It’s not all bad news (MTS)

WHAT MATTERED TODAY

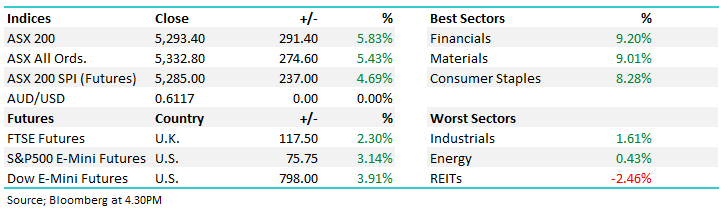

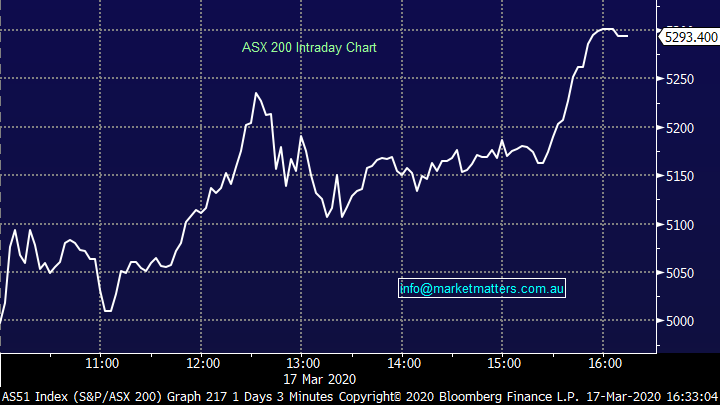

Today was the 3rd aggressive buy day in the last 6 trading sessions and while the index is still down 8% in that time, it feels to me a meaningful low isn’t too far away. The headlines across TV screens this morning clearly rattled a few investors given the calls / texts I received early on, understandable given the Dow Jones fell nearly 13% overnight, however important to recognise that we had led this move on Monday with our own 10% decline. SPI Futures made a marginal new low just after midnight on Tuesday at 4780 before rallying ~500pts for the 2nd time in 3 trading sessions. As we suggested this morning, this implies that buyers are ready and willing around the 4800 level to step up and buy the market aggressively.

On the SPI, the decline from the high of 7148 to the overnight low of 4780 totals 2368 points / 33.1% over 18 sessions – simply a huge move over that time period

On the market today, stocks rebounded, financials and materials led the gains hence the decent move on the index. The highest quality members of each respective sector led the gains i.e. CBA rallied +13.26% versus NAB up 6.76%, BHP up 11.94% v RIO up 6.89%.

Overall, the ASX 200 added +291pts / 5.83% today to close at 5293 - Dow Futures are trading down +649pts/+3.18%, and they were trading limit up at one stage today

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Not all bad news: Not sure about you however I’m sick of reading / listening to such doom and gloom. While we’re clearly facing a major challenge and there will be more to play out here, the constant negative rhetoric is exhausting and erodes confidence. While I’m no medical expert, nor have I called the current decline particularly well, I remain convinced that in 6-12 months’ time, the market will be in a lot better shape, and that as investors is what we need to focus on.

As we’ve been suggesting, now is the time to ‘up spec’ portfolios, get rid of the shares that you’ve held because they’re in a loss, and put together a portfolio with high quality stocks, in essence, work to improve the quality of exposures. Examples we’ve done in our own Growth Portfolio over the last few weeks include moving from NAB to CBA, PDL to MFG, PGH & BLD into BHP, BIN & MQG, and we’ve got more work to do.

While the markets rally today barely moves the needle on the recent decline, it does show how quickly stocks will go once a bid comes into the market. In this decline traditional safe haven assets haven’t really been supported, the most obvious move has been into cash, implying that cash will hit the market at some point.

