Stocks catching our eye into weakness… (EHL, BIN, CBA)

WHAT MATTERED TODAY

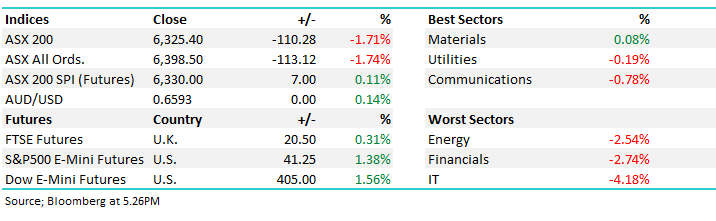

Down again today ending near the session lows despite the US futures trading higher throughout our time zone. Asian markets were also higher today benefitting from a weakening $US after Jerome Powell and co cut rates at an emergency meeting overnight. At the sector level today, financials again a drag while the gold stocks benefitted from safe have demand

From the peak of 7197 just 9 trading days ago, the mkt had a low of 6245 on Monday morning before closing todays session at 6325, the drop from high to low being a fairly stark 952pts / -13.2%. Not many places to hide in this market. When the dust does settle, there are some compelling buys – fear gripping mkts at the moment however that will change at some point.

Overall, the ASX 200 fell another -110pts / -1.71% today to close at 6325. Dow Futures are trading up +353pts/+1.34%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

A few stocks: While fear is front and centre here and now, some really compelling stocks starting to show their hand into weakness. While its hard to do, and taking losses on stocks is difficult for some, we need to try and put our blinkers on and think about the portfolio we want to have coming out of this turmoil. While there is a lot of rhetoric being written around whether or not to buy this weakness, the reality for a lot of us is that its now more about what we want hold as the dust settles – a good time to reposition portfolios into the chaos. Stocks that looks interesting here:

Ramsay Healthcare (RHC) hit from ~$81 down to ~$66

Webjet (WEB) whacked from ~$14.50 to ~$8.50

Altium (ALU) down from ~$42 to ~$30

BHP from ~$41 to $32

Macquarie (MQG) ~$152 down to $132

Z1P Co (ZIP) ~$6 to ~$2.80

Emeco (EHL) ~$2.55 to ~$1.80

Wisr (WZR) ~33c to ~15c…to name a few

Ramsay Healthcare (RHC) Chart

Banks: All the major banks have now announced that they will pass on the 25 bps rate cut in full to variable rate home loan customers. ANZ went a little further and reduced investor interest only rates by 35 bps, but that just brings them into line with their peers. ANZ and NAB said the interest rate changes are effective on 13th March. It’s the 24th for CBA and 17th for WBC. The standard variable owner/occupier P&I interest rates are: ANZ 4.54%, CBA 4.55%, NAB 4.52%, WBC 4.58%

In 1H20, CBA’s Australian loan to deposit spread increased by 4 bps from 2H19 to 1H20 and NIM increased by 1 bps. Whether or not they can repeat this performance in 2H20 relies on the action they take on deposits and how depositors react. In terms of earnings impact for CBA in real terms, this one cut is not a major issue - by passing on the full cut rather than 20bp which they would have liked, this hurts their net interest margin by 2bp or more widely, impacts their earnings by 1% - not a huge issue now but it becomes one if more cuts happen and the Government continues to put pressure on them to pass on in full. Interestingly, reports emerged today that the Government would have increased the bank levy had the cut not been passed on in full – seems extraordinary.

CBA Chart

Elsewhere today: While the market tumbles, small pockets of good news are popping up – and the market isn’t giving the stocks the credit they deserve – understandable. Emeco (EHL) -5.73%, took a hit with the market today despite having their credit rating upgraded to B+ by Fitch. The release from the ratings agency said “that Emeco’s business profile has improved following its acquisition of Pit N Portal.” A big reason why EHL is trading so cheap is because of its high debt levels, leveraged at 1.77x operating EBITDA as at the half year result last month, carrying $US409.1m in net debt. A ratings upgrade will make it easier to refinance when the time comes, and highlights the progress the company has made over the last 12 or so months.

Another one of our holdings, Bingo (BIN) -1.07%, has also come off with the market, though there look to be some underlying trends in their favour despite the economic slowdown. This week Scott Morrison announced some changes to procurement rules which will make it move viable to source recycled products – more demand out of Bingo’s recycling facilities. While the Victorian government has also announced they will almost double the states land fill levy to bring it in line with NSW over the next few years. While landfill volumes will fall as a result, it will push more waste into the higher margin recycling facilities Bingo has. BIN traded dividend today for 2.2c FF

Bingo (BIN) Chart

BROKER MOVES

- BHP Raised to Overweight at JPMorgan

- BHP ADRs Cut to Hold at Argus

- Rio Tinto Raised to Buy at SocGen

- Telstra Raised to Buy at New Street Research; PT A$3.90

- Avita Medical ADRs Rated New Buy at BTIG; PT $10

- Regis Resources Raised to Neutral at JPMorgan; PT A$3.90

- Newcrest Raised to Neutral at JPMorgan; PT A$26

- Newcrest Raised to Buy at Shaw and Partners; PT A$30

- Goodman Group Cut to Sell at Goldman; PT A$12.91

- Fortescue Raised to Buy at Shaw and Partners; PT A$10

- Alumina Raised to Buy at Shaw and Partners; PT A$2.05

- Whitehaven Raised to Buy at Shaw and Partners; PT A$2.90

- IGO Raised to Buy at Shaw and Partners; PT A$5.90

- GrainCorp Raised to Buy at Bell Potter; PT A$9.10

- CBA Raised to Buy at Bell Potter; PT A$88.80

- Viva Energy REIT Raised to Buy at Goldman; PT A$2.92

OUR CALLS

To changes today

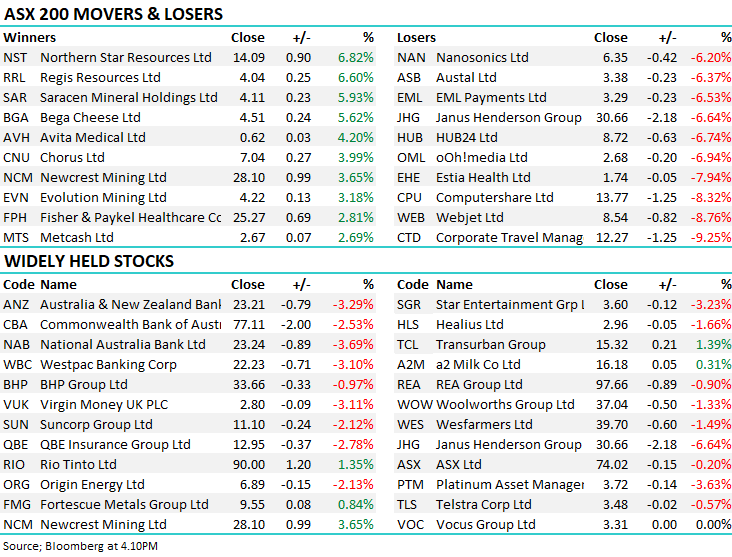

Major Movers Today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.