Cracks appearing with index momentum waning (PDL, BLD)

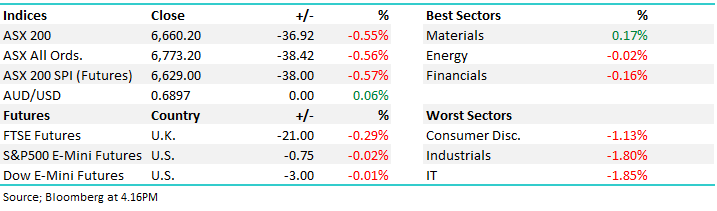

WHAT MATTERED TODAY

A soft session across the local market today with early strength getting overcome after the first hour with sellers dominating thereafter. The IT Stocks were again in the cross hairs, AfterPay (APT) –4.39%, Appen –7.85%, Zip Co –6.27%, stood out for the wrong reasons and this is a sector we continue to avoid. On the flipside, the only sector in the green today was the materials thanks to high commodity prices overnight. BHP and Rio did the heavy lifting here as you can expect with gold stocks rolling over with the gold price, and FMG the anomaly of the iron ore names with a few brokers noting the share price had run a bit harder than the commodity.

The ASX has now had three session where it has failed to hold onto early gains implying a soft underbelly is becoming obvious. We are now neutral / negative the ASX in the short term. US Futures were fairly muted during our time zone while there wasn’t a lot happening in Asia either so much of the selling seems locally focused at this stage.

Overall, the ASX 200 closed -36pts/-0.55% lower today to 6660, Dow Futures are trading flat.

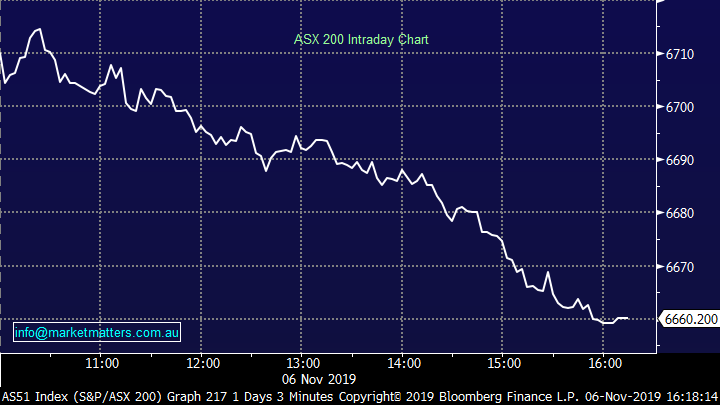

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

Medibank Private (MPL) –8.53%; saw shares slide today following an update regarding performance thus far in the financial year showing claims at $21m more for FY19 that was provisioned at the time the results were announced with underlying growth at 2.4%, above the 2% reported at the time. More of a concern for the market is the comment that the increase represents a trend, and Medibank now expects “the increase in claims per policy unit in the second half of FY19 to continue throughout FY20.”

On the other side of the ledger, the company has managed to increase the book, with growth of around 0.6% in the current financial year MPL is on track to at least stabilize policyholder volumes this year as was targeted at the full year result. Medibank also put some of the blame back on their previous owners, calling on the government to reform the system to ensure healthcare and its insurance remains affordable, presumably not at the cost of profits for Medibank. We struggle to buy MPL around here given the issues in the sector.

