Sell strength – buy weakness, the mantra continues (FMG, NCM, SGR) ** BHP.LN, JPM.US, IEM, COPX. US, BNKS**

WHAT MATTERED TODAY

As one of the traders we deal with said today, same old deal, buy weakness and sell strength….he must read the MM daily note! Early strength at the index level was ultimately sold into and the market trickled down into the close. Energy the standout sector today after crude bounced overnight – Santos (STO) broke to the upside and now looks bullish - our previous downside target not reached, while Woodside (WPL) also had a day in the sun rallying +2.36% - both look good here. Stock options expiry today so a busy one on the desk + I’m trying to make sailing tonight, hence a brief note today.

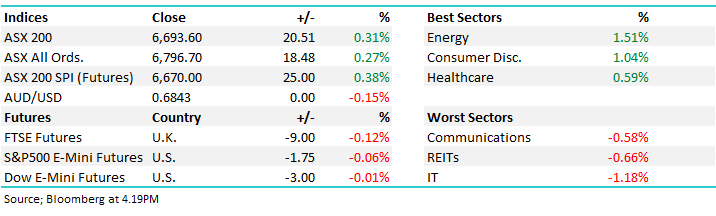

Overall, the ASX 200 closed +20pts higher today to 6693, Dow Futures are trading down -3pts/-0.01%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

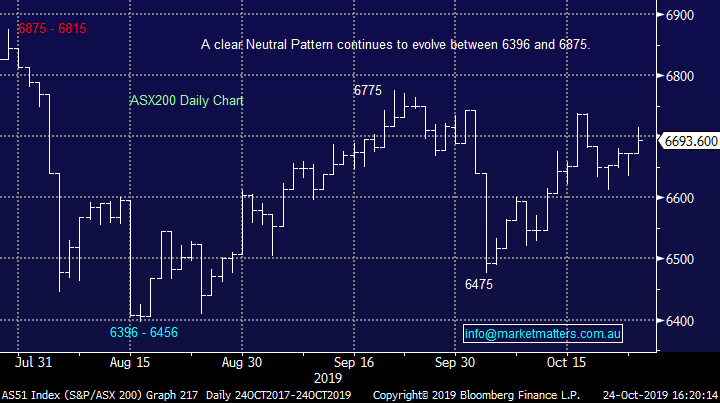

Fortescue (FMG) +0.46%; up today, but more or less in line with the market. They were out with their 1st quarter production numbers before market which saw iron ore output up 5% with C1 costs coming in at $US12.95/wmt, well below the guidance range. The great deleveraging story continues with net debt down to just $500m, and even with a tax bill and dividend coming in the next quarter, Fortescue is well below their leverage targets.

Tightness in the iron ore market has helped squeeze the discount FMG takes for their lower grade ore down to an average of 11% for the quarter vs the peak at ~44% back in January 2018. All in all a good set of numbers with guidance maintained, and FMG rallied strongly early before giving back the bulk of the gains as the session rolled on. We own FMG in the Growth Portfolio.

Fortescue Metals (FMG) Chart

Newcrest Mining (NCM) -1.6% : Another tough day for NCM after their 1Q production numbers were a touch light on. Gold production was 511,636 ounces (about a 14% miss v mkt expectations) due to a change in the processing method at Telfer and an extended shutdown at Cadia. 1Q marked the lowest quarterly output in a year. Lower grades also had an impact and saw higher costs for the period. All-in sustaining costs (AISC) surged to $899 an ounce vs. the market's expected $790. Copper also a slight miss however offsetting these was increased FY20 production guidance for gold and copper by 1.5% and 19%, respectively, to 2.38-2.54 million ounces of gold and 130,000-145,000 tons of copper. We own NCM, although it’s starting to test our patience

Newcrest Mining (NCM) Chart

Star Entertainment (SGR) & JB Hi-Fi (JBH) both had good sessions up +5.38% & +6.77% respectively while Qantas (QAN) was down on the back of weakness from Hong Kong riots and the trade war, the flying Kangaroo off -3.68%. Star now broken out and looks good here with the Casino operator saying that revenue was up +1.5% in the first half so far plus they talked about $45m of cost outs.

