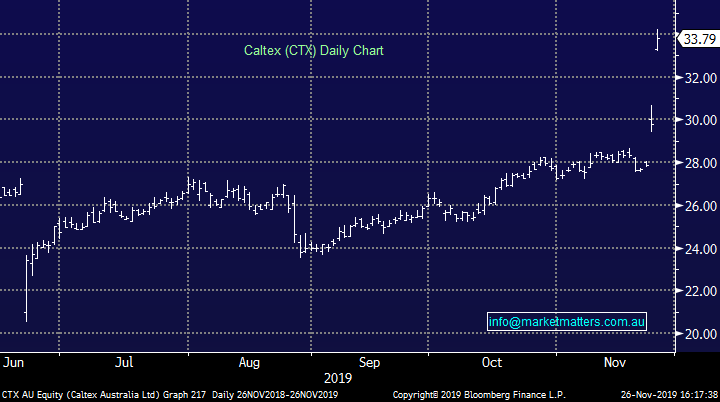

Markets buoyed by continuing trade talks (IGL, SSM, NWH, CTX) **BABA US, WFC US**

WHAT MATTERED TODAY

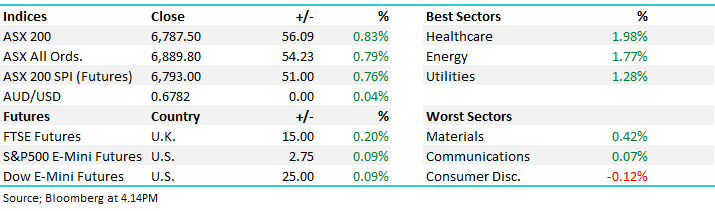

A more bullish session than futures were implying this morning buoyed by reports that China and the US held a call today and quote ‘agreed to continue phase 1 talks. Seems fairly anaemic news however when the market is bullish, stocks tend to latch onto the positive side of news flow. Asian markets were mostly higher again today, the only exception being Hong Kong, which was trading flat into our close, while US Futures were also up during our time zone, but not materially so.

At a sector level today, Healthcare led the way thanks to a +2.3% rally in CSL, what a phenomenal run it’s had while the Energy sector was buoyed by a takeover bid for Caltex (CTX), the stock rallying +13% as a consequence – Harry covers off this below. Elsewhere, AGMs were a plenty today, a few stocks across MM portfolios provided updates with NRW Holdings (NWH) being the standout. Focus remained on Westpac (WBC) with board / management changes announced this morning, WBC bouncing +1.72% as a consequence outperforming peers.

Overall, the ASX 200 added +56pts /+0.83% today to close at 6787. Dow Futures are trading up +25pts

