Stocks hit as Trump targets Sth America – RBA holds rates (NCM, CTX)

WHAT MATTERED TODAY

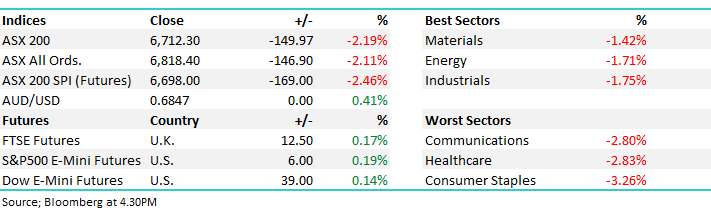

The market sold off today down ~150pts points which on the face of it, is a fairly savage move, however the internals weren’t that bad, it was more of an orderly sell off throughout the session – a top left to bottom right sort of move but selling wasn’t panic like. The sectors that have been strongest in recent times were hardest hit, Consumer Staples down more than 3% felt the brunt while Healthcare and Communications were also weak, nearly 3% a piece simply implying profit taking. The sectors that are usually ‘risk off’, the materials and energy stocks were best on ground in a weak market overall.

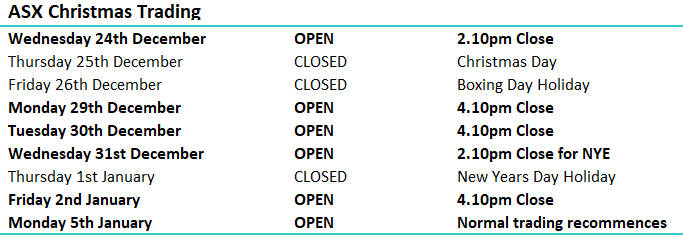

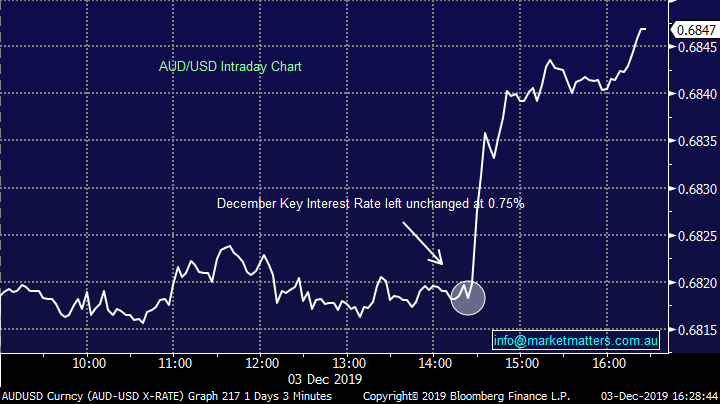

The RBA rates decision at 2.30pm this afternoon confirmed no cut as expected however the commentary was interesting and ultimately led to a spike higher in the Aussie Dollar as shown here:

Australian Dollar/ US Dollar Chart

While rates were kept unchanged at 0.75% as expected, they made a few more optimistic / positive comments than in November, implying that rates may not go lower. They left inflation forecasts unchanged but they do see inflation kicking up above 2% in 2020/21 which is a negative for those looking for more cuts. They also said that record low interest rates have put downward pressure on the Australian dollar, supporting activity across a range of industries, and they also said that risks to the global economy “have lessened recently.” They went on to say that past easing is having an impact, while noting “long and variable lags” in the transmission of monetary policy. Governor low noted “further signs of a turnaround” in the key Sydney and Melbourne property markets, as well as improvements in house prices in other parts of the country.

All up, a more positive assessment than the interest rate bears would have liked hence the move higher in the currency.

When the AUD rallies we tend to see money flow out of Australian stocks and that certainly happened today. During our time zone US Futures actually rallied +0.20% while Asian markets were down, but not to the magnitude we were.

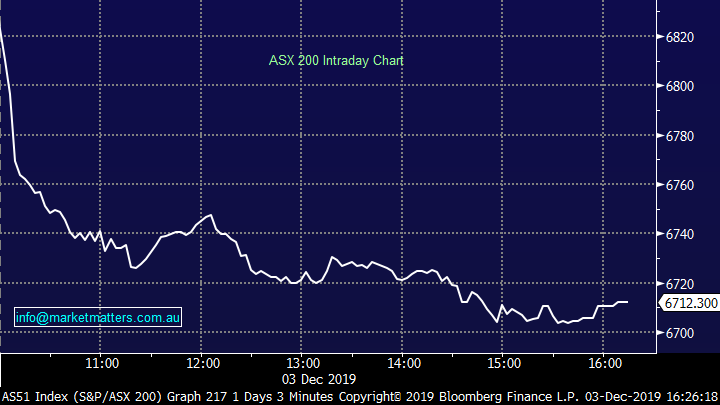

Overall, the ASX 200 lost -150pts /-2.19% today to close at 6712. Dow Futures are trading marginally higher by 50pts/0.20%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Stocks resilient in a weak market: Always good to look at stocks that are supported in a weak market and there were a few notable ones today – a number of them we hold. Gold stocks obviously the first place to look at and they were generally well bid with a flight to some level of safety. Evolution (EVN) was strong adding +1.5% however Newcrest moved lower underperforming the sector. There seems to be some concern around the place that NCM will be forced to stop work at the Cadia mine in the Hunter Valley as water dries up. All mines need water to operate and as the drought starts to bite, some mines will have to be put on hold – that said, we’re hearing mixed reports on this hence why NCM was volatile today.

