Nearmap off track as growth lows (FMG, NEA, NCM, SUN)

WHAT MATTERED TODAY

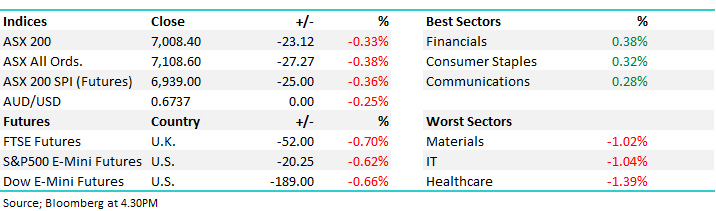

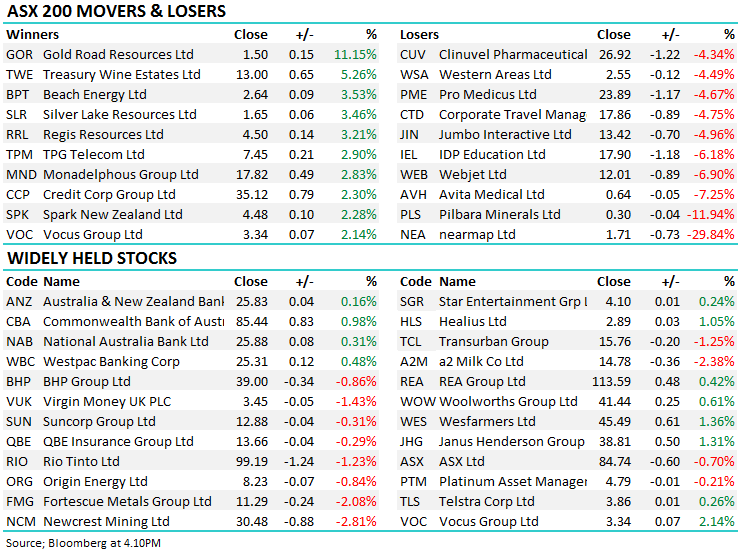

The best of the session was seen early today with the ASX opening higher in the early stages; however the optimism was short lived and sellers emerged throughout the day. Not aggressive at the index level although a couple of stocks missed the mark and were taken out the back and dealt with. Aerial mapping business Nearmap (NEA) the latest to hose down expectations ahead of reporting, stock was whacked 30%, while Pilbara Minerals (PLS) missed production / cash flow numbers and fell ~12%. All in all, it looks like the index is losing momentum and our call for another leg lower before the buying opportunity arises seems right (for now).

Financials were best today while the Healthcare sector saw most selling following by the IT stocks i.e. implies profit taking in the hot sectors. Around the region, mainland China remains on holidays while it was red throughout the rest of Asian.

Overall, the ASX 200 fell -23pts / -0.33% today to close at 7008. Dow Futures are trading lower by -189pts/-0.66%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

