Westpac out with results and surprise equity raise (WBC, NWH, CSR)

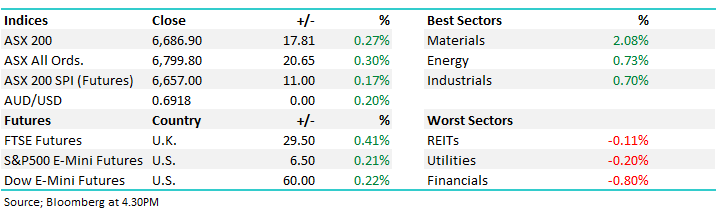

WHAT MATTERED TODAY

A choppy session to start the week although considering that Westpac (WBC) was in a trading halt to raise $2.5bn in fresh equity after reporting results this morning, the market actually did okay overall thanks to buying in the resource sector. A few standouts there pushing the material sector up by an impressive 2% on the session. Looks like some money coming out of the banks and finding its way in the miners following ANZ & now WBC missing the mark & tweaking their dividends.

Of note, Fortescue (FMG) was up more than 4%, RIO was up 3.54% while BHP added 2.18% - good moves. Copper stocks were also strong and this is a theme we’ll cover in the AM report tomorrow after I’ve just recorded a video with Shaw and Partners Resource Analyst, Peter O’Connor . Amongst the banks that traded today , NAB was knocked by -2.53%, CBA fell -1.52% & ANZ was off -0.92%.

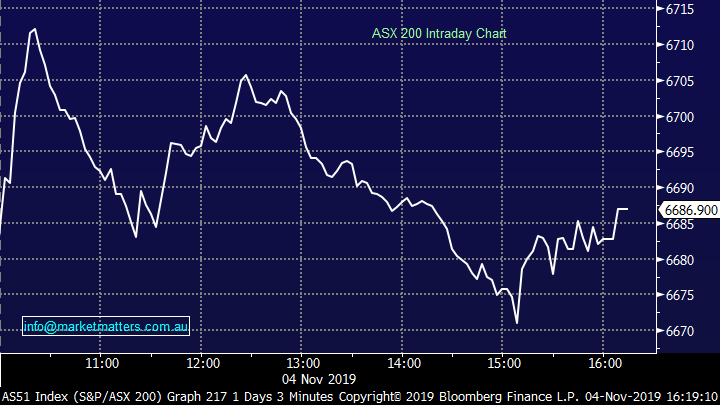

Overall, the ASX 200 closed +17pts / 0.27% higher today to 6686, Dow Futures are trading up +61pts / +0.22%

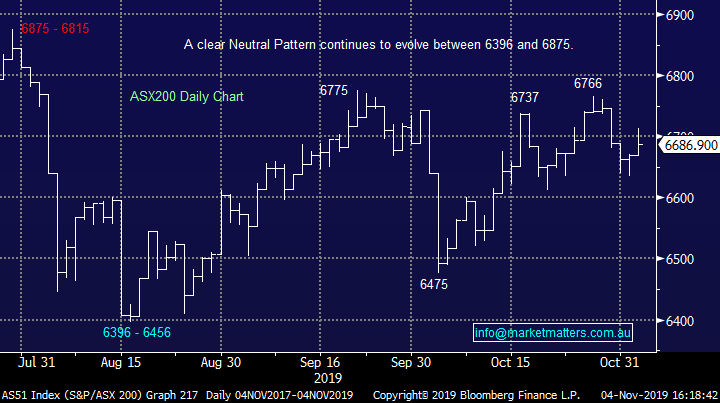

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

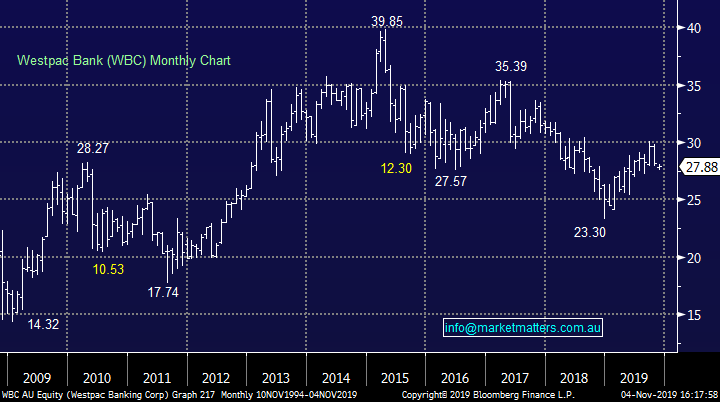

Westpac (WBC) Trading Halt: A lot going on in Westpac today (other than shares trading). We’ll break it up into the various components of today’s announcement.

