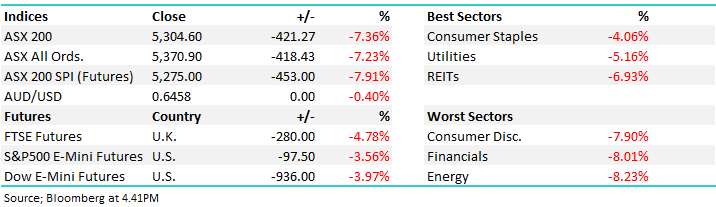

Stimulus fails to ignite the market, trades to new lows

WHAT MATTERED TODAY

Policy response day as we suggested this morning failed to deliver even a whimper for the bulls, if indeed there are any left! The market opened down around -100pts which was +100pts better than the futures implied, we saw some support after Prime Minister Scott Morrison outlined a domestic stimulus package however that was short lived when President Trump took to the teleprompter at midday to outline ‘some’ help to small business but he failed to offer much else. The big news being that the US has banned visitors from Europe for the next 30 days to try and curb the virus – clearly an aggressive measure

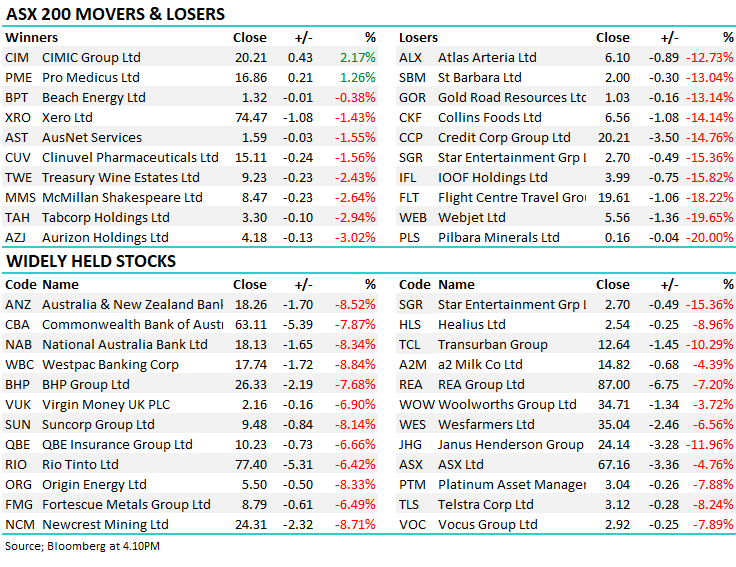

There was no-where to hide today, 2 stocks out of the ASX 200 closed up, and looking across the sectors it was simply a bloodbath. Banks off -7.64% as a group, BOQ best down -6.04%, WBC worst off -8.84%, Capital Goods down -7.14% as a sector, Cimic was up 2% the best of them while Reliance Worldwide (RWC) was the worst off -12.19%, Commercial Services which include things like Smart Group (SIQ) and Bingo (BIN) was down -7.14%, McMillan (MMS) the standout there down ‘just’ -2.64% while Seek (SEK) fell by -7.25%, Aristocrat Leisure (ALL) amongst consumer services was down -11.59% however Star Entertainment (SGR) down -15.36% and Flight Centre (FLT) down -18.22% took the cake there.

Amongst the diversified financials debt collector Credit Corp (CCP) fell -14.76% although you’d think they’ll have more inventory in the months ahead, Magellan (MFG) down -11.35% and IOOF (IFL) 15.82% helped to drag the sector 9.85% lower. Oil search (OSH) down another 10% while Beach Energy (BPT) fell just 0.38%, not a bad effort in a sector that fell 7.17%.

Anything thing food related did okay (comparatively speaking) with Costa (CGC) trading ex-dividend 2c and declining a total of -4%, the sector was off -5.06%. Other stocks that stood out included Transurban (TCL) down 10.29%, Qantas down another 9.9% taking its total decline to more than 50%. The IT stocks were more mixed, Wisetech (WTC) down 3.65% while Afterpay (APT) fell by 11.65%, rival Z1P fell -18.82%, closing at $1.38 versus ~$6 late last year.

During carnage like this, it’s all about the decisions we make on positions held, and what stocks we want to emerge with out of this rout – i.e making the right switching calls. It’s too late to sell in my opinion, instead now it’s about positioning with an eye 12-18months in the future. We have been in this position before and although the characteristics of each sell-off is different, they all have one common denominator, the market tends to underestimate our ability to adapt and move beyond the crisis.

This is clearly a big market shakeout…from the 7197 high set just 15 trading days ago, the market closed today at 5304, down 1893pts / 26.3%

Asian markets were also soft today, Japan down -4.41% the worst of them while China fell by -1.87%.

Overall, the ASX 200 fell -421pts / -7.36% today to close at 5304 - Dow Futures are trading down -1015pts/-4.31%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

STIMULUS: As expected, Scott Morrison ditched the Coalitions plans to deliver a surplus and heralded a $17.6b stimulus package to help boost economic activity in the face of COVID-19. Around 2 thirds of the package will be distributed before the end of the financial year as the government attempts to stop an economic recession. The package includes a one-off cash payment to welfare recipients costing nearly $5b. Small businesses also benefit substantially with a cash flow boost in the form of refunds on tax payments, faster depreciation on assets as well as an increase in the instant asset write off. Apprentices will also be supported, with employers eligible for a wage subsidy of 50% of the trainee’s wage.

The package is big, around 1.5% of the country’s GDP but the Coalition is keen to maintain its status as the party with superior economic management skills which means avoiding a recession. I suspect more will be added to the package if the virus and its impact lingers. The market was mostly unfazed with the bulk of the announcement already leaked and investors hoping for a little more were disappointed.