As suggested above, the material stocks outperformed today, not something you’d expect in such a weak market however this fits the theme we’ve been writing about of late – they enjoy higher interest rates and today the RBA reduced the chance for further cuts. Mining services stocks also did well, Emeco (EHL) finished +2.51% higher today back up above $2, NRW Holdings (NWH) was up strongly early on, although still finished in the green while Select Harvest (SHV) continued its recent run adding +1.47% after delivering strong FY19 numbers late last week.

Newcrest Mining (NCM) Chart

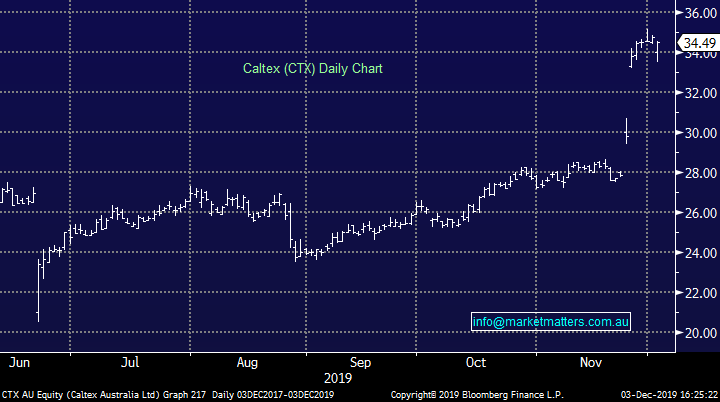

Caltex (CTX) -0.78%; was out today to reject the Alimentation Couche-Tard (ATD) bid at $34.50, but also extended an olive branch the Canadian group to hopefully keep them interested. Caltex believes it is worth more than the $8.6b bid saying it comes near the low point in the earnings cycle and incorrectly values the tax credits available to the bulk of shareholders, while there are a number of opportunities to add value to the current business, including the proposed IPO of a portion of the property portfolio. Caltex did leave the door ajar, offering Couche-Tard a deeper dive into the books and “non-public information” in an effort to increase the offer. While it remains uncertain, the market took the optimistic view a better offer would come along, and shares held up ok. It’s the second offer CTX has rejected, and the board look set to play hard ball.

Caltex (CTX) Chart

Broker moves;

- IMF Bentham Raised to Buy at Baillieu Ltd; PT A$4.35

- Insurance Australia Raised to Buy at Citi; PT A$8.75

- Treasury Wine Rated New Hold at Jefferies; PT A$17.50

- Silver Lake Reinstated Buy at Canaccord; PT A$1.45

- Western Areas Rated New Add at Morgans Financial Limited

- Redbubble Raised to Add at Morgans Financial Limited; PT A$2.28

- Technology One Cut to Hold at Bell Potter; PT A$9.50

- Rio Tinto Raised to Sector Perform at RBC; PT 3,900 pence

- Janus Henderson GDRs Raised to Buy at Baillieu Ltd; PT A$43

OUR CALLS

No changes to the portfolios today.

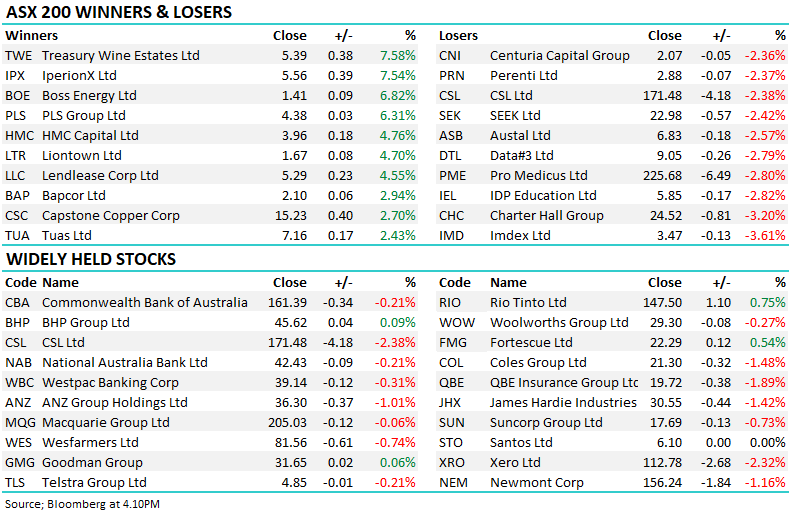

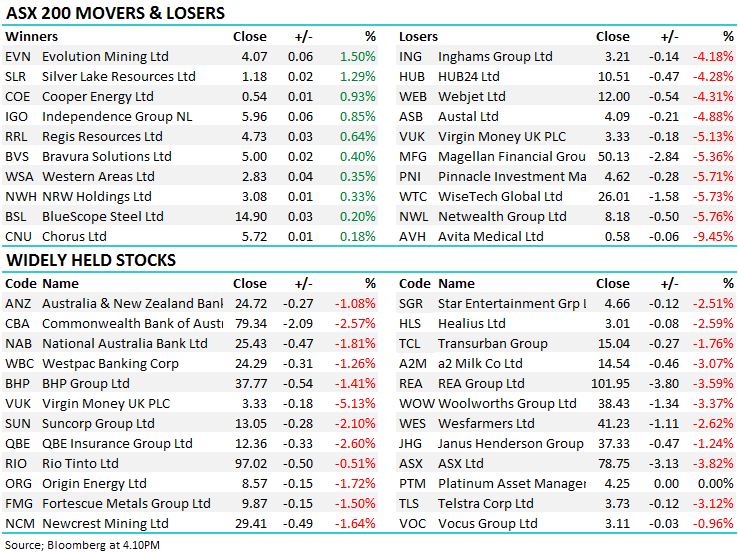

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.