Market stages impressive recovery (BHP, NWH)

WHAT MATTERED TODAY

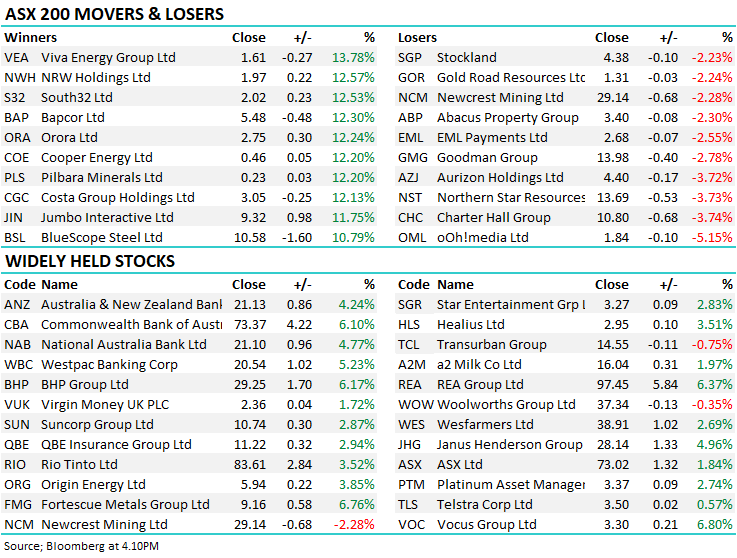

The market staged a huge recovery today, aggressive across the board especially from the morning lows where stocks turned up and went on with it. What a difference a day makes - CBA had a low of $65.75 before closing on the high at $73.37, Macquarie (MQG) opened $115.83 before closing at $126.55 while Costa (CGC) was probably the most impressive hitting a low of $2.37 early before closing up +12.13% at $3.05 – lots of other examples across the market as some pent up buying was unleashed.

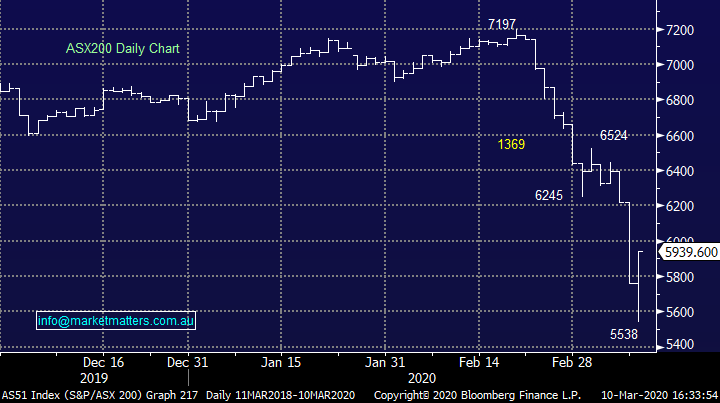

SPI Futures were painting a bleak open for the ASX after the Dow Jones fell ~2000pts overnight, local futures traded down to a 5345 low overnight before rallying +620 points / 11.5% to close out at 5965, simply a massive move on the upside from the overnight trough.

News across Bloomberg this morning just before open that Trump was holding a press conference today on ‘ very substantial’ economic stimulus to counteract the virus, talks of cuts to payroll tax amongst other things while in China we saw President Xi Jinping tour Wuhan, a major vote of confidence in the region that added just 19 new cases overnight.

Locally there’s growing talk that our own Govt is also finalizing a fiscal package that is likely to be big and used to offset the financial impacts of the drought, the fires, and the virus. More on this to come. Oil stocks bounced back today after being taken to the cleaners yesterday with one fundie today calling the sector the ‘buy of the year’- I’m not in that camp but gee views / sentiment change on a dime. Markets were oversold and bounced hard, we could easily revert back tomorrow, however we’ll take a day like today and hopefully a few more.

One of the things that always amazes me in the market is how bearish we all can become but in a heartbeat, switch the other way…hard to see how things change so dramatically in either direction by such a quantum, but they do, and we need to live with it.

Asian markets were all higher today although less so than our own.

