NWH excites but traders take some profits (VUK, NWH)

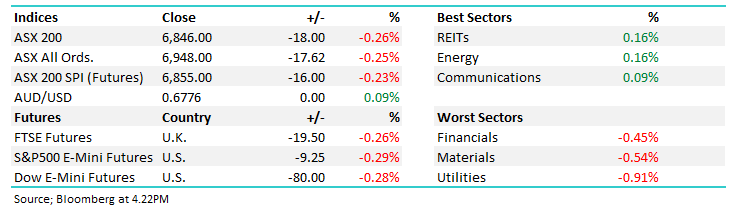

WHAT MATTERED TODAY

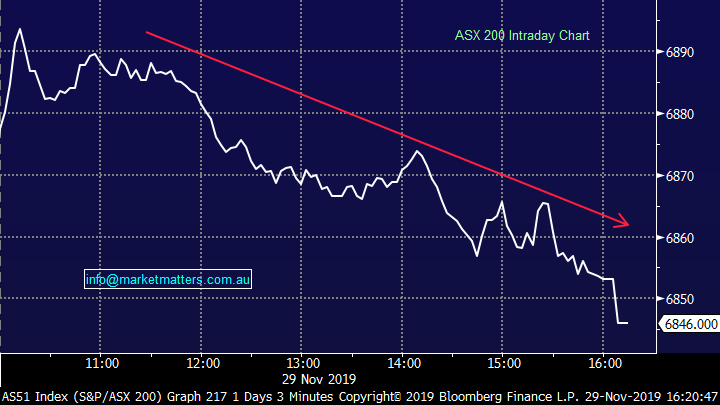

Early bidding soon gave way to some profit taking as the index eased back from intra-day all-time highs set 15 minutes into the session marginally below the 6900 marker. The ASX200 closed on the session’s low thanks to a 7pt sell off on the closing match. Resources gave up the most points in the session with each of the iron ore names opening higher only to close down around ~0.5%, while gold names were soft throughout. Banks rounded out a difficult week on the back foot, but utilities were the worst hit today.

It wasn’t all bad news though – NRW Holdings (NWH) came back online and traded firmly higher following their capital raise to buy BGC Contracting. Shares closed up 5.3% but were 14% higher (plus a 2c divi) earlier in the session. Virgin Money (VUK), Clydesdale’s replacement, was up 24.54% on their full year result – more on these below.

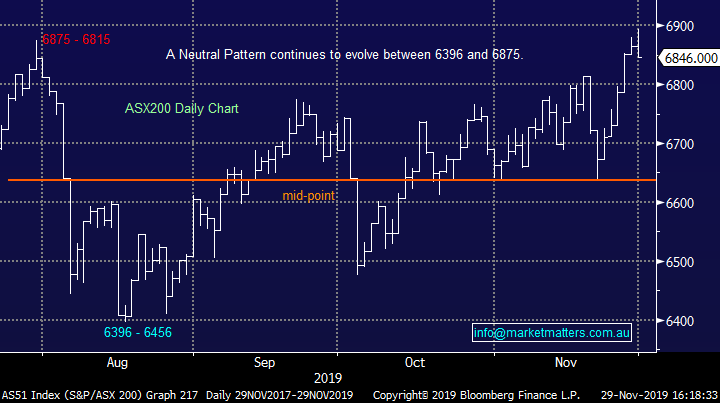

For the week, stocks were up 137pts, cracking through all-time highs – this equates to a ~2% gain in equities.

Overall, the ASX 200 closed down -18pts or -0.26% today to 6846, Dow Futures are trading down 80pts-/0.28%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

Sectors this week:

Stocks this week:

Virgin Money (VUK) +24.54%; The old Clydesdale bank, and prior to that the UK arm of NAB, has seen its shares rocket higher today following their full year result posted to the UK market last night - now up over 70% from the panic lows set last month on hard BREXIT fears and earnings problems tore the stock up. The result itself was a long way from the FY18 result but curbed a multitude of fears the market had from the UK based deposit taker. Underlying profit before tax came in at £539M, around about in line with consensus but 7% below last year.