JBH hit a record high despite all the gloom around retail – seems peeps are still buying electrical goods. They reaffirmed FY20 guidance - as the 8th most short stock on the ASX, this strength could last longer.

Star Entertainment (SGR) Chart

Broker moves;

· Fortescue Cut to Sell at Morningstar

· Bendigo & Adelaide Rated New Underperform at Jefferies

· Mercury NZ Raised to Hold at Deutsche Bank; PT NZD4.54

· Genesis Energy Raised to Hold at Deutsche Bank; PT NZD2.83

OUR CALLS

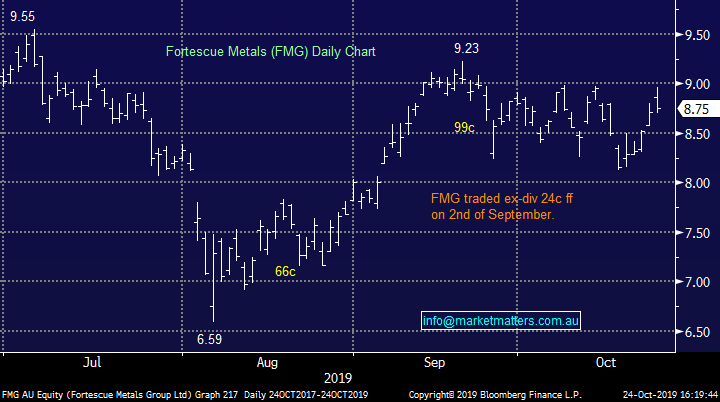

We are allocating further capital into both the MM International Equities Portfolio, and the MM Global ETF Portfolio.

**International Equities**

We are buying BHP, however buying on the London Stock Exchange to get the benefit of any British Pound Strength. Obviously buying in Australia is also relevant & clearly easier for the majority.

BHP Group PLC (BHP.LN) Chart

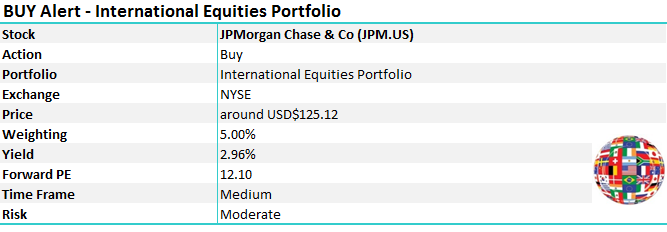

We are also increasing our exposure to US banks through the purchase of JP Morgan in the US

JP Morgan Chase (JPM US) Chart

**Global ETF**

A fair bit happening here to better align this portfolio with a global macro views

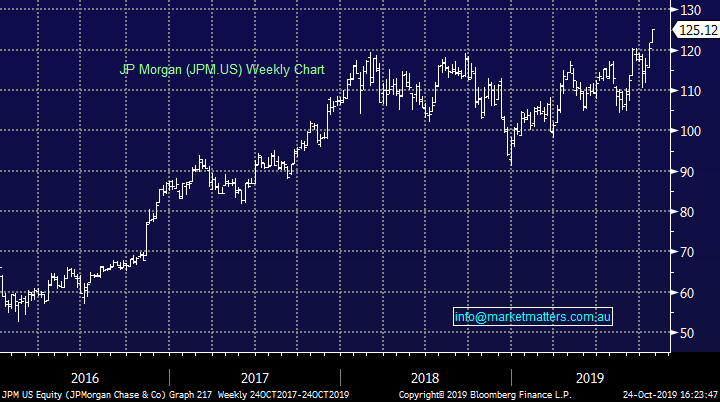

We are looking for Emerging Markets to outperform US markets as $US weakness prevails, as such we’re buying the IEM which is listed on the ASX

