Strong production numbers from RIO to end the week (RIO, NUF)

WHAT MATTERED TODAY

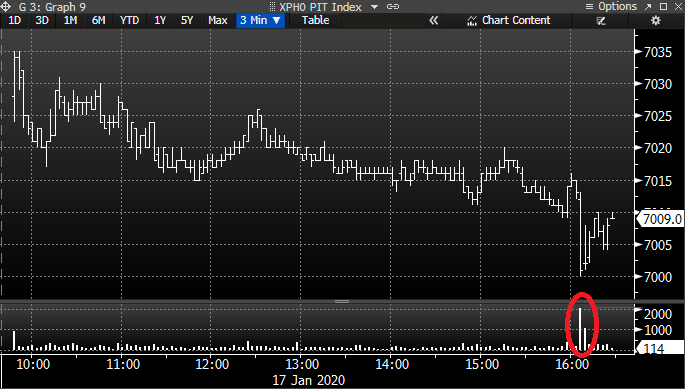

A more subdued session to end the first week back on the desk with stocks opening firm before trickling down from early highs into the close (2000 lots of futures done on the death put the boot in late). A few weeks ago I flagged a trend that if stocks fall between 4pm and 4.10pm (in the match) it was a good indicator of weakness to come overseas, so for those with interest, it played out today so theory suggests overseas stocks should be weaker tonight. Doesn’t work all the time however when I see it, I often buy a few puts on the close – today I did that …I ll report back on Monday!

SPI Futures 3-minute intra-day chart

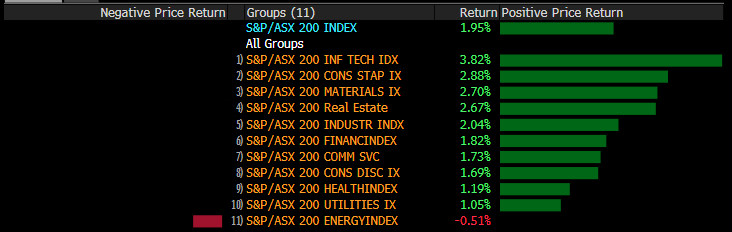

The market was just a stone’s throw away from the 7100 level this morning driven largely by a strong move in the material sector followed closely by the supermarket stocks, on the flipside, the Energy names led by Woodside (WPL) was a drag. A few downgrades today for WPL, a stock we’re now looking to cut from the Income Portfolio – more on that next week however capex intentions imply a possible cut to the dividend.

The first week back on the desk after Christmas is always a touch hard, feels like a long week however the markets have certainly helped us ease back in. A number of quarterly production reports from the mining sector this week with RIO Tinto (RIO) out today, a good read as Harry covers off below.

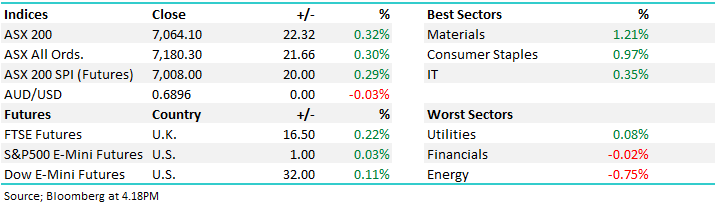

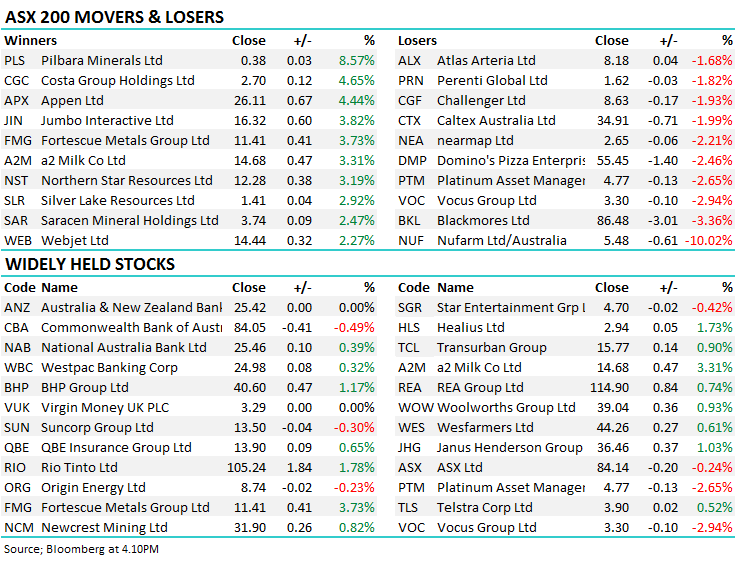

Overall, the ASX 200 closed up +22pts or +0.32% today to 7064, Dow Futures are trading up 32pts/+0.12%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

Rio Tinto (RIO) +1.78%; stock was higher on Dec quarter production report that met expectations across the board – copper, iron ore, aluminium the main segments all meeting guidance. FY20 guidance was much the same with Aluminium and TiO2 expected to be flat year on year, copper slightly behind and iron ore and Bauxite higher than 2019. Iron ore guidance bets production to return to levels near the record 2018 year where Rio shipped 338mt. We like Rio – own it in both portfolios - although not our first pick of the diversified miners at current levels. Iron ore is also trading at elevated levels and while this could continue for some months, it will eventually track lower as the global supply issues ease.

Rio Tinto (RIO) Chart

Nufarm (NUF) –10.02%; shares fell sharply today after the company guided 1H EBITDA to around 50% below last year’s 1st half, and 30% below consensus. Each of the geographies are experiencing earnings pressure with a mix of prices, competition or input costs tightening margins. The company is looking for operations to rebound into the second half, but a big 20/80 skew was already baked in prior to this announcement. If the same skew was overlayed on a first half EBITDA of $60, Nufarm might be able to edge $300m for the full year, 37% below current consensus. Looks to be stuck in a downgrade cycle, not for us.

Nufarm (NUF) Chart

Sectors this week:

Stocks this week:

BROKER MOVES;

· Magellan Financial Cut to Underperform at Macquarie; PT A$55 **Trading on 27x this does look overdone

· Perseus Raised to Outperform at Macquarie; PT A$1.20

· Perseus Cut to Underperform at Credit Suisse

· Platinum Asset Cut to Underperform at Macquarie; PT A$4.30

· Alumina Rated New Underperform at Jefferies; PT A$1.95

· Woodside Cut to Neutral at Evans & Partners Pty Ltd; PT A$36 ** lots of downgrades flowing through for WPL after yesterday’s update **

· AMA Group Raised to Buy at Goldman; PT A$1.15

· IMF Bentham Cut to Hold at Baillieu Ltd; PT A$4.85

OUR CALLS

No changes to the portfolios today.

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.