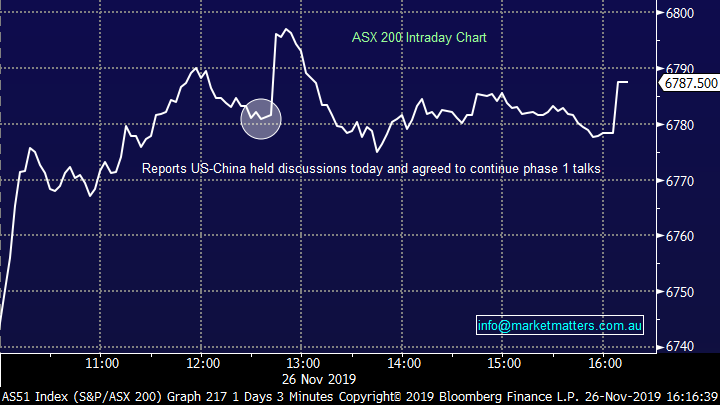

ASX 200 Chart

ASX 200 Chart – market looking to re-test upper range one again

CATCHING OUR EYE

Westpac (WBC) SPP Dates: I put an email into WBC investor relations yesterday about record dates for the SPP entitlement… Hi Andrew – I’m sure you’ve got plenty on your plate at the moment, so I’ll be brief. Regarding the retail component of the SPP, there seems to be an issue with the record date meaning that those who bought stock on the 1st November, pre-results and pre-capital raise announcement are not entitled to participate in the SPP. It only applies to buyers on that one day. This is very odd – I’ve not seen this before. It seems you have made the record date 1 day early? Using the same premise as a dividend, it would be absurd for us to buy stock the day before it trades ex-dividend and not pick up the right to the dividend, which is essentially what has happened here. Why has it transpired like this? Many thanks James. I spoke with Andrew following this and it’s being escalated internally. I won’t hold my breath however I’m perplexed in the outcome that has unfolded.

IVE Group (IGL) +1.72%: Was out yesterday with an announcement about the purchase of Salmat’s (SLM) marketing solutions business which is Australia’s largest catalogue distribution business. There wasn’t a large amount of information in the release however more detail was provided at their AGM today, and the stock has reacted more favourably. Firstly, on the acquisition, they’ve paid $25m upfront (completion January 2020) with a further $25-$30m capital investment to automate the division – this will be debt funded. The purchase ties in with their strategy of being completely vertically integrated end to end provider within the marketing and communications industry, and importantly, they believe the acquisition will be earnings accretive in FY20.

At their AGM today they talked about the quality of their FY19 result – best they’ve delivered for a while and presented a fairly upbeat assessment for FY20, although they didn’t provide specific guidance. Trading on just 9x and yielding ~7.5% fully franked, this is a business that should be trading higher. We hold in the Income Portfolio

IVE Group (IGL) Chart

Service Stream (SSM) +0.84%: We covered this morning however there’s been a clear motivated seller of the stock yesterday and again this morning, however it seemed once that seller was done on open, some clear air was given to the stock which bounced +4% from today’s low. We remain keen on SSM despite recent weakness.

Service Stream (SSM) Chart

NRW Holdings (NWH) +4.03%: The mining services business held their AGM today and the guidance at a divisional level implied an upgrade at the revenue line. They have four main divisions, Civil, Mining, Mining Technologies & Drill and Blast. While the bulk of their expected revenue is now secured for FY20, their divisional guidance implied some upside in the civil area which suggests they may well beat current consensus. They should deliver revenue just shy of $1.6bn while current market expectations are for $1.46bn. We remain positive on the stock.

NRW Holdings (NWH) Chart

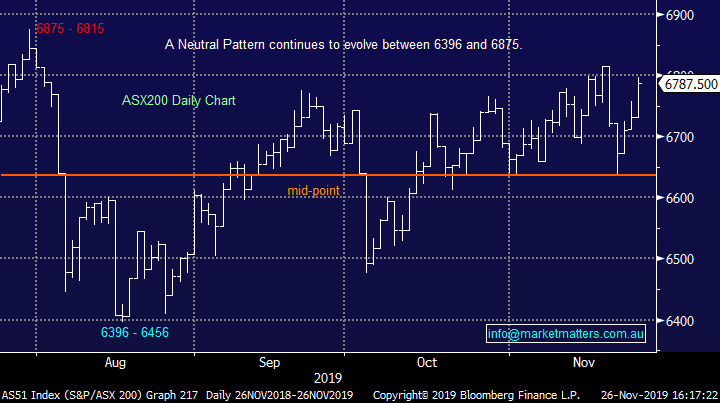

Caltex (CTX) +13.43%; challenged for the best on ground yesterday, but certainly took the 3 points today on announcing a takeover bid from Canadian company Alimentations Couche-Tard. The non-binding offers for $34.50 represented a 15.8% premium to yesterday’s close, and shares finished ~2% behind the bid today. The bid comes following Caltex rejecting a previously undisclosed offer from Couche-Tard at $32 with the extra $2.50 enough to bring the board to the table. The discussions are in the early stages and would prevent Caltex from spinning out part of the property portfolio as was announced yesterday. With still a reasonable margin in the shares to the offer price, this would be one to hold for now however upside is limited for any new buyers.

