Bingo ‘bins’ the shorts at today’s update (BIN, PGH, APT, ECX)

WHAT MATTERED TODAY

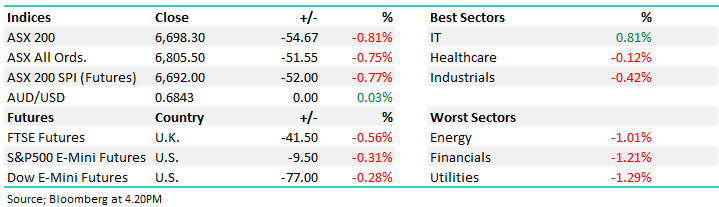

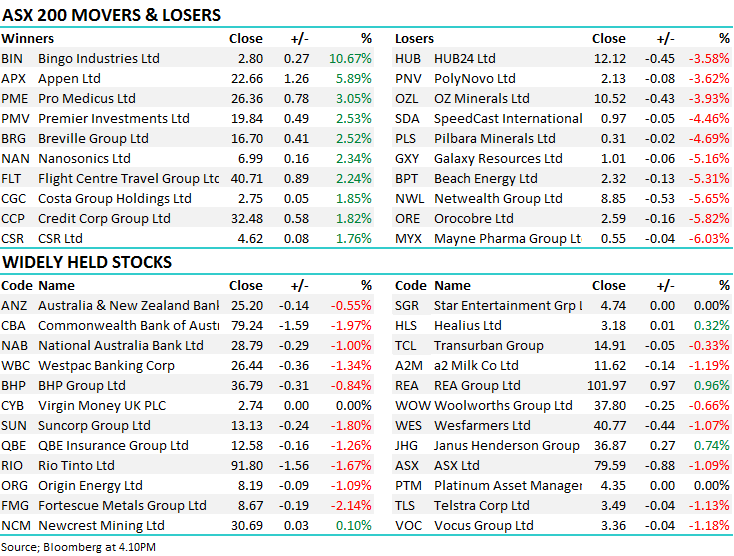

A slow and steady grind lower today from the get-go with the market pulling back -68pts from the early highs – a similar trend to yesterday however with more aggression on the sell side – Asian markets were weak across the board while US Futures also traded down on the day. At a sector level, the IT stocks continued their recovery edging slightly higher, Appen (APX) the best of them which has now bounced +10% from sub $20 recent lows, however it was a soft affair elsewhere with all other sectors closing in the red.

Overall, the ASX 200 lost -54pts/-0.81% today to close at 6698 – the range bound market continues. Dow Futures are trading down -80pts

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

Bingo (BIN) +10.67%: Had their AGM today and provided a trading update pre-market. Important to think about this update against the backdrop of market positioning. 10% of the company is sold short, 17th most shorted stock on the ASX with the short thesis being 1. Weakness in residential construction will hurt 2. Recent price rises will hit volumes 3. Inexperienced management will drop the ball integrating the Dial-a-Dump acquisition & 4 guidance for FY20 would be below consensus.

Addressing the above, residential volumes were soft but within expectations, price rises had impacted volumes but again not to a concerning degree and margins improved implying the company is maintaining the strategy (tick), the DADI acquisition is being bedded down well and finally consensus EBITDA for FY20 was at $159m and today they guided to $159-164m – a beat at the mid-point however a meet would have done.

I was on the conference call this morning and the guys handled themselves well. I came away thinking that there was more upside than downside to the guided number. Shorts are hurting on this one and they would have amplified today’s gains, particularly early on. 8.9m shares were traded today – about 4x the daily average. 60m+ shares in this stock are still held short. We didn’t get a chance to buy stock today, we’ll wait for it to settle however we’re now bullish BIN after today’s news

Bingo (BIN) Chart

Pact Group (PGH) +1.98%: One we hold in the Growth Portfolio, held their AGM today. There was little new detail in the presentations with the bulk dedicated to last year’s result as well as highlighting targets and progress with the sustainability targets. The company is undertaking a strategic review which is usually an excuse to sell some parts of the business, or at least offload some costs which could be a good thing for Pact given their high debt levels. The CEO confirmed trading conditions so far in FY20 “have been in line with our expectations” as per the August result and guidance remains unchanged.

