HSBC sees Sydney property up ~10% next year (A2M, WTC, KGN)

WHAT MATTERED TODAY

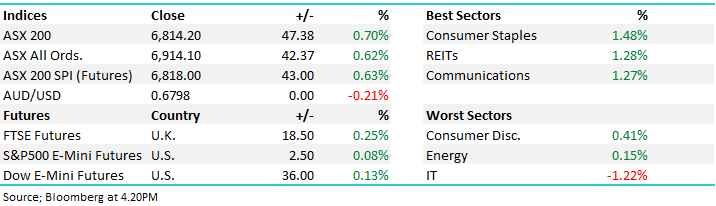

Somewhat of a reversion today of the recent trends with the high value growth stocks suffering some selling led by Wisetech (WTC) while a number of the value plays bounced strongly as AGM season heats up. The market was weak on open this morning before minutes from the RBA suggested they were close to cutting rates on Cup day, closer than the market gave them credit for. That saw the Australian Dollar sold off while the market bounced more than +55pts from the lows.

At a sector level, consumer staples and real-estate did well, benefiting from the decline in bonds yields while the materials stocks also traded higher today, up around 0.6%. US Futures were fairly quiet during our time zone while Asian markets were mostly up.

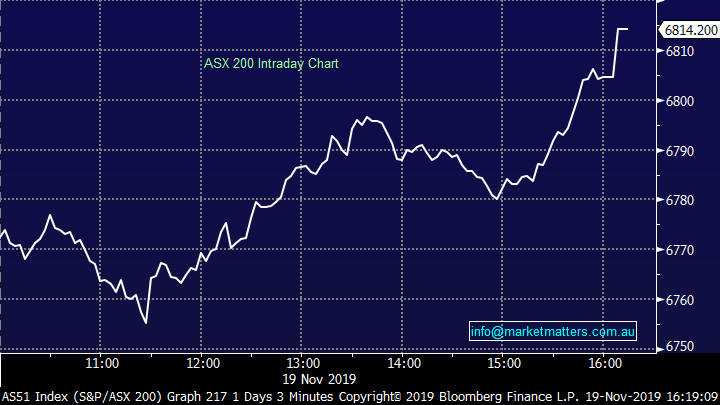

Overall, the ASX 200 gained +47pts/+0.7% today to close at 6814. Dow Futures are trading marginally higher

ASX 200 Chart – Big line of Futures through on the close

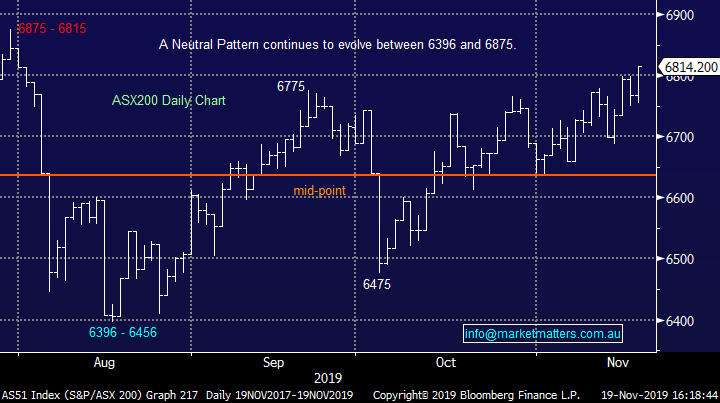

ASX 200 Chart – ASX 200 has now broken the August high

CATCHING MY EYE;