The statutory after tax figure fell into a significant loss of -£268M thanks to climbing remediation costs from claims against the bank. Net interest margin continued to come under pressure, coming in at 166bps for the full year, but as low as 160bps in the last quarter. Funding costs are rising and the home loan book earnt 8bps less. The result reads poorly, but when shares are priced at around half of NTA, a little goes a long way. Clearly there is trouble within the business, but the market was positioned particularly negative heading into the result. The Virgin Money integration is coming along well, and will complement the business long term if it can be executed properly. A big part of this will be costs, with plenty of fat on the bone here for VUK to carve into. MM is neutral VUK here.

Virgin Money (VUK) Chart

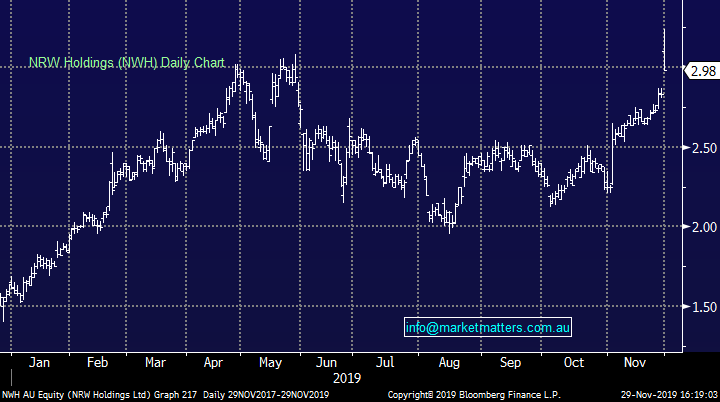

NWH Holdings (NWH) +5.3%; The mining services business came back online today after placing $120m worth of stock at $2.85, a premium to the last traded price on 27th November. The funds are being used to make a good acquisition that will be earnings accretive by around 14% from the get go. NWR also traded ex-dividend today for 2cps. While the stock was stronger earlier, up 13% at the peak, a rally of 5% following the placement of stock is clearly a vote of confidence by the market on the acquisition. A share purchase plan now open for holders. We own in the Growth Portfolio.

NRW Holdings (NWH) Chart

BROKER MOVES;

- OZ Minerals Raised to Buy at Canaccord; PT A$10.90

- Metlifecare Cut to Neutral at Forsyth Barr; PT NZ$6.30

- Brambles Cut to Sell at Morningstar

- AMA Group Rated New Neutral at Goldman; PT A$1.38

- Fletcher Building Cut to Sell at Goldman; PT NZ$4.70

- Empired Cut to Hold at Bell Potter; PT 38 Australian cents

OUR CALLS

No changes to the portfolios today.

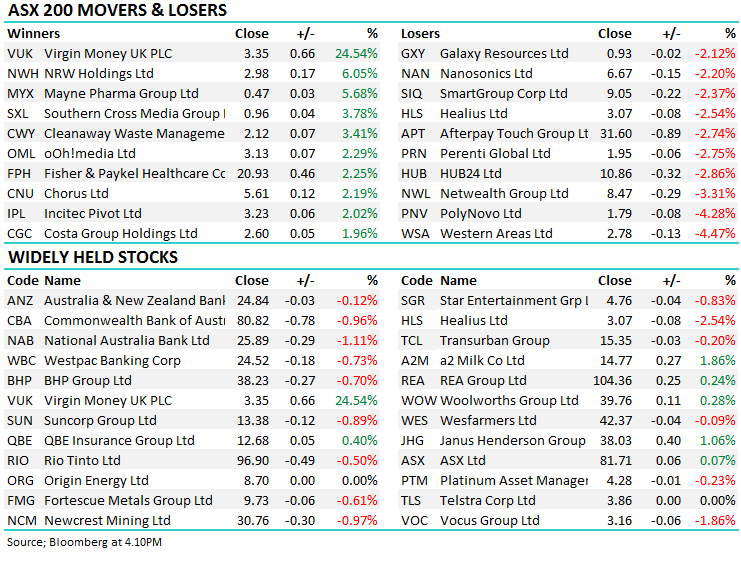

Major Movers Today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.