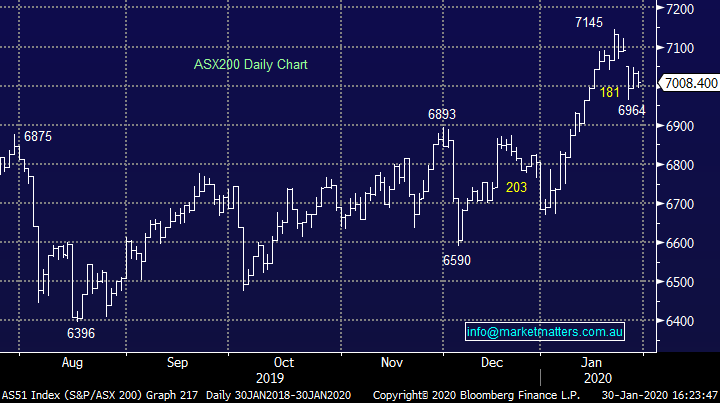

Fortescue Metals (FMG) –2.08%: Great set of production numbers from FMG today with an upgrade to FY guidance to boot, albeit a small one (+1.5%). Lots of interest in FMG so worth delving into the detail on this with Peter O’Connor’s (Shaw) comments as follows….A good set of numbers which were in line with ship tracking data (weekly) so no surprise but nonetheless a good way to wrap up the half year. Shipments of 46.4mt, nine per cent higher than Q2 FY19 bringing first half shipments to a record 88.6mt. C1 costs of US$12.54/wmt, four per cent lower than Q2 FY19. FY20 Guidance upgraded. Based on the trend of 1H20 results – production, sales and costs – FMG has upped FY20 shipment guidance by ~1.5% and lowered cost guidance by ~3.7%.

o Shipments at the upper end of the range of 170 - 175Mt,

o C1 costs in the range of $12.75-13.25/wmt vs previously guided $13.25-13.75/wmt.

o Confirms total capital expenditure of $2.4B

· Price. Fortescue’s average revenue was US$76/dmt in the quarter. The average price realisation was 86 per cent (we were looking at 88%) of the average 62% CFR Index price of US$89/dmt for the quarter. The closing Platts 62% CFR Index price at 31 December was US$92/dmt (US$93/dmt at 30 September 2019).

· Earnings sensitivity. All else equal these two updated guidance inputs would lift FY20 earnings by 1.7% whilst the slightly lower price realisation (86% vs 88% expected) would take 2.2% off earnings = net down 0.5% for FY20.

· Financials. Net debt has declined to a low US$0.7bn ü We expect the trend of allocating FCF to projects and dividends to continue especially with net debt now almost nil.

· Pilbara power solution. Developing iron ore project now has a comprehensive (and carbon reduced) energy solution, the Pilbara Generation project” involving both transmission and generation assets for a combined $700m. Worth noting that 50% of power to be sourced from renewables.

We like FMG, but at lower levels. Today’s sell off implies a lot of good news already baked into the price.

Fortescue Metals (FMG) Chart

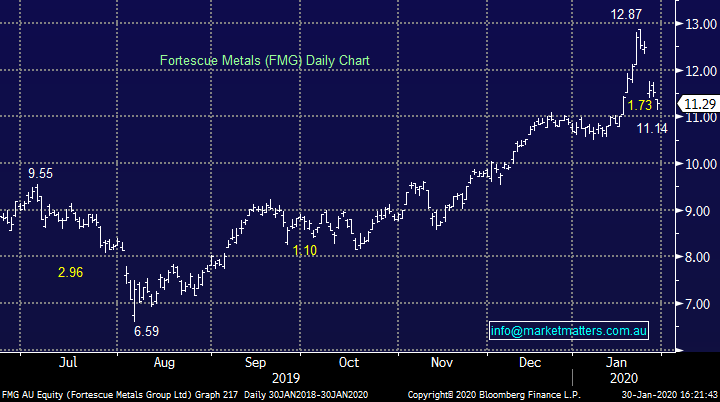

Newcrest Mining (NCM) -2.81%: December quarter production out this morning and there was a decent bounce QoQ however it was coming off a low base given a lot of maintenance in the 3 months to Sep. Cadia the main focus, it’s NCMs cash cow and they booked their 2nd best quarter of production ever with the mill running at >30mtpa, however there were issues at Lihir and Telfer that took some of the shine off.

Growth projects look on track while they also said that water could become an issue at the end of 2020 if current conditions persist (which is very unlikely). Guidance was unchanged for Gold production of 2.375 -2.535Moz, although they did steer to the low end of range citing Telfer (noted in SQ) and now Lihir drag. Copper production 130 - 145Kt. All in all, an okay set of numbers, but not great, stock looking more negative technically.

Newcrest Mining (NCM) Chart

Nearmap (NEA) –29.84%: for the second day in a row the ASX saw 2 stocks hit for more than a quarter of their value with Nearmap taking a beating from investors today. The mapping tech company gave an FY20 update this morning that showed annualized contract value (ACV) rise 23% over the calendar year as at the end of December, climbing to $96.6m. while the growth is impressive, the company downgraded ACV expectations for the financial year end by around 10% to $102m-$110m on the back of some large contract churn events in North America.