Based on the peak in SPI FUTURES just 13 trading days ago at 7148, the mkt dropped 1803 points / 25.22% to the overnight low of 5345, before closing today at 5965

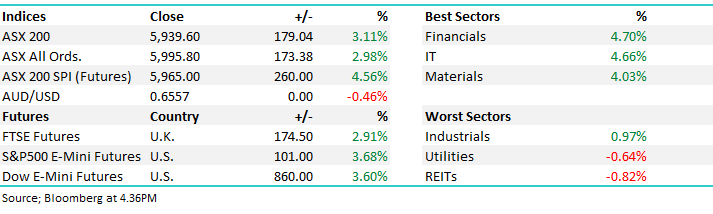

At a sector level today, the financials saw the love followed by the other higher beta IT and Materials stocks. The defensives lagged

Overall, the ASX 200 added +179pts / 3.11% today to close at 5939 - Dow Futures are trading up +860pts/+3.60%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

NRW Holdings (NWH) +12.57%: the contractor presented at the Euroz conference today combining with the broad based risk-on attitude helping the stock rip higher from its early session lows. The presentation reiterated why we like the stock – good cash conversion helping pay down debt, strong recurring revenue with growth and cost out measures as acquisitions come through.

The company talked up their current year’s outlook with the bulk of their $2b expected revenue secured, while FY21 has $1.8b already on board alongside a longer term pipeline of $10b. Recently we have seen Rio Tinto hint at increasing maintenance spend as their assets age and it appears to be a trend across the mining industry with NWH noting further demand in WA and Queensland in particular. We remain positive NRW, - a bit shaken from their recent volatility but like it none-the-less.

NRW Holdings (NWH) Chart

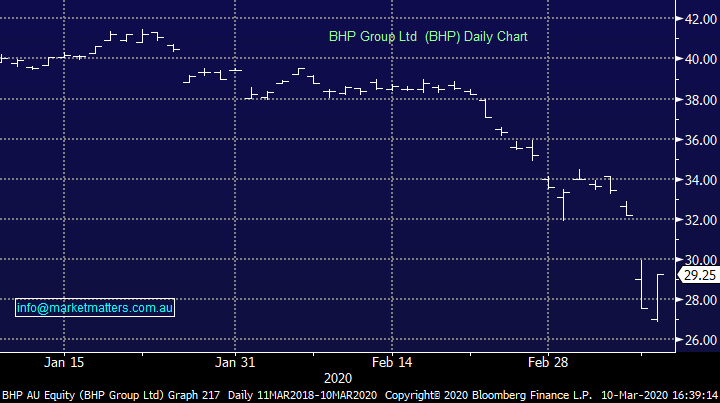

BHP Group (BHP) +6.17%: chairman Ken McKenzie was vocal at today’s AFR Business Summit, talking up the company’s ability to withstand shocks while capturing upside in recoveries. Particularly interesting was his attention to potential acquisitions as the miner looks to flex its balance sheet to leverage a rebound in growth.

SolGold appears to be a key target as BHP not so quietly builds a stake as attention turns to “future facing” assets – nickel in particular a key element in batteries among other things. BHP currently has around $US2b more in cash than it holds in debt, with plenty of headroom in terms of target leverage levels. It’s low cost position across the commodity deck puts it in a unique position to sustain profits in weakness. We recently added to our BHP position.

BHP Group (BHP) Chart

BROKER MOVES Mirvac Group Raised to Buy at UBS; PT A$3.49

- Domain Holdings Raised to Buy at UBS; PT A$3.60

- Carsales.com Raised to Neutral at UBS; PT A$15.65

- REA Group Raised to Buy at UBS; PT A$110

- Seven West Cut to Neutral at UBS; PT 12 Australian cents

- Beach Energy Raised to Outperform at Macquarie; PT A$2.10

- ARB Raised to Hold at Morningstar

- Caltex Australia Raised to Buy at Morningstar

- Credit Corp Raised to Buy at Morningstar

- Breville Raised to Hold at Morningstar

- Incitec Raised to Buy at Morningstar

- Challenger Raised to Buy at Morningstar

- Metcash Raised to Hold at Morningstar

- Orica Raised to Hold at Morningstar

- Origin Energy Raised to Buy at Morningstar

- Cromwell Property Raised to Hold at Morningstar

- Suncorp Raised to Buy at Morningstar

- Sims Raised to Buy at Morningstar

- Worley Raised to Buy at Morningstar

- Seven Group Raised to Buy at Morningstar

- Mineral Resources Raised to Buy at Morningstar

- Technology One Raised to Hold at Morningstar

- Orora Raised to Buy at Morningstar

- Carsales.com Raised to Buy at Morningstar

- Netwealth Raised to Hold at Morningstar

- Afterpay Raised to Hold at Morningstar

- Stockland Raised to Neutral at UBS; PT A$4.80

- Altium Raised to Buy at Bell Potter; PT A$35

- Caltex Australia Cut to Sell at Shaw and Partners; PT A$23.50

OUR CALLS

To changes today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.