3 themes remaining in play (Z1P, APT, MSFT US, XRO, BHP)

Happy Friday everybody! Todays a short note as I take the family away for the long weekend hence no report on Sunday but back to business on Tuesday, have a fantastic break – James & the team.

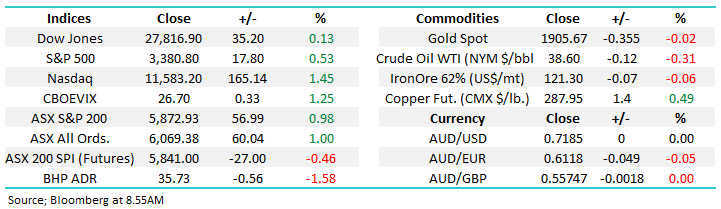

The ASX200 managed to regain half of Wednesdays losses yesterday but it was an unconvincing session as we gave back almost half of the day’s gains in the late afternoon. A 1% gain felt disappointing come 4pm especially with over 80% of the market rallying but none of the big names made any meaningful headway, and CSL actually struggled to close positive. In hindsight the local market got it right with US stocks struggling to match their gains in our time zone, the SPI futures are calling the local market down -0.4% this morning led by BHP which fell around 60c in the US.

Unfortunately the longer the broad Australian market ignores gains in overseas markets the less confidence I have that the ASX will make fresh post March highs in the weeks ahead but as we will look at later some of the sectors are dancing to our tune. There are numerous concerns looming on the horizon for investors from the end to JobKeeper, the US election plus of course when will we find a vaccine for COVID-19 hence it’s no surprise there’s a dearth of buyers into strength. Thus, our interpretation is slowly evolving to selectively bullish as opposed to outright market bullish.

MM is selectively bullish stocks short-term.

ASX200 Index Chart

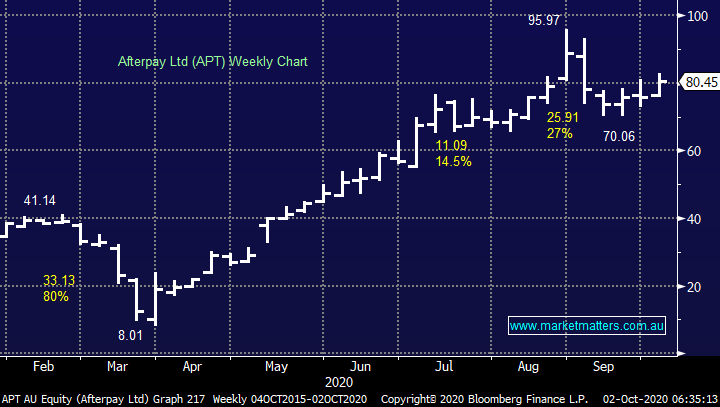

Yesterday we covered the BNPL space yesterday and for those that missed my video I strongly recommend a listen, I believe Jono Higgins is arguably the best in the BNPL space – I have attached the vide again below. On cue our preferred vehicle within the sector Z1P rallied strongly on Thursday, finally closing up 7% to be the days 2nd best performer – we remain positive Z1P and APT, initially looking for ~20% upside.

MM is bullish the BNPL stocks through October.

Zip Co Ltd (Z1P) Chart

Afterpay Ltd (APT) Chart

Overseas Indices & markets

Overnight US stocks continued their recovery led by the NASDAQ which gained +1.45% - remember the NASDAQ is carrying a record short position. The tech stocks are looking great, especially if they can add to weekly gains tonight, we remain bullish with an initial target ~10% higher.

MM continues to believe US stocks have found a low.

US NASDAQ Index Chart

When I look at Microsoft (MSFT US) which hasn’t undertaken a stock split in 2020 the technical picture would be ideal if we see a rally towards $US240 over the coming weeks. This appears a big ask without the tailwind of some good news but with a record short position in tech never say never.

MM remains bullish & long Microsoft (MSFT US)

Microsoft (MSFT US) Chart

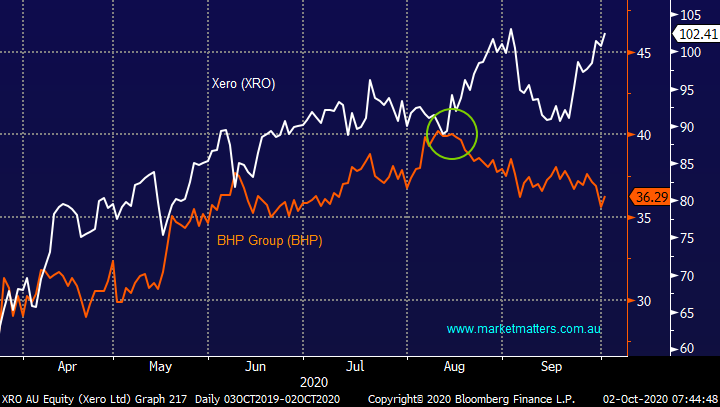

1 Techs rallying as resources struggle.

Overnight on the S&P500 we again saw the IT Sector rally nicely while Resources slipped lower, in our opinion the elastic band is slowly tightening. MM is very overweight the IT Sector but anticipates rebalancing towards the Resources Sector in the weeks / months ahead, but there’s no hurry at this stage. The chart below illustrates the relative performance of 2 major players within both sectors with the relative performance since the green circle illustrating why MM has reweighted towards the tech space.

MM expects ongoing outperformance from tech through October.

Xero (XRO) v BHP Group (BHP) Chart

2 $US Index poised to turn lower.

MM remains bearish the $US looking for the recent rally towards the 95 area to prove another bear market rally although we do feel the greenback has started “looking for a low”. The chart below illustrates the inverse correlation between the $US and precious metals i.e. as the $US falls gold for example rallies. We believe the $US Index is headed back towards 90 which should help gold mount another challenge on the +$US2,000/oz area but I wouldn’t be surprised to see gold stocks fall short of their late July highs when the sector euphoria was getting out of control, we’ve seen a large degree of this phenomenon through 2020.

MM is bullish precious metals in the weeks ahead.

$US Index v Gold ($US/oz) Chart

3 Volatility will remain elevated in Q4 of 2020.

The VIX Index shown below usually spikes higher when stocks fall, and such moves are magnified when the markets carrying large option positions. While we expect volatility to remain relatively high in Q4 we do expect the VIX to remain contained in the 20-40 region hence “sell strength and buy weakness”.

MM expects Septembers elevated volatility to remain through Q4.

US Fear Index (VIX) Chart

Conclusion

Have a great long weekend, at this stage MM likes our holdings and doesn’t anticipate being too active until later in the month.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.