TRUMP: Failed to deliver much today besides a reminder to wash hands, a promise of potential payroll relief and a $50bn increase in loans available to small business. Overall, a big disappointment. He did announce plans to close flights from Europe, which is an aggressive approach, but warranted.

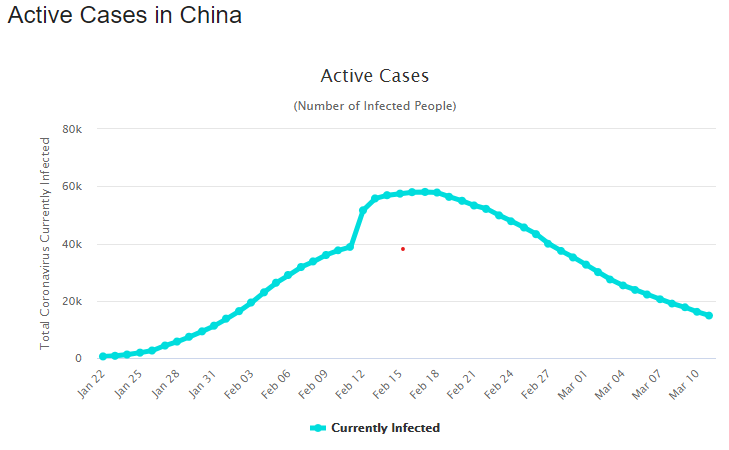

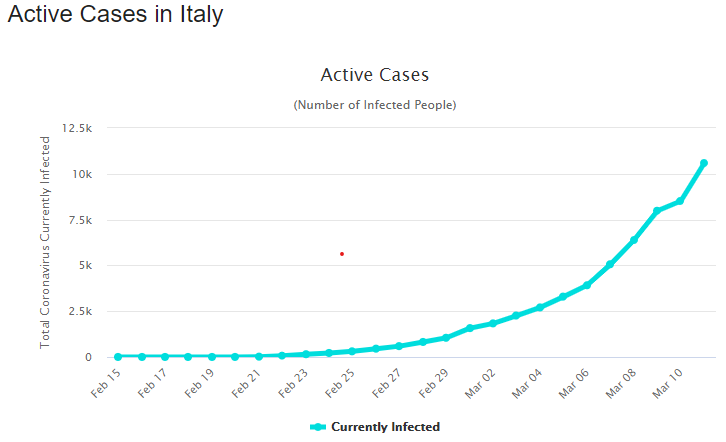

He's doing it because of the charts below….

China took a hard line and new cases have all but dried up there...

Active cases are falling after peaking a month ago….

Source www.worldometers.info

On the other hand, Italy was slow to react and cases there have spiked meaningfully and now top 12,000

Source www.worldometers.info

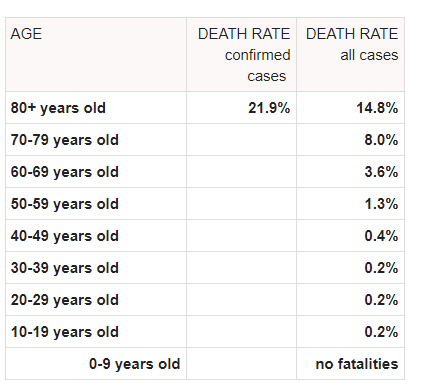

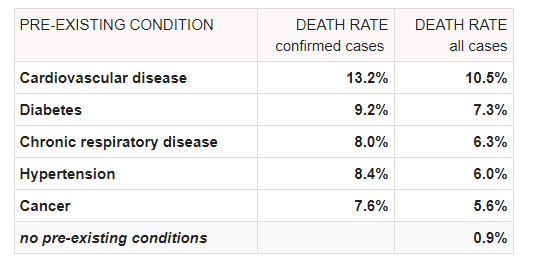

Death rates high in the elderly, but not so elsewhere

And most have a pre-existing condition

Source www.worldometers.info

While we think government initiatives combined with central bank intervention are important, and we need a more robust approach from the US sooner rather than later, we need to remember that the more important issue in this market is the growth rate of the virus, and specifically how quickly it will spread, and how bad it will get. That, more than any policies from Canberra, Washington or interest rate cuts, will decide whether we fall further or whether this entire correction ends up being one enormous buying opportunity

BROKER MOVES:

· Cimic Raised to Buy at HSBC; PT A$31

· SeaLink Rated New Outperform at Macquarie; PT A$4.48

· Newcrest Cut to Underperform at CIBC; PT A$25

· Technology One Raised to Outperform at Macquarie; PT A$9.75

· City Chic Collective Ltd Raised to Overweight at Wilsons

· Sydney Airport Raised to Buy at Morningstar

· Qantas Raised to Buy at Morningstar

· AP Eagers Raised to Buy at Morningstar

· Abacus Property Raised to Buy at Morningstar

· Flight Centre Cut to Underweight at JPMorgan; PT A$21.50

· Senex Raised to Buy at Citi; PT 39 Australian cents

· Sims Raised to Buy at Jefferies; PT A$9.40

· Computershare Raised to Add at Morgans Financial Limited

· Woodside Raised to Positive at Evans & Partners Pty Ltd

· Oil Search Raised to Neutral at Evans & Partners Pty Ltd

· Resapp Health Cut to Hold at Morgans Financial Limited

· Senex Raised to Overweight at JPMorgan; PT 38 Australian cents

· Breville Raised to Buy at Bell Potter; PT A$21.15

OUR CALLS

To changes today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.