The downgrade came on the back of a large partner cancelling their contract and two downgrades to autonomous vehicle contracts. We spoke about the increase in competition in the space in the Tuesday morning report with Aerometrex (AMX) listing on the ASX late last year, raising money to push for growth. The key for Nearmap’s longevity is scale and today’s announcement set them back a bit in terms of really commercializing the product. The market was concerned that the company’s investment in customer experience has come back to bite them. Similar to TWE yesterday, a lower growth rate was punished by the market. Not one to be a hero in for now.

Nearmap (NEA) Chart

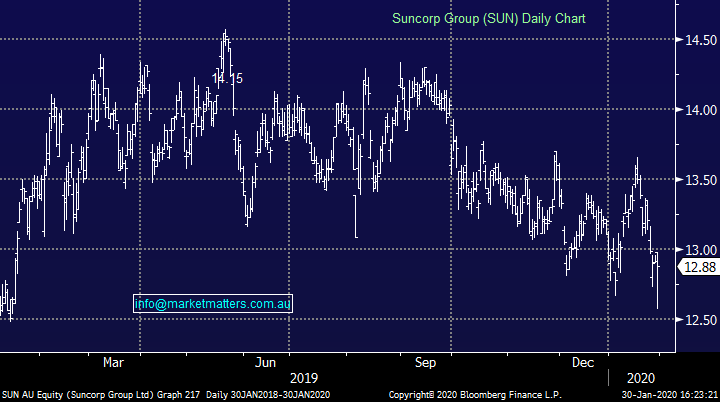

Suncorp (SUN) -0.31%: followed IAG in guiding the market lower in terms of reserve releases following a number of claim events taking place in the first half. With bushfires, hailstorms and floods all impacting peril costs, Suncorp now expects to see reserve releases of between $50m-$70m in both the first half and the second of FY20, around half of the windfall the company received last year. Despite all of this, Suncorp has not changed its natural hazard cost expectations for the year thanks to its reinsurance program which will take the brunt of the hit. Shares held up reasonably well, likely because the market moved on Suncorp last week when IAG downgraded.

Suncorp (SUN) Chart

Broker moves;

· Northern Star Cut to Neutral at Citi; PT A$12.70

· Northern Star Cut to Underperform at Credit Suisse; PT A$10.30

· Northern Star Cut to Neutral at Hartleys Ltd; PT A$11.03

· Northern Star Cut to Hold at Canaccord; PT A$13

· Steadfast Rated New Buy at Citi; PT A$4.35

· GPT Group Raised to Neutral at Citi; PT A$5.68

· Treasury Wine Raised to Neutral at Citi

· Treasury Wine Raised to Neutral at Goldman

· Treasury Wine Raised to Hold at Morningstar

· Treasury Wine Cut to Hold at Morgans Financial Limited

· Transurban Cut to Neutral at JPMorgan; PT A$16

· Monadelphous Raised to Buy at Goldman; PT A$20.40

· Seven Group Cut to Neutral at Goldman; PT A$22

· Virgin Money UK GDRs Raised to Add at Morgans Financial Limited

· Kathmandu Cut to Underweight at Morgan Stanley; PT A$2.75

· Accent Group Rated New Overweight at Morgan Stanley; PT A$2.30

· City Chic Collective Ltd Rated New Overweight at Morgan Stanley

· Seek Cut to Underperform at Jefferies; PT A$20.70

· OZ Minerals Raised to Neutral at JPMorgan; PT A$9.25

· AGL Energy Cut to Neutral at JPMorgan; PT A$20.50

OUR CALLS

Just reiterating yesterday’s moves…We trimmed Pact group (PGH) in the Growth Portfolio.

We took a 56% profit on GMA and bought Metcash (MTS) in the Income Portfolio

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.