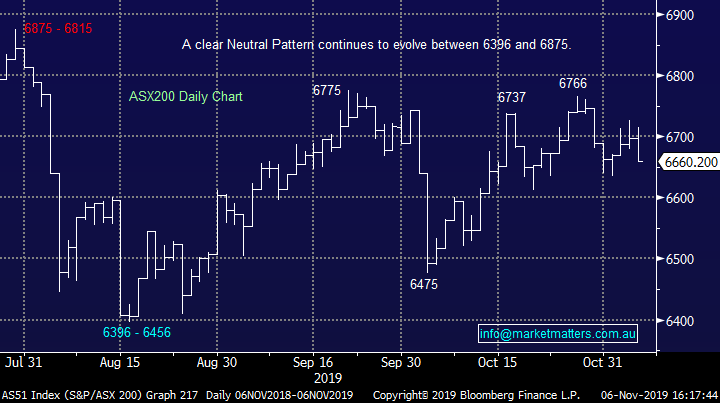

Medibank (MPL) Chart

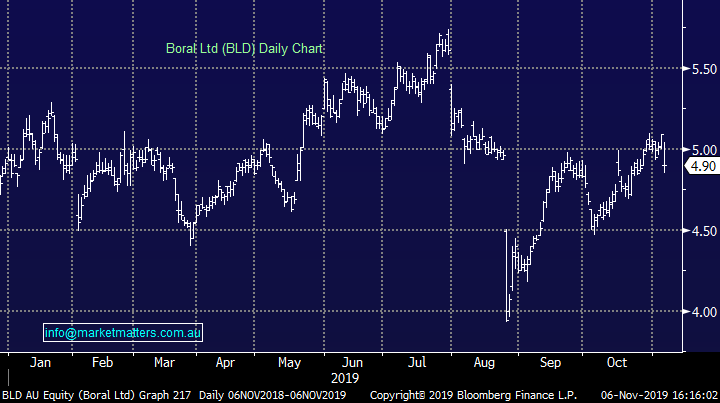

Boral (BLD) –3.73%; the construction materials company held their AGM today with shares lower as a result of the mixed outlook commentary. The company maintained FY20 NPAT guidance at 5-15% lower than FY19, however this is well below the market consensus 1% fall in earnings. Analysts appear a little more optimistic regarding Boral’s transformational program with the contribution set to ramp up in the second half. The company also talked to a second half skew with signs of life in better demand despite lower volumes on pcp. Shares were down today, however they were probably better off than they should have been given the update, but with BLD trading on just 13.7x forward earnings, its expectations are undemanding. At the 5 year average PE of 15.6x, BLD would trade at $5.82.

Boral (BLD) Chart

Broker moves;

· REA Group Cut to Neutral at Macquarie; PT A$109

· Dexus Cut to Sell at Morningstar; PT A$9.50

· Fortescue Cut to Neutral at Clarksons Platou Securities Inc

· Charter Hall Group Reinstated Neutral at Credit Suisse

· Coca-Cola Amatil Raised to Overweight at JPMorgan; PT A$11

OUR CALLS

Today we trimmed back our Costa holding by 2.2%, or sold around 30% of our weighting with the view that we’ll take up the rights at $2.20. This is simply to reduce our exposure to more palatable levels into strength. After coming back on the market at $2.38, CGC has found some reasonable buying closing today at $2.75

We put an alert out this morning to buy Pendal Group (PDL) after they reported full year results this morning that were better than the market had feared. We were clearly on the right track however the stock ripped higher in quick succession leaving us buried on the bid at lower levels – we have not been filled as yet however we have amended our buy level up to an $8.00 limit – we will continue to update this in coming notes.

This highlights the joys of running a real portfolio vs paper trading - Pendal was on the move early and was out the door before the alert was sent out.

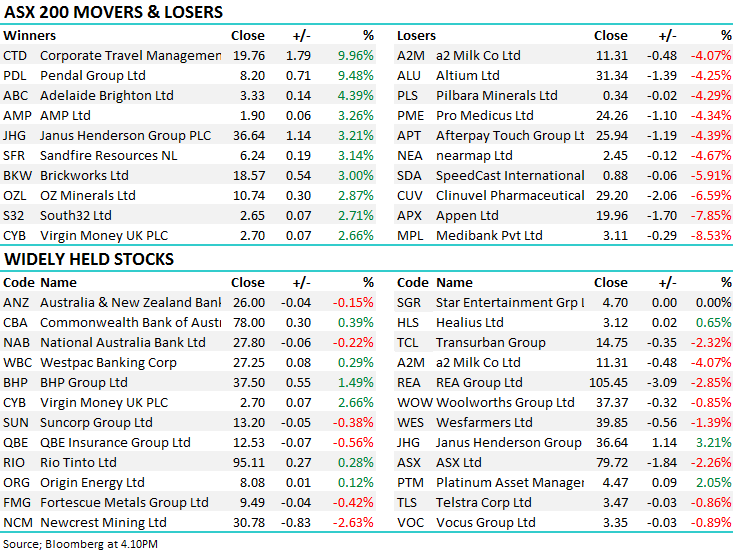

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.