In terms of a more positive rhetoric about prevailing backdrop, China has now closed down its last coronavirus hospital as there is not enough new cases to support it while reports are that doctors in India have been successful in treating Coronavirus using a combination of drugs. Researchers of the Erasmus Medical Center claim to have found an antibody against coronavirus and a 103-year-old Chinese grandmother has made a full recovery from COVID-19 after being treated for 6 days in Wuhan, China.

While Apple and others have closed down stores globally, they have reopened all 42 china stores as the world’s second largest economy gets back up and running. In South Korea, the number of new cases on a daily basis is now declining however Italy is still a major concern, though it must be acknowledged they do have the oldest population in Europe. In Israel there are reports of a vaccine, while Canada is also claiming strong progress in Covid-19 research.

While this is an evolving situation and the headlines will get worse before they get better, it’s worth remembering that we will adapt and markets will start to look through this, and stocks will rally hard when that happens.

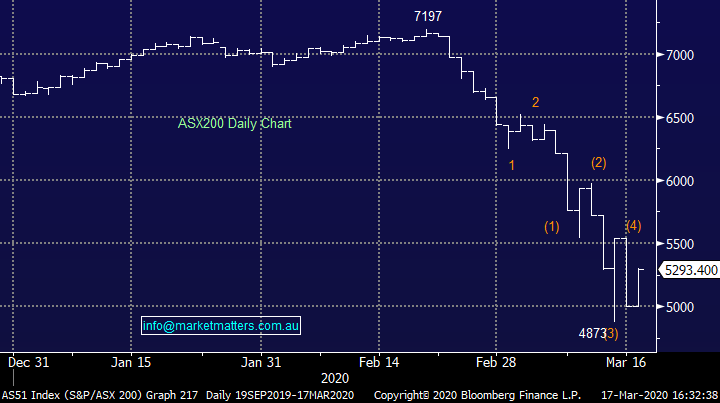

Supermarkets: Traded sharply higher today as brokers push through upgrades on the back of increased demand for staples. Panic buying ahead of the corona virus is estimated to have brought forward around 2 weeks of spending in supermarkets, helping contribute to an expected lift in earnings for the four main staples plays – Woolworths (WOW), Coles (COL), Metcash (MTS) and The Reject Shop (TRS). Coles hit a new all-time high today while Metcash topped the ASX200, adding 27% - we own MTS in the Income Portfolio

Metcash (MTS) Chart

BROKER MOVES:

- Woolworths Group Raised to Buy at UBS; PT A$39.70

- Metcash Raised to Buy at UBS; PT A$2.90

- Coles Group Raised to Neutral at UBS; PT A$15

- Northern Star Raised to Overweight at JPMorgan; PT A$13.50

- Suncorp Raised to Neutral at Macquarie; PT A$9.80

- Breville Rated New Buy at EL & C Baillieu; PT A$19.50

- Cochlear Raised to Neutral at Citi; PT A$196

- Sydney Airport Raised to Outperform at RBC; PT A$7

- Atlas Arteria Raised to Buy at Morningstar

- BWP Trust Raised to Buy at Morningstar

- Vocus Raised to Buy at Morningstar

- Aristocrat Raised to Buy at Morningstar

- Seek Raised to Buy at Morningstar

- Mirvac Group Raised to Hold at Morningstar

- Goodman Group Raised to Hold at Morningstar

- Stockland Raised to Buy at Morningstar

- Vicinity Centres Raised to Buy at Morningstar

- Steadfast Raised to Buy at Morningstar

- Metcash Raised to Buy at Jefferies; PT A$2.70

- Harvey Norman Cut to Hold at Jefferies; PT A$2.80

- Flight Centre Raised to Buy at Shaw and Partners; PT A$34

- Beach Energy Raised to Buy at Shaw and Partners; PT A$1.90

- PWR Holdings Raised to Buy at Bell Potter; PT A$3.75

- BHP Raised to Overweight at Morgan Stanley; PT A$36.50

- Woodside Raised to Sector Perform at RBC; PT A$22

OUR CALLS

No changes to the portoflios today

We were filled in Microsoft overnight in the international equities portoflio

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.