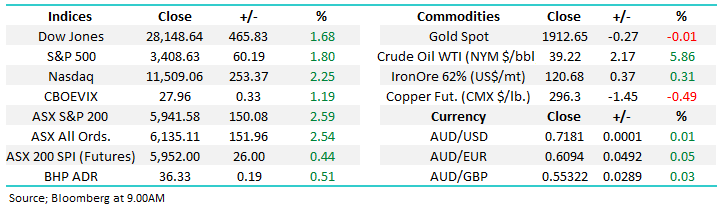

A quick overview to start the week (CBA, AAPL US, XRO, BHP)

I hope everyone living in ACT, NSW, QLD and SA enjoyed the long weekend, the weather was certainly spectacular, I was camping up the Myall Lakes and it was a cracking few days, although very busy and I can certainly understand why sales at Super Retail Groups BCF outlets have been strong. Today a short missive as we get back into the swing of things for what looks likely to be a quarter full of opportunity for the prepared investor.

The ASX200 soared 150-points yesterday, its best performance in 3-months as many Australians enjoyed the great weather and a long weekend, sentiment was buoyed by the news that President Trump’s health was improving as he battles COVID-19 – this morning we’ve woken up to see US equities roaring ahead, another tick to the ASX picking overseas markets. Investors who aren’t convinced that stock markets are hoping for a Trump victory only have to look at the last 2 sessions for a large degree of confirmation:

1 – Last Friday afternoon after the news broke that Trump had contracted COVID-19 the local market plunged down over 80-points, basically all in the last hour after the news spread like wildfire.

2 – On Monday the news although at times convoluted was painting an improving picture around President Trumps health sending the market soaring led by the Banks and Energy Sectors, the 2 major laggards of recent times.

Biden remains firm favourite to move into the White House and recently its felt like Trump needed to “pull a rabbit out of the hat”, perhaps his diagnosis could just be it - I can imagine the rallying cry, “I beat the China plague, common America we can do this together” when combined with a potential sympathy increase in popularity, as it did for Boris Johnson in the UK, perhaps he can just surprise the bookies a 2nd time. The market feels like its reviewing stocks with a glass half-full attitude.

Today’s Budget Day in Australia and the markets are expecting further pro-growth economic stimulus, it’s only the details around what and when / where the attention is really being focused. Most pundits have now pushed back forecasts for the RBA to take centre stage next month on Melbourne Cup Day, expectations are for a combined cut to 0.1% and a further tweak to their 3-year bond target. In other words stocks are looking for both the government and RBA to maintain their tailwind / support for stock valuations.

MM remains selectively bullish stocks short-term.

ASX200 Index Chart

Yesterday saw the “Big 4” banks rally an average of more than 4%, a very helping hand for the ASX200. We think the banks look good value into the last 2-months weakness, especially after APRA have taken over the responsible lending position from ASIC, in the past they’ve been far more business friendly. If we assume the Banking Sector has reached a major valuation support area it’s hard to imagine the index falling much below the 5800 level, today its back towards 6000 again!

MM is bullish the banks from current levels.

Commonwealth Bank (CBA) Chart

Overseas Indices & markets

Overnight US stocks continued their recovery led by the NASDAQ which gained another +2.2% - remember the NASDAQ is carrying a record short position. The tech stocks are looking great, especially if they can add to weekly gains through this week, we remain bullish with an initial target ~10% higher but we are watching for early signs of rotation into the underperformers such as banks and energy, exactly as we witnessed on the local bourse yesterday.

MM continues to believe US stocks have found a short-term low.

US NASDAQ Index Chart

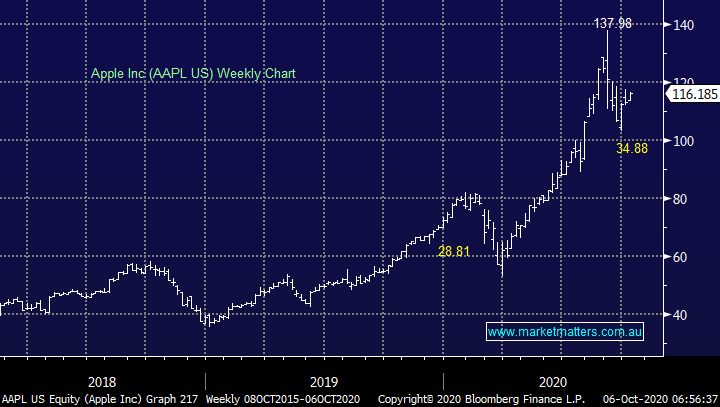

We regularly talk about being prepared at MM and the roadmap for both Apple (AAPL US) and US tech is painting a perfect technical picture, so good it probably wont unfold but we do have the required event risk backdrop to cause a large degree of volatility hence thinking and planning ahead is vital:

1 – The technical picture points to a fresh high for AAPL up towards $US140 before a period of downside consolidation, the record short position for US tech could easily see a squeeze in stocks like Apple into the US election, especially if the result threatens to become more of a coin toss.

