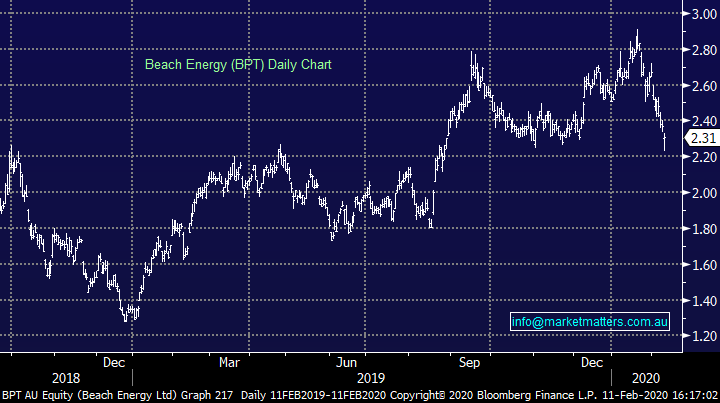

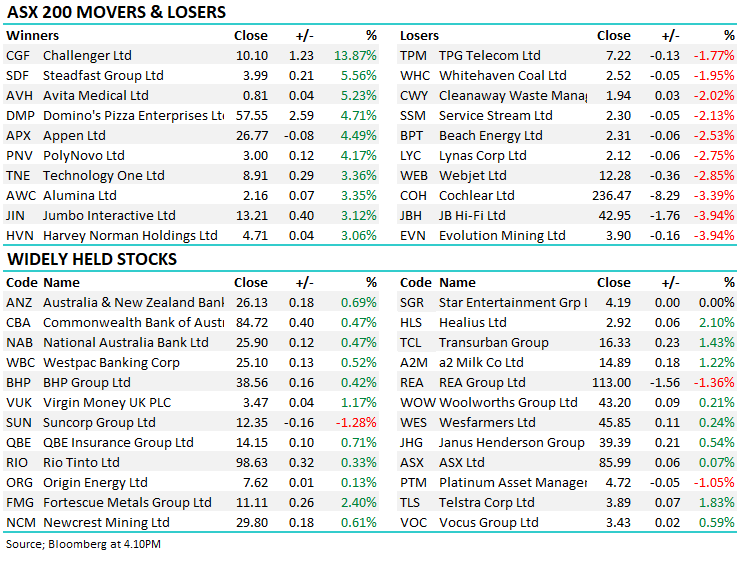

And the market charges on – ASX up +42pts (CGF, SUN, BPT, MQG)

WHAT MATTERED TODAY

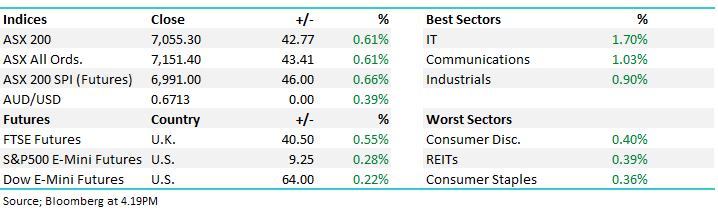

Back in the winner’s circle today with the market charging higher again, the index trading well up through 7000 on good momentum across the market today. The IT stocks did best, rebounding from losses yesterday while the consumer staples lagged, although broad based buying across the market today. Asian markets were mostly higher while US Futures also spent the day in the green.

Reporting season kicking up locally with a reporting schedule available: CLICK HERE

In the recording below I cover results from Beach Energy (BPT), Suncorp (SUN), Challenger Financial (CGF) & Northern Star (NST)

Tomorrow we have a huge volume of reports including: BAP, CAR, CBA, CPU, CSL, DOW, EVN, IAG, IEL, JHX, MCR, MP1, ORA, TGR

Overall, the ASX 200 added +42pts / +0.61% today to close at 7055. Dow Futures are trading higher by +71pts/+0.24%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

Challenger Group Financial (CGF) +13.87%: ripped higher today on a reasonable 1H result, although the rally in SP is more about market positioning. In terms of the result, 1H20 NPAT came in a shade over $191m which was inline with expectations, ROE was strong for the period and they guided well for the full year, pre-tax profit to be at the top end of the 500-550m range, the market was at $535m so some upside there. The market hates this stock, the most bullish PT I could see before this update was $8.50, Shaw’s price target languishing at $6.00!!! Ouch. Last November there was 50m / 8% shares held short, now there are 34m / 5.7% and I bet a lot less after today. I think shorts falling on their sword more than anything on this one today however given likely upgrades tomorrow, the rally could last a few days more.