1. Earnings

A weak year for WBC and the rest of the banks although the cynic in me would suggest the Government has incentivised the banks to report weakness in earnings this time around. That said, it’s hard not to look at the trends in today’s numbers with a ho hum sort of view. WBC delivered a 3% decline in cash earnings (excluding notable items) from 1H19 to 2H19. The reasons for the decline over this period were a combination of a 5% decline in non-interest income caused by wealth management and life insurance, a 1% increase in expenses and the bad debt charge increased from $333M to $461M in response to increasing new impairments and past due loans. In terms of margins, these actually increased by 1bp from 1H19 to 2H19.

For the full year, cash earnings came in at $6.85bn versus market expectations of $6.97bn implying a miss of around 1.7% at the earnings line – not a huge miss but clearly not great.

2. Dividend

The dividend was cut to 80 cps which was more aggressive than we / the market thought. The market was pricing in a cut, although not by that much. Morgan Stanley the only broker I could see prior to have 80cps pencilled in. The reduced dividend if sustained puts it on 160c for the full year, which is a dividend yield of 6.3% fully franked based on the placement price of $25.32.

3. Capital Raise

To shore up its balance sheet ahead of tougher capital rules, the bank will sell A$2 billion of shares to institutional investors at $25.32 a pop a 9.2% discount to Friday’s closing price. Retail shareholders will have the capacity to buy up to 30k worth of stock through a share purchase plan (SPP) at the same price. The insto placement today was covered in around 3.5mins!! given the deep discount. We would not expect shares to trade down to that level.

Westpac (WBC) Chart

NRW Holdings (NWH) +13.33%: Up strongly today for the same reason why Emeco (EHL) is down (-2.91%). Both companies are in the mix to buy Perth based BGC contracting, which is a large privately held mining services business. NRW has been listed as the preferred bidder with CEO Jules Pemberton saying he’ll only proceed if it is earnings accretive. NRW has multiple options to fund the deal hence the positive movement in SP today.

On the flipside, EHL is also looking at the deal however they don’t have the balance sheet strength that NWH has, hence the market is ‘less keen’ for EHL to pursue it from what I can tell. While EHL has some balance sheet issues, they’re priced for it trading it on just 6x while NWH is a better, stronger business and priced accordingly, on 13x forward. .

This creates a predicament for MM in so far as we hold both stocks. If NWH are successful, both NWH & EHL should rally, NWH on the earnings uplift and EHL on confirmation that they’re not going to put their balance sheet under more stress. The flipside would also be true – clearly we are cheering for NWH in this transaction and todays move implies that is the most likely outcome.

NRW Holdings (NWH) Chart

CSR +9.47%: Sits in the MM Income portfolio and today the Australian Newspaper reported that CSR could be a takeover target. The paper names GFG Alliance which is understood to have made efforts to buy the business about a year ago when shares were trading at $2.69 — their lowest level since 2016. GFG Alliance purchased the failed Australian steel manufacturer Arrium in 2017 for $700m. (Source: The Australian). Citi also fell on their sword upgrading from a sell to hold equivalent. We are looking to sell this holding into strength.

CSR Chart

Broker moves;

• CSR Raised to Neutral at Citi; PT A$4.30

• Mercury NZ Cut to Neutral at UBS; PT NZD4.90

• Regis Healthcare Cut to Neutral at UBS; PT A$3.20

• Macquarie Group Raised to Buy at Bell Potter; PT A$149

• Macquarie Group Cut to Neutral at Credit Suisse; PT A$135

• Caltex Australia Rated New Hold at Jefferies; PT A$30

• Viva Energy Group Rated New Buy at Jefferies; PT A$2.30

OUR CALLS

No changes today

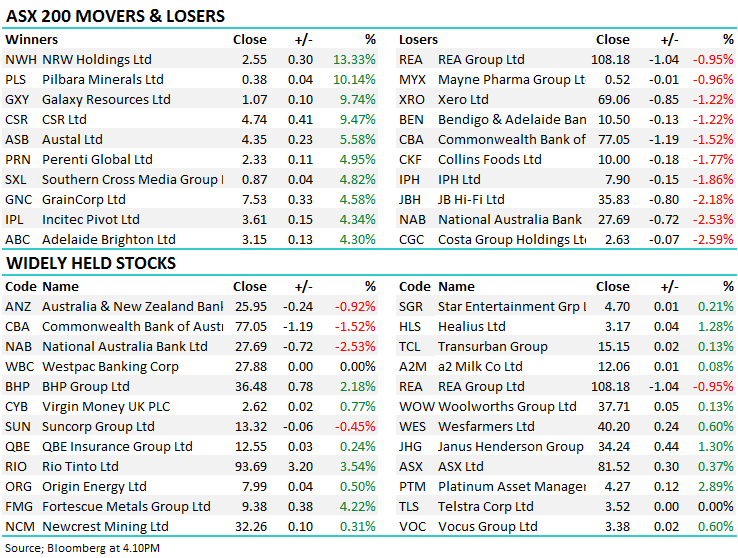

Major Movers Today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.