The positive market reaction today shows not a lot of upside is backed in to the PGH cake!

Pact Group (PGH) Chart

Eclipx (ECX) –7.95%; Fleet management services company Eclipx was sold off today on the full year results it posted this morning. The company has spent the second half of the year restructuring with the sale of a number of businesses that have been deemed non-core. GraysOnline, AreYouSelling and Commercial Equipment Finance have been offloaded while Right2Drive and CarLoans are also on the chopping block. This leaves Eclipx with the core fleet and novated leasing businesses which saw a 10% EBITDA decline for the full year on FY18, however the second half was largely in line with the first showing some stabilization. This did little to hide the soft result however the business has come a long way from insolvency fears earlier in 2019 around the half year result. Still, it’s not a business we like given the tight margins and continued restructuring issues.

Eclipx (ECX) Chart

Afterpay Touch (APT) +0.62%; a wild trading day for Afterpay on their AGM, with the stock as high as +9.56% and as low as -4.73% from yesterday’s close only to finish marginally higher. The AGM came with FY20 progress which has seen sales up 110% on the same 4-month period last year with active customers also more than doubling. The growth trajectory seems to be holding pace with an average of 15k customers on boarded in October – the fastest run rate yet for Afterpay. The international expansion looks to be on track with the new UK seeing underlying sales annualised at $0.4b while a strategic partnership with US technology platform investor Coatue set to fast track penetration in the states.

For the most part though there wasn’t a great deal of new detail bar announcing a strategic partnership with ebay Australia, while the figures point to a continuation of the trend for APT.

Afterpay Touch (APT) Chart

Broker moves; Funnily enough, UBS (that were paid to raise capital for CGC) reaffirmed their buy thesis on Costa (CGC) while they cut their price target to $3.25. While the view is a conflicted one, they say…

"The key debate is now, in our view, what does a normal year for Costa look like and where should it trade given a lack of visibility and materiality of the 2H19 downgrade - with the balance sheet post raising well within covenants and UBS [estimated] 24 per cent 3-yr earnings growth we continue to believe Costa should trade at a premium to listed peers. That said; visibility over 2020 is unlikely to improve until early Q2 when Moroccan and Australian Citrus & Berry earnings visibility improves." They forecast EBITDA of $149m for FY20 versus company guidance of $150m. Essentially, there is a lot of uncertainty about what CGC earnings will be in FY20, hence why they raised capital to deal with the uncertainty. We still like it here despite wearing a lot of pain on the position recently.

Costa Group (CGC) Chart

OUR CALLS

No changes today.

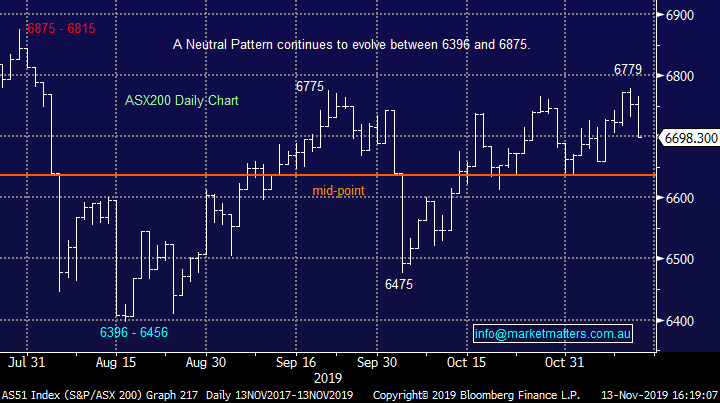

Major Movers Today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.