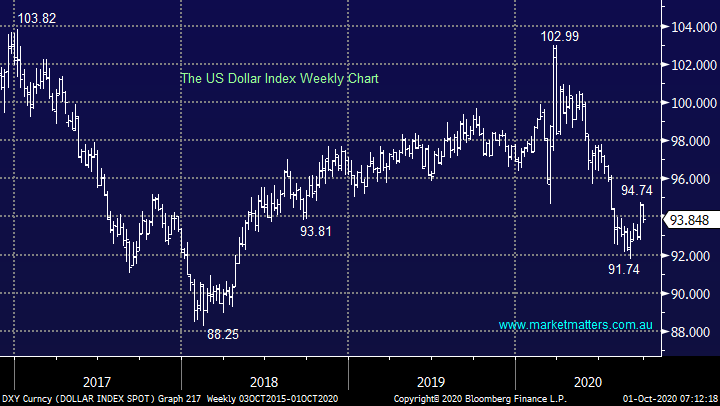

As the chart below illustrates the $US Index has been struggling above the 94 area, if we are correct this ~3% advance will fail and gains will be reversed, a close below 93.50 will generate a technical sell signal. The implications to MM remain as follows:

1 – Precious metals and other commodities should rally.

2 – A weak $US has largely been supportive of US equities which coincides with our bullish outlook into October, so far so good.

MM remains bearish the $US into Christmas looking for a further ~5% downside.

$US Index Chart

Looking at the BNPL into Christmas.

The crux of today’s report is the following video which I made yesterday with BNPL expert Jono Higgins, afterwards I have then gone through a few salient takeout’s by MM looking specifically looking at the 2 major providers Zip Co (Z1P) and Afterpay Ltd (APT). For people not too familiar with “Buy Now Pay Later” space it now enjoys annual turnover of $14bn after just 5-years with 30% of Australians now using either Z1P and APT but only 5% of Americans are at this point in time, hence the obvious path of growth.

Online shopping has accelerated through the COVID-19 pandemic and we believe it won’t be reversed when a vaccine is eventually found, subsequently we’ve seen 10-years of growth for the BNPL stocks in just 6-months but the cynics will obviously say that’s as good as it gets.

Timing

In the next few weeks, we will see much of the sector report from for the last quarter, the numbers should be excellent following strong retail sales. Also, to compound the optimism we are now entering the strongest quarter of the year as we all gear up for Christmas, in other words the next few months should be a purple patch for the sector. After the recent aggressive corrections we believe this is an ideal time from a risk reward perspective to be long the sector.

Risks

Obviously the main question is how much is built into share price of these growth businesses and yet again it brings me back to our view on the market as a whole “buy weakness & sell strength” – remember the sector has been weak of late. We believe there are 3 main areas of risk:

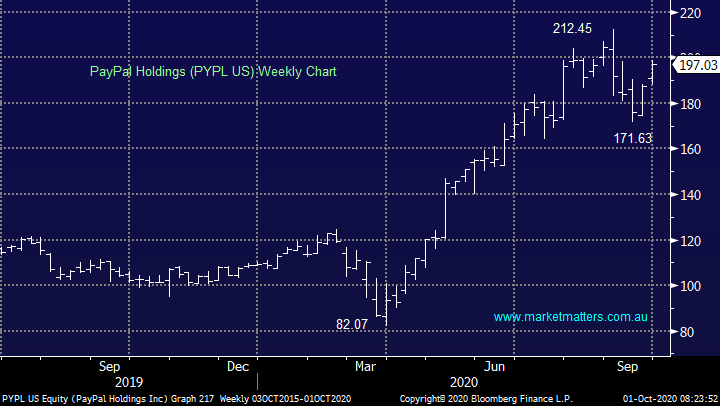

1 – Competition: we saw recently the impact on the local stocks when PayPal (PYPL US) stated its intention to enter the fray but at this stage in our opinion their offering isn’t as attractive as the Australian competition. Undoubtedly competition will increase but as we mentioned earlier if the US takes up this new method of credit like Australia the sectors set to boom leaving plenty on the table for new players. Margins will also fall through competition but that may easily not unfold for 2 years, we need to watch the timeline carefully in this rapidly evolving space. However, as the sector slowly matures the winners of BNPL will have plenty of room to diversify into the likes of car & home loans from a large and happy customer base.