iShares Emerging Markets ETF (IEM) Chart

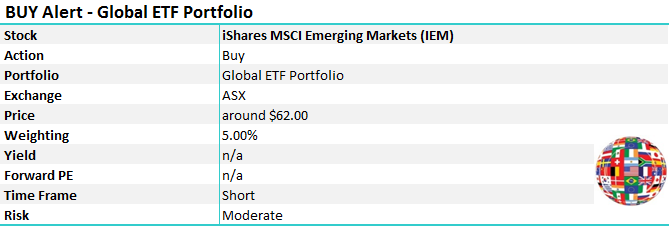

We are bullish copper into 2020 with our preferred way of investing around this view via the Global X Copper Miners ETF (COPX US) listed in the US. For more information on this ETF go to: https://www.globalxetfs.com/funds/copx/

Global X Copper Miners ETF (COPX US) Chart

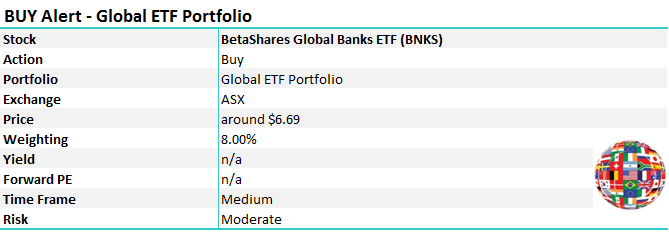

We are keen on the banking sector into 2020, a sector which enjoys rising margins as interest rates and reflation rise. Our preferred ETF for global banks’ exposure is the BetaShares Global banks ETF (BNKS) which is listed in Australia and is currency hedged : https://www.betashares.com.au/fund/global-banks-etf-currency-hedged/

BetaShares Global Bank ETF (BNKS) Chart

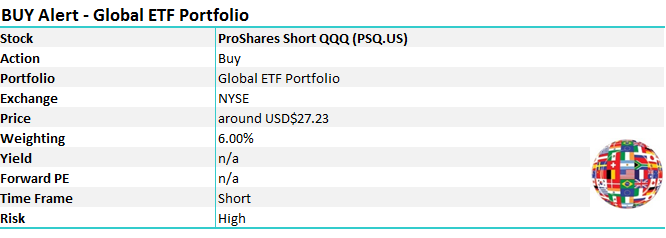

Lastly we feel our “anti” growth opinion can be best played through going short the US NASDAQ. Our preferred ETF for a short exposure to the NASDAQ is the ProShares short QQQ ETF (PSQ US) : https://www.etf.com/PSQ

PSQ. US Index Chart

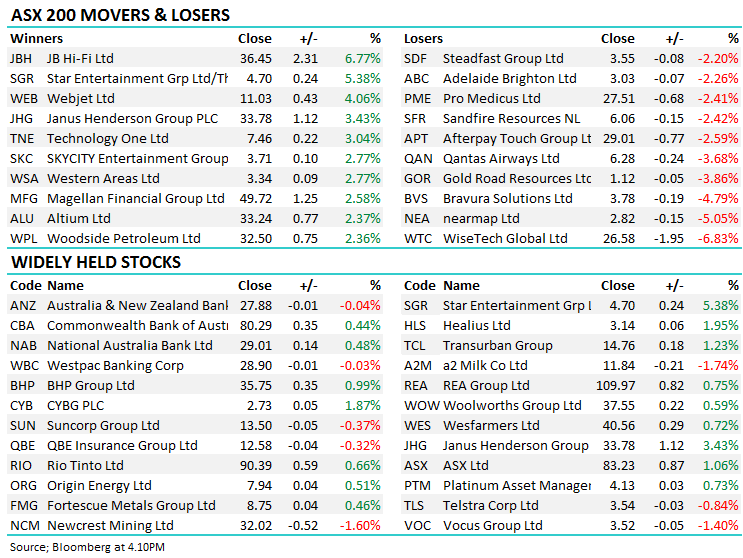

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.