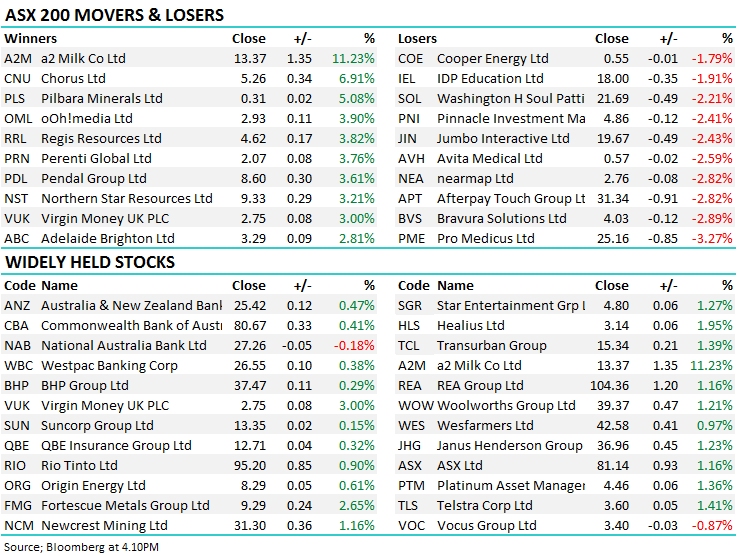

Stocks with AGM’s today: A2 Milk (A2M) +11.23%, Wisetech (WTC) -7.69%, Monadelphous (MND) +0.20% , Praemium (PPS) +1.75% , Pro Medicus (PME) -3.27% , Kogan (KGN) –6.59%, Propel (PFP) +1.27%, REA Group (REA) +1.16%, Sonic (SHL) +2.06%

Kogan was decent early before sustained selling throughout the session - now looks a short term sell technically…

Kogan (KGN) Chart

Housing Bulls Emerge: HSBC has become bullish on local housing doubling its forecast for Australian property price increases next year thanks to low rates and easier credit from the banks. They now forecast prices to rise by 5% to 9% in 2020, up from previously expected gains of 0% to 4%, Paul Bloxham, HSBC’s chief Australia and New Zealand economist, said in a note on Tuesday. Sydney & Melbourne in the box seat for the gains with the bank forecasting 8-12% growth in Sydney and 10-14% in Melbourne…Rising asset prices are ultimately good for stocks as well – we all feel good about ourselves when house prices are increasing!

Wisetech (WTC) -7.69%: held their AGM today and re-affirmed guidance for EBITDA of $145 - $153m while the market is currently looking for $151m, however the focus was squarely on the issues raised in the recent short report from J Cap. Rather helpfully, J Cap also sent out a list of questions investors should ask the company at the AGM today...one being the recognition of organic growth rates with WTC claiming organic growth at +33% while J Cap think 10% is the right number. The longer this goes on, the more investors will simply think the stock is ‘all too hard’ and look for growth opportunities without such a grey cloud hanging over them. Think about it, if a Fund Manager, or an market Newsletter for that matter now tips WTC and the short thesis proves accurate, they’ll look like idiots, and we all know how superficial the finance industry is!!

Wisetech (WTC) Chart

A2 Milk (A2M) +11.23%: Dual listed milk product producer A2 Milk has rocketed today, easily the best performer in the top 200 locally as well as the top 50 in New Zealand. The rally comes on comments made at the company’s AGM in Auckland with outlook comments far surpassing the market’s expectations. A2 has started FY20 strongly with expectations of first half revenue to hit $NZ780m to $NZ800m, hitting growth of 29% on the first half of FY19. Margins are also expected to expand to 31-32% in the half with improving price metrics as well as favourable FX moves helping lift the result. Revenue growth has been mostly driven by significant international infant formula growth, particularly in China which saw ~84% growth and now represents over 15% of the revenue make up.

The company does expect some slip in margin in the second half with packaging and input costs creeping higher while also lifting marketing spend and investing in distribution channels through China, however margins are still expected in the range of 31-32%. This compares to market consensus EBITDA margins of circa 28%, or an 11% beat at the EBITDA line if revenue expectations are met which the company is on track to do.

A2 Milk (A2M) Chart

Broker moves;

• PolyNovo Raised to Hold at Baillieu Ltd; PT A$2

• Rural Funds Raised to Overweight at Wilsons; PT A$2.09

• Monash IVF Raised to Add at Morgans Financial Limited

• Domino’s Pizza Cut to Reduce at Morgans Financial Limited; PT A$45.23

• Beacon Lighting Cut to Hold at Morgans Financial Limited

• Coca-Cola Amatil Raised to Neutral at Credit Suisse; PT A$11

• Australian Pharma Raised to Hold at Bell Potter; PT A$1.37

• Appen Cut to Hold at Bell Potter; PT A$28

• Appen Raised to Buy at Baillieu Ltd; PT A$29.32

• SmartGroup Cut to Hold at Morgans Financial Limited; PT A$10.01

• Alacer Gold Cut to Sector Perform at National Bank; PT C$7.50

OUR CALLS

No trades today however a few of our recent buys have started to move…Pendal (PDL) had a good session putting on +3.61% to close at $8.60 while Sims 9SGM) ticked up through $11, adding +1.75% on the session. Emeco (EHL) which delivered a strong update at their AGM last week also put on +3.33% - a reasonable day for the MM Stocks.

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.