Challenger Group Financial (CGF) Chart

Suncorp (SUN) -1.28%: weaker on a good day for the index, Suncorp was out with a first half result that missed the mark. 1st half NPAT more than doubled to $642m, however this included a large realized gain on the sales of Capital SMART & ACM Parts and as a result, cash earnings were 13% below consensus at $365m. Starting with insurance though, profit after tax fell 4% to $123m on the back of strong claims despite gross written premiums rising 1.9%. Natural hazard claims were $104m above allowance in the half to $489m. The NZ arm was hit harder, with PAT falling 10% vs the 1st half 19, with claims rising a whopping 16.8%.

Even the banking & wealth arm took a hit to profit, falling 6.6% to $171m in the half. While NIM was higher to 1.92%, operating expenses climbed 5.9% and lending fell 1.4%. Ultra-low bad debts propped up some of the costs squeeze however it wasn’t enough to save the bank. The rising costs of the bank concerns us, Insurance looks to only be getting harder on rising reinsurance costs. One to avoid.

Suncorp (SUN) Chart

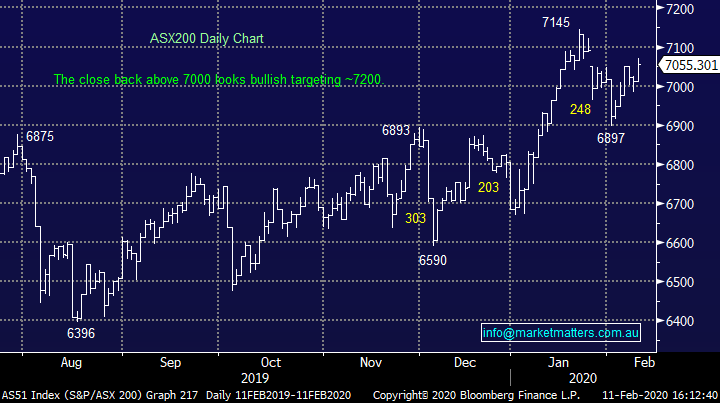

Beach Energy (BPT) -2.53%: a mixed half year result today, the stock was hit hard early but staged a recovery as the session rolled on. Some highlights:

- Underlying net profit was a shade above expectations, printing $274m versus $269m expected for the half

- They tightened up full year production guidance from 27-29 MMboe to 27-28MMboe, a slight decrease at the mid-point

- They also tightened full year EBITDA guidance with a very slight downside skew, expecting $1.275 to $1.35bn for the year. The market was at $1.295bn so all okay there

- They increased guidance in terms of exploration spend fairly meaningfully, although this is a result of exploration success so speaks favourably about future growth

All-in-all not a bad set of numbers, with higher exploration costs recognized with better drilling results. Maintenance was up, but so was the realized oil price to offset. We hold and as we wrote in the AM Note today, Oil stocks moving higher on a day where Oil prices have continued to decline is a bullish move. The Local Energy sector near a low in our view…

Beach Energy (BPT) Chart

Macquarie Group (MQG) -0.55%: out with an operational briefing today after completing their third quarter of the financial year which showed stellar performances in banking and asset management offsetting a softer markets facing side. Macquarie Asset Management (MAM) is said to have increased base fees while capturing higher performance fees in the quarter, while the banking arm has quietly captured a bigger chunk of the home loan market, although coming off a low base. The markets facing commodity & global markets as well as Macquarie Capital have struggled to match the 3rd quarter of FY19 given the strength the pcp showed, partially offset by reasonable trading activities. Macquarie still expect to show the group’s result to be slightly below that of FY19, though the market has a slight increase in profit priced in. There is a lot of good news built in here.

Macquarie Group (MQG) Chart

Broker moves;

- JB Hi-Fi Cut to Sell at Citi; PT A$39.50

- JB Hi-Fi Raised to Outperform at Macquarie; PT A$51.10

- JB Hi-Fi Cut to Neutral at Goldman; PT A$44.30

- Altium Cut to Hold at Bell Potter; PT A$42.50

- Synlait Milk Raised to Neutral at Macquarie; PT NZ$8.72

- Synlait Milk Raised to Neutral at Jarden Securities; PT NZ$8.84

- Flight Centre Cut to Hold at Ord Minnett; PT A$41.38

- Kathmandu Cut to Neutral at Jarden Securities; PT NZ$3.65

- Contact Energy Raised to Outperform at Jarden Securities

- Gold Road Cut to Hold at Numis; PT A$1.70

- Oil Search Raised to Neutral at JPMorgan; PT A$6.85

- Boral Raised to Buy at Morningstar

- Boral Raised to Neutral at JPMorgan; PT A$4.50

OUR CALLS

No amendments today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.