2 – If in November Joe Biden does indeed become the 46th President of the US its generally expected to be a headwind for tech hence a pullback in November / December, before the traditional Christmas rally, would not surprise.

MM remains bullish & long Apple Inc (AAPL US).

Apple Inc (AAPL US) Chart

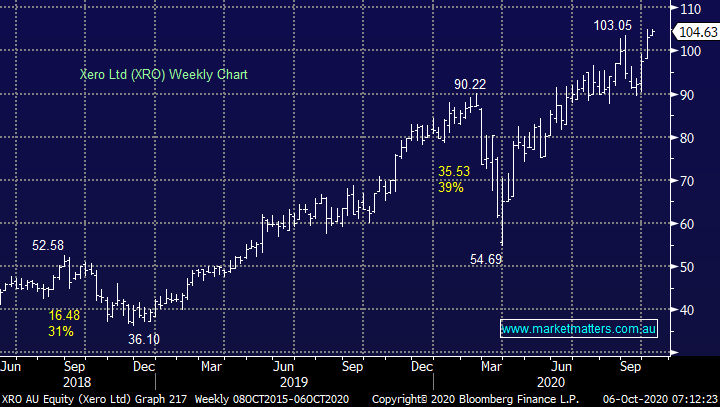

1 Australian Tech’s remains on course for a strong month.

This morning the top performing Australian tech stock of the last month is set to at least post a fresh all-time high i.e. Xero (XRO) is already up +10.4% for the last month and its set to break $105 this morning. MM believes XRO is leading the way for the rest of the sector to at least a strong October. We remain currently very overweight the sector looking for such a move, but we anticipate lightening into strength probably via the weaker member as opposed to standout XRO.

MM expects ongoing outperformance from tech through October.

Xero (XRO) Chart

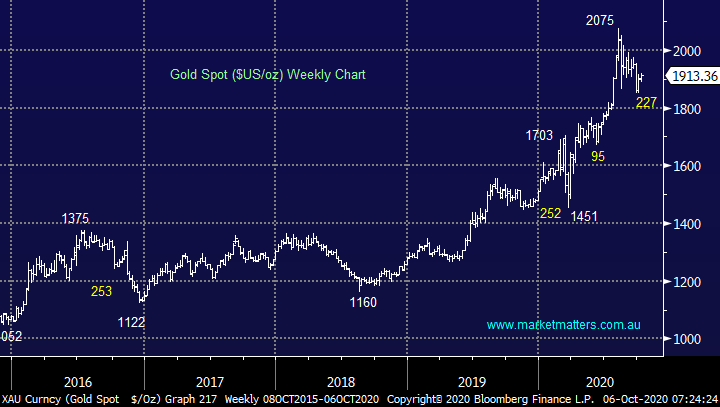

2 Gold looks set to pop 10%.

Golds starting to regain its mojo over the last 2 weeks and as COVID-19 starts to arguably win the 2nd round in the northern hemisphere it’s easy to comprehend another avalanche of economic stimulus which is likely to send gold back towards $US2,100 plus of course we still have the critical economic tailwind of negative real interest rates i.e. the inflation rate is above current interest rates.

MM is bullish precious metals in the weeks ahead.

Gold ($US/oz) Chart

3 Its still “Risk on” for now.

The ASX Small Cap Index has been outperforming since early August, not always a great signal but certainly supportive short-term. The implication is investors are casting their net further afield in the effort to find perceived value in today’s market, this is unfortunately the common characteristic prior to a pullback but there are no signs at present.

MM remains bullish short-term.

ASX200 v ASX Small Cap Index Chart

4 Resources may be set for another leg higher.

Resources have pulled back over recent weeks with the likes of copper correcting -9.2% and heavyweight BHP Group (BHP) close to -14%. The last few days have looked promising and the sector might be ready to again challenge 2020 highs, a tough call to say if they will / can outperform tech at this stage.

MM likes resources into recent weakness.

Copper December Futures Contract ($US/lb) Chart

BHP Group (BHP) Chart

5 Volatility will remain elevated in Q4 of 2020.

The VIX Index shown below usually spikes higher when stocks fall with these moves being magnified when the markets carrying large option positions. While we expect volatility to remain relatively high in Q4 we do expect the VIX to remain contained in the 20-40 region hence “sell strength and buy weakness”.

MM expects Septembers mildly elevated volatility to remain through Q4.

US Fear Index (VIX) Chart

Conclusion

At this stage MM likes our holdings and doesn’t anticipate being too active until later in the month – we remain short-term bullish.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.