Have we just seen the capitulation low?

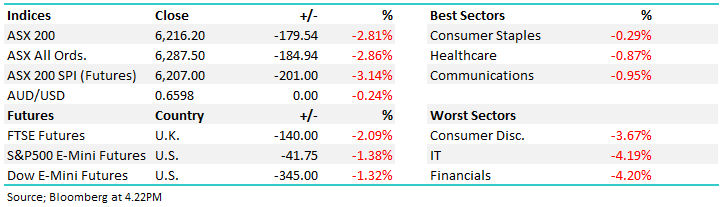

WHAT MATTERED TODAY

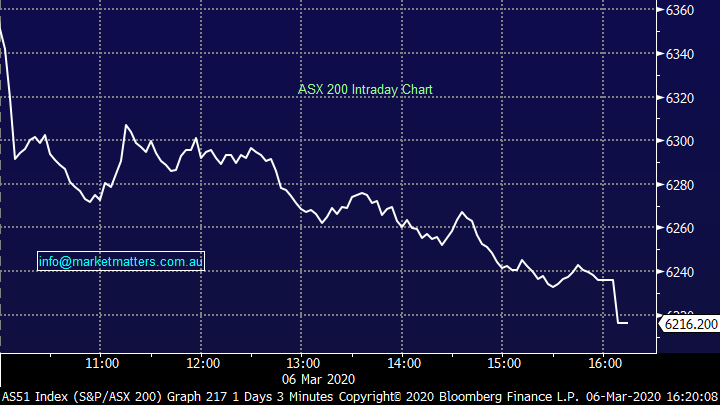

A soft lead from the US followed through to the local market today with our bourse simply sliding all day before sellers really put the boot in late - the index closing on the low of the day and new closing low for this rout.

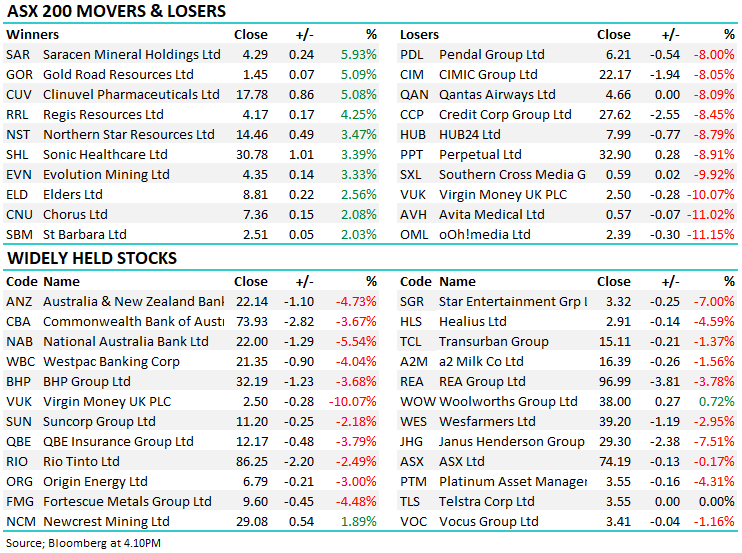

Financials the biggest drag today, the big 4 banks taking 50pts off the index with CBA closing the day at $73.93, down nearly 4% on the session after trading to a $90.99 high in January. Banks had in their worst sessions of the fortnight – new 7 year lows for Westpac and NAB – they are coping it from two angles at the moment – lower rates are expected to squeeze NIM and rising fears that the economic slowdown will see unemployment rise and put pressure on loan repayments. The staples sector was best on ground today, the supermarkets benefitting from panic buying, simply unreal…while Golds were also well bid. Today’s weakness was broad based, very much a reflection of investors not wanting to be exposed for the weekend – 2 days without liquidity in this evolving situation can be unnerving.

Elsewhere energy names took a beating after OPEC met last night and looked to cut production by 1.5mBOE/day however Russia failed to sign off and now there’s a risk they flood the market with supply.