2 – Market : we believe the market itself is the largest risk to these high Beta stocks, if fund managers decide to sell off the high growth stocks BNPL will be included, the NASDAQ is the best barometer of growth valuations and at MM we are bullish at least short-term.

NB High Beta stocks usually move in an exaggerated manner both up and down to the index.

3 – Execution: Obviously high growth businesses need to implement their strategy carefully, investors like ourselves must watch this carefully.

PayPal Holdings (PYPL) Chart

Current cycle tailwinds

1 – A number of large businesses are taking strategic stakes in the Australian BNPL sector such as Tencent’s (700 HK) 5% in APT and Westpac in Z1P, plus Amazon (AMZN US) own a bunch of warrants that will allow them to buy into the stock in the future. Consolidation is not yet on the table but the likes of Mastercard (MA US) and Visa (V US) can buy say Z1P without raising equity i.e. its probably just a matter of when, not if.

2 – The cost of capital is rapidly falling as the companies show excellent risk profiles for their customers plus of course it helps that central banks are cutting rates and stimulating the global economy.

Valuation

At this stage we believe it’s not about profits, it’s all about growth as the companies reinvest earnings. In the future we can compare the stocks to PYPL which trades on 22x gross profit but its way too early in our opinion.

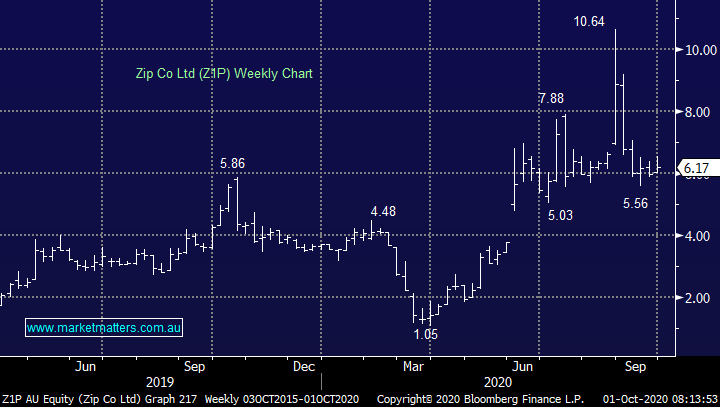

Zip Co (Z1P) $6.17

Zip is our favourite major stock in the space, especially as its trading at a 65% discount to APT. The companies currently accumulating a whopping 6,500 new customers daily, I wish MM was!

MM is bullish Z1P with an initial target 25-30% higher.

Zip (Z1P) Chart

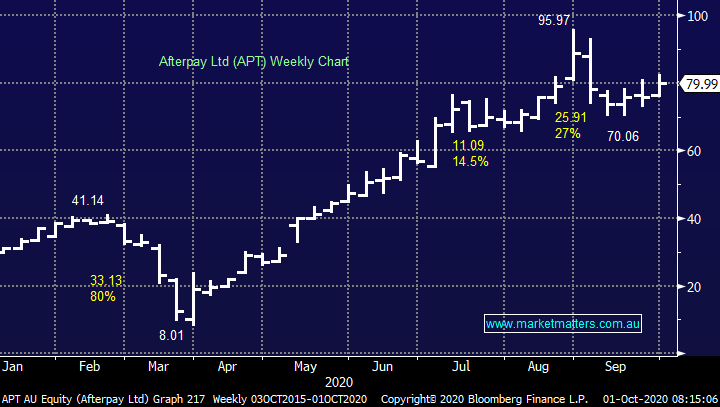

Afterpay Ltd (APT) $79.99

APT is the sector heavyweight with a current market cap of almost $23bn. We like the stock around $80 but see a little more upside and value in Z1P.

MM is bullish APT looking for a test of $100.

Afterpay Ltd (APT) Chart

Conclusion

MM is bullish both APT and Z1P.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.