Stocks up but close well below session highs – Sydney house prices on a tear (WBC, NWH)

WHAT MATTERED TODAY

It seemed like the positive data around Sydney property spurred on buying this morning, with the major banks seeing some love after a torrid period of late. The AFR running with the headline of Sydney posting the strongest growth in 31 years + is on track to recoup the recent 15% decline by as early as March 2020. CoreLogic data saying that Sydney added +2.7% in November while Melbourne added +2.2%. Elsewhere, Hobart added +2.3%, Canberra +1.6%, Brisbane +0.8% and Adelaide +0.5% - these are clearly strong numbers that should make the RBA question whether or not further cuts are appropriate – more insight on this at tomorrows interest rate decision (no cut expected).

On the flipside of that argument, building approvals were weak, down 8.1% MoM and 23.6% YoY, both weaker than expectations data showed at 11.30am this morning.

Local Economic Data today

In China, the weekends stronger than expected official manufacturing data was baked up by the Caixin figures today which printed 51.8 v 51.5 expected and a tickle above last months read of +51.7 – all bodes well pre-trade deal.

Chinese manufacturing data

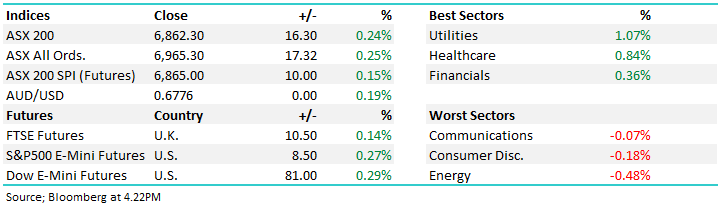

At a sector level today, most were in the green implying broad-based buying of todays strength, Gold, Energy &Telcos the only laggards, although we did see sellers emerge right at the end the day to push the market well off session highs. Overseas, Asian markets were strong, Japan up more than 1% the best of the region while Hong Kong stocks added +0.5%

Overall, the ASX 200 gained +16pts /0.24% today to close at 6862. Dow Futures are trading high by 81pts/0.29%

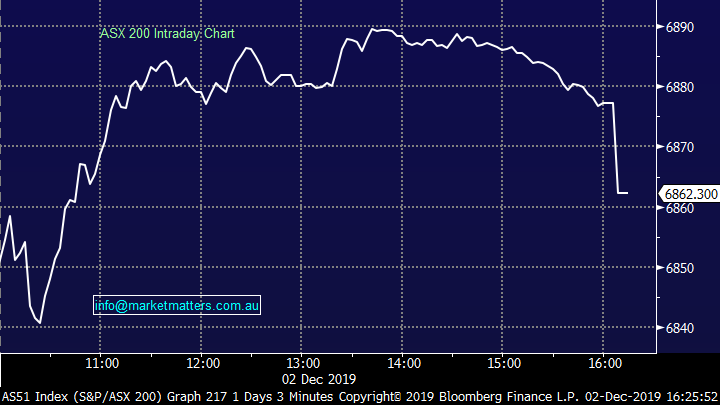

ASX 200 Chart – Early strength, late selling as a big line of selling hit the market near the close.

ASX 200 Chart

CATCHING OUR EYE

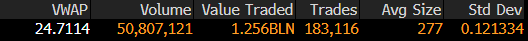

Westpac Share Purchase Plan (SPP) pricing: The WBC SPP closes today and the pricing will be set at a 2% discount to the volume weighted average price (VWAP) during the pricing period. .

VWAP is $24.71 therefore the SPP pricing will likely be set at $24.21 (subject to WBC calculations & rounding). There is a facility available until the 6th December to withdraw from the SPP.

Westpac (WBC) Chart

Seasonals: Not a lot of specific stock news across the ticker today, however as we enter December we’re now hearing a lot about the Santa Claus rally that will push the ASX 200 above the 7000 mark. Statistically, this will likely happen given December is a typically strong month for equities. We’ll pen a note shortly on the seasonal characteristics of this time of year – normally a time for cheer in the mkts…

NRW Holdings (NWH) +3.02%: Up again today and now comfortably trading above the $3 handle. We’ve covered this a few times recently however it’s a stock we own that’s doing good things. UBS upgraded + put out a bullish note on the recent acquisition of BGC Contracting. UBS predict 13% earnings per share growth for a company trading on 12x,. They upgraded their target price from $3.20 to $3.85 – we’re happy holders

NRW Holdings (NWH) Chart

Broker moves;

- Nine Entertainment Cut to Hold at Morningstar

- AGL Energy Raised to Overweight at JPMorgan; PT A$24.10

- Infigen Cut to Neutral at JPMorgan; PT 70 Australian cents

- Origin Energy Raised to Overweight at JPMorgan; PT A$9.50

- Beach Energy Raised to Overweight at JPMorgan; PT A$2.60

- Growthpoint Rated New Neutral at Credit Suisse; PT A$4.13

- Northern Star Raised to Overweight at JPMorgan; PT A$11.50

OUR CALLS

No changes to the portfolios today.

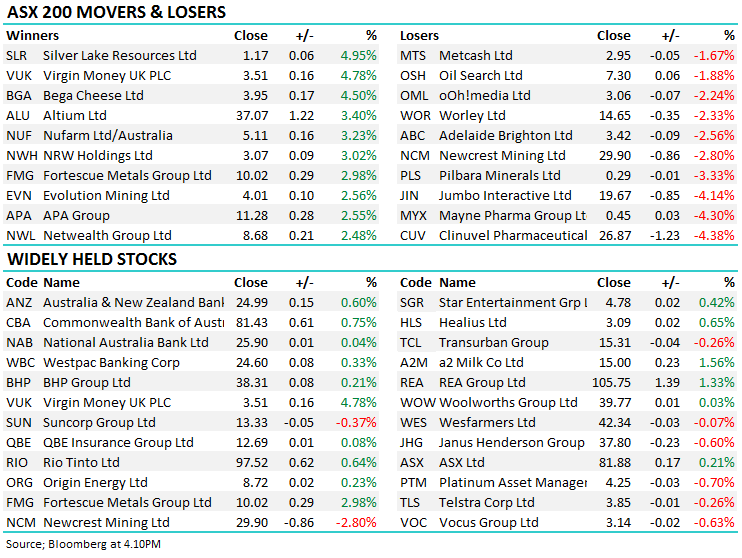

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.