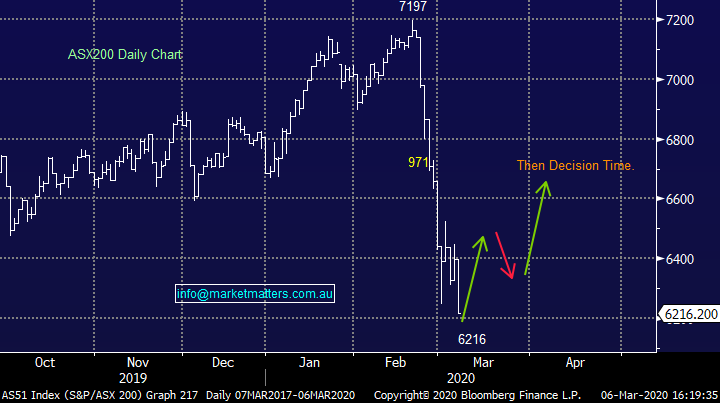

From the peak of 7197 just 11 trading days ago, the mkt closed on the lows today at 6216, the drop from high to close today being a fairly stark -971pts / -13.49%.

Asian markets were lower today, between 2-3% across the board while US Futures were also weak during our time zone.

Overall, the ASX 200 closed down -179pts or -2.81% today to 6216, Dow Futures are trading down -332pts/-1.27%.

ASX 200 Chart

Worth revisiting what we wrote this morning…we believe stocks are currently “looking for a low” even if it is short-term hence we are considering hitting the buy button if the ASX200 tests the 6200 area, got close this afternoon - our “Gut Feel” for how the local market is currently unfolding is illustrated below but I’m sure subscribers understand this could be one news flash away from looking wrong. The big swings on Wall Street this week highlight the current level of uncertainty playing out – we’re dealing with a virus and while buying into panic lows usually rewards the patient, it’s not yet clear whether or not last Fridays capitulation style sell-off in the US was the point of most pain – I sense that it was and today was potentially ours however time will tell.

ASX 200 Chart

CATCHING MY EYE;

Sectors this week: ASX down -3.5% on the week, financials biggest drag.

Stocks this week:

BROKER MOVES;

· Iluka Raised to Buy at Citi; PT A$9.80

· Alumina Raised to Buy at Citi; PT A$2.30

· Sonic Healthcare Raised to Buy at Citi; PT A$33.75

· Goodman Group Cut to Neutral at UBS; PT A$16

· Oil Search Raised to Outperform at Macquarie; PT A$6.20

· Crown Resorts Raised to Outperform at Macquarie; PT A$11.95

· Select Harvests Raised to Market-Weight at Wilsons; PT A$6.33

· Bank of Queensland Cut to Hold at Bell Potter; PT A$7.60

· Metcash Cut to Sell at Morningstar

· Transurban Raised to Overweight at JPMorgan; PT A$17

· TPG Telecom Cut to Neutral at JPMorgan; PT A$8.25

· NAB Cut to Underperform at Credit Suisse; PT A$22.90

· CBA Raised to Neutral at Credit Suisse; PT A$77

· Computershare Cut to Neutral at Credit Suisse; PT A$15.25

· ASX Raised to Neutral at Credit Suisse; PT A$70

· Coca-Cola Amatil Raised to Buy at Jefferies; PT A$13.50

· BHP Raised to Add at Morgans Financial Limited; PT A$36.46

· Rio Tinto Raised to Add at Morgans Financial Limited

· NAB Cut to Hold at Bell Potter; PT A$25

· Reliance Worldwide Raised to Buy at Baillieu Ltd; PT A$4

· Avita Medical Raised to Speculative Buy at Bell Potter

OUR CALLS

No changes to the portfolios today. We’ve held tight across our portfolios thus far with the Growth Portfolio more or less fully invested, ditto for the Income Portfolio although it’s a lot more defensively set while the international portfolios are still holding reasonable levels of cash.

Our Growth Portfolio is where we’re now feeling most pain as the ASX 200 has closed today at a new low. We’ve been reluctant to sell stocks into such significant weakness - at this stage, panic is playing out in the market,, it was obvious today and we continue to believe (too optimistically to date) that stocks are nearing at least a short term inflexion point. We’ll review this stance over the weekend with one eye firmly on the portfolio we want to have coming out of this sell-off. Worth remembering that when stocks bounce, they will bounce very hard however the key question being from what level.

Major Movers Today

Have a great Weekend all

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.