ASX 200 closes in on 7000 (JPM, EML, PDL)

WHAT MATTERED TODAY

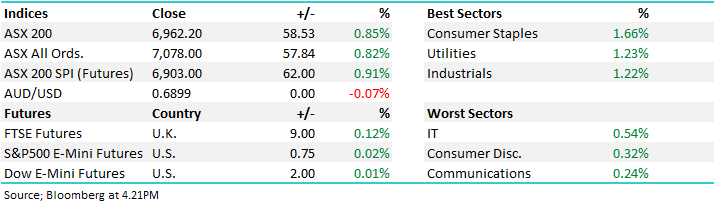

A bullish session today with the market opening higher then grinding up into the close, making another all-time closing high in the process. Clearly the market remains bullish and todays buying was broad based. We do often see strong buying in the start of January as light volumes persist, especially when December saw equities down more than 2% in what’s usually a bullish month for stocks. The last 2 years now December returns have been negative while the ground has been well and truly made up in January, however as we approach 7000, now only 38pts away some caution should be applied.

Worth remembering that the calendar year 19 performance was largely a result of P/E expansion rather than earnings growth, with the ASX 200 moving from 15x in Jan to 19x by New Year’s Eve. A similar theme played out in the US so now we need to see some semblance of earnings growth to support valuations, starting tonight as US as quarterlies kick off.

Volumes did kick up a bit today relative to yesterday as interest starts to build in the mkt again, although Sydney traffic implies still a lot away. The mining sector will be in focus as we move into the back end of January and early Feb with production reports and earnings. This remains a sector we’re bullish on following from strong outperformance in December (was the only sector that closed the month in the green). We remain overweight + Peter O’Connor at Shaw upgraded S32 to buy today, this is one we ideally want to add to the portfolio.

Overall, the ASX 200 added +58pts / +0.85% today to close at 6962. Dow Futures are trading flat

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

US Reporting Starts: Quarterly reporting kicks off in the US tonight with a few names we’re interested in out with 4Q19 numbers. Citigroup are expected to deliver Earnings Per Share (EPS) of 1.835 with guidance expected of 2.12 for 1Q20, while JP Morgan which we hold in the MM International Equities portfolio is also out with results. EPS for the quarter forecast to be 2.359 rising to 2.66 for 1Q20, or in other words, earnings growth of 13%. Look out for tomorrow mornings international note for more details / views here.

JP Morgan Chart

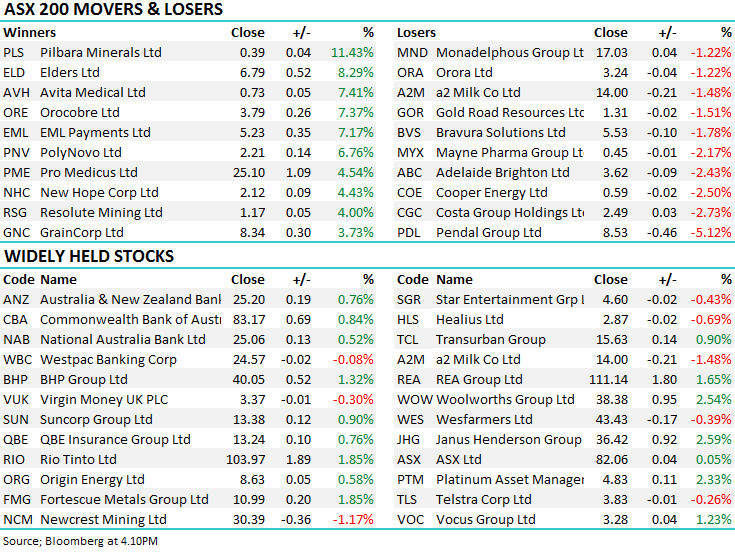

EML Payments (EML) +7.17%; one of last year’s best performers, the payments software and tech company caught a bid again today, trading higher from the get-go after announcing it had signed an agreement with NSW Health to provide its General Purpose Reloadable card program for nearly 50k employees. Although the contract hasn’t been deemed material under listing and EML hasn’t changed guidance, it further solidifies their software as the leading platform for salary packaging. The cards are used by employers for pre-tax living expenses and puts EML on track to reach their target of 300,000 customers by early next year.

EML Payments (EML) Chart

Pendal (PDL) -5.12%; the fund manager saw shares slide today on the back of another round of FUM outflows across the group in December. Despite the recall of funds from clients, FUM managed to climb 1% to $101.4b thanks to a strong market tailwind. One positive sign was a net inflow into UK funds, likely on the back of Boris Johnson’s big election win driving investor confidence. Despite all of this, Pendal said that the outflows would have an annualized impact of $8.9m to fee income, nearly 2% of FY19 revenue. A disappointing outcome for December and it’s likely to drive downgrades from here. We own the stock from lower levels, but today’s update was a weak one. Now on review. It’s cheap but momentum now an issue. It wasn’t all bad news though, money seemed to move into the Janus Henderson (JHG) which we also own.

Pendal (PDL) Chart

Broker moves;

· Orocobre Cut to Underweight at JPMorgan; PT A$2.55

· Independence Group Cut to Underweight at JPMorgan; PT A$5.70

· Fortescue Cut to Neutral at JPMorgan; PT A$11

· Netwealth Raised to Buy at Citi; PT A$9.60

· Seven Group Cut to Neutral at JPMorgan; PT A$21

· Downer EDI Raised to Overweight at JPMorgan; PT A$9.50

· South32 Raised to Buy at Shaw and Partners; PT A$3

· Iluka Raised to Buy at Shaw and Partners; PT A$10

· Sandfire Cut to Sell at Goldman; PT A$5.20

OUR CALLS

No changes today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.