Caltex (CTX) Chart

Broker moves; SKI raised to outperform; this sits in our income portfolio.

· IOOF Holdings Cut to Sell at UBS; PT A$6.70

· Bank of Queensland Raised to Neutral at UBS; PT A$8.25

· Bank of Queensland PT Cut to A$7.50 from A$8 at Morgan Stanley

· AMP Cut to Sell at UBS; PT A$1.80

· Sigma Healthcare Cut to Sell at Citi; PT 65 Australian cents

· Sky Network TV Raised to Neutral at Macquarie; PT NZ$0.88

· Spark Infra Raised to Outperform at Macquarie; PT A$2.37

· Mayne Pharma Cut to Underweight at Wilsons

· Caltex Australia Cut to Hold at Morningstar

· Caltex Australia Raised to Overweight at Morgan Stanley

· Seven West Cut to Sell at Goldman; PT 34 Australian cents

· Carnarvon Rated New Overweight at JPMorgan

· Stride Property Raised to Hold at Deutsche Bank; PT NZD2.18

· Painchek Rated New Buy at Canaccord; PT 55 Australian cents

· IPH Raised to Buy at Goldman; PT A$9.50

· Alumina Cut to Neutral at Credit Suisse; PT A$2.40

OUR CALLS

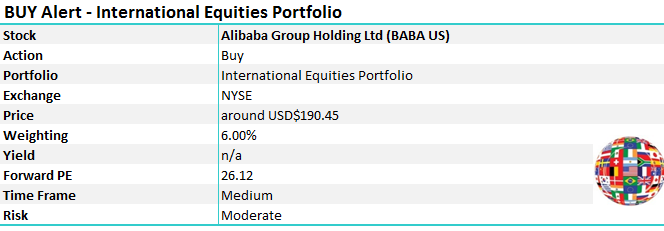

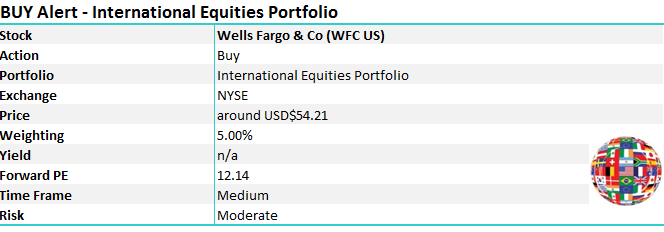

International Equities Portfolio: As per comments in recent notes, we are adding two more stocks to the international equities portfolio, Alibaba (BABA US) and Wells Fargo (WFC US).

Alibaba Group (BABA US) Chart

Wells Fargo (WFC US) Chart

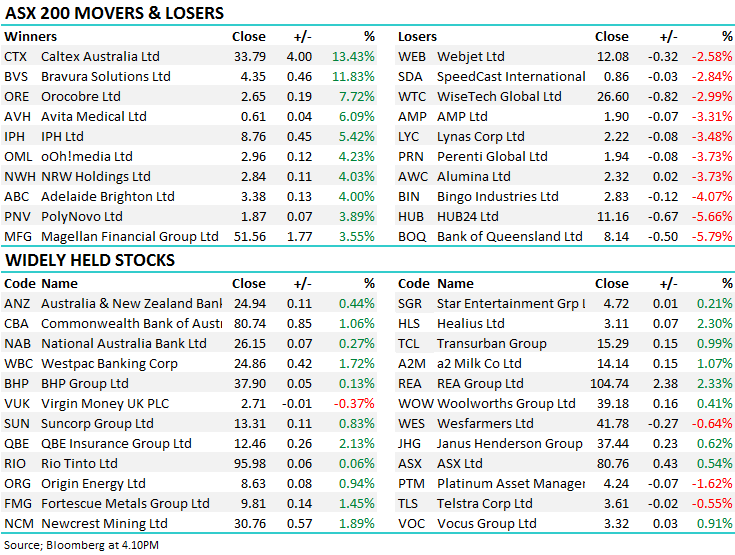

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.