Property stocks now feel the heat (CIM, MQG, FLT)

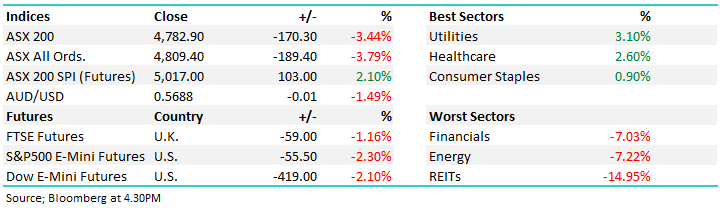

WHAT MATTERED TODAY

The market hit again today despite the RBA’s decision to cut the cash rate by 25 basis points to a historic low of 0.25%, plus they announced arrange of other measures to no-avail. The market was higher this morning, up 3% however a 6% turnaround and we closed near the session lows. The Real-Estate stocks were hit hard today, the 1-2 combination of concern that rents will not get paid at a time when credit markets are also under pressure, simply some huge lines of stock right across the board, sector heavyweight Goodman Group (GMG) down -14.61% = an example. Every REIT (other than GMG, CHC & INA) is now trading below NTA, some at massive discounts (Stockland (SGP) & National Storage (NSR), the latter of which had a deal on the table at $2.40 with two underbidder’s at $2.20, now the stock trading at $1.225, astonishing!

Economic data out this morning however largely backward looking, GDP at 1.8% YoY v expectations of 1.7%, unemployment AT 5.1% v 5.3% expected…yada yada yada…all backward looking though.

Eco Data Today

Source: Bloomberg

Overall, the ASX 200 fell -170pts / -3.44% today to close at 4953 - Dow Futures are trading down -271pts/-1.36%.

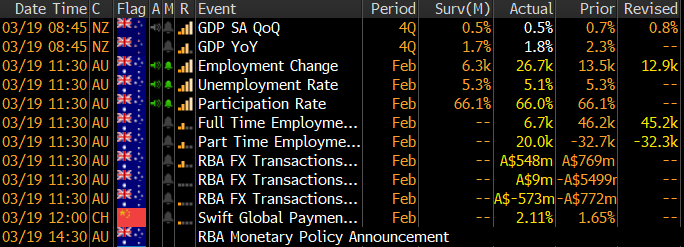

ASX 200 Chart – market simply grinded lower

ASX 200 Chart

CATCHING MY EYE:

Regulatory Trading Halts: a total of 6 stocks were halted for 2 minutes by the regulator today for some excessive moves in the session. Credit Corp (CCP) was halted twice in the session – it hit a low of $7.23, down 41% soon after the first halt was lifted, but shares did recover into the close. Contractor Cimic (CIM) wasn’t so lucky with the halt failing to stem the flow of selling as investors jump ship, closing down 31%. Printing business Ive Group (IGL) saw money flee for the exits (albeit it’s a think stocks with only 800k worth of shares trading), particularly late in the day, crashing over 40% today taking the total fall to 75% since the start of February. IDP Education (IEL) cratered as more pressure is placed on travel – Australia has just banned non-residents from entering the country, not a great sign for student placement services. In the travel space, Flight Centre (FLT) and Helloworld Travel (HLO) took a breather – the other travel booking stock Webjet (WEB) spent the day in their own half as they look to raise capital, a sign of things to come.

Cimic (CIM) Chart

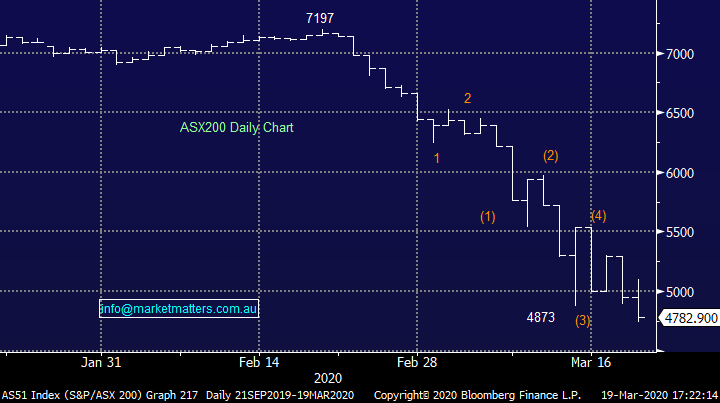

Macquarie (MQG) -12.90%: A second tough day on the trot for Macquarie which is not surprising given how heavily linked their revenue is to the market, and how the market has been in recent times.

1. In the GFC, the All Ords declined and average of by 42% from 1H08 to 2H09 and MQG’s revenue declined by 46% over the same period; and

2. Coming out of the GFC, the All Ords increased by an average of 31% from 2H09 to 1H11 and MQG’s revenue increased by 43% over the same period.

They also have around $1.6bn invested in an aircraft business along with a decent exposure to the US energy sector, clearly two areas that are very much under the pump. My view on MQG is that it is a well-run business, it’s exposed to the market (for better or worse) and is the financial company most likely to take advantage of the opportunities that come its way. It was a better company after the last crisis and hopefully the same will happen this time.

Macquarie (MQG) Chart

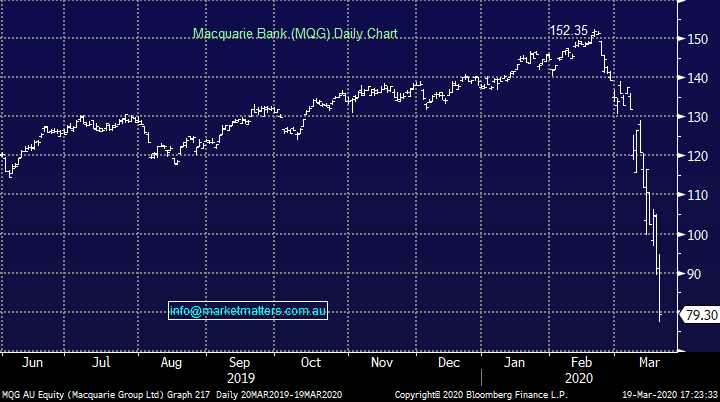

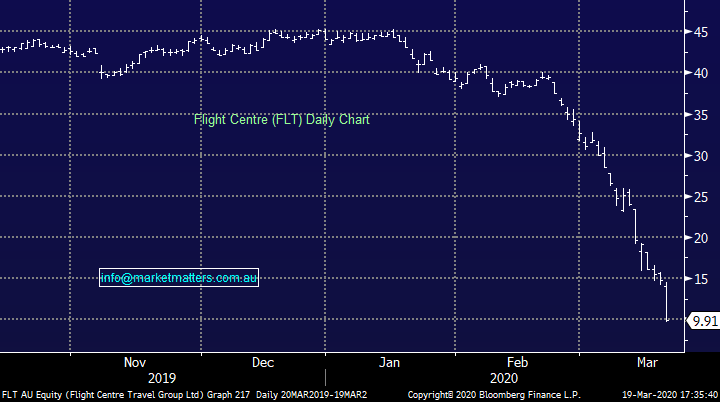

Flight Centre (FLT) -33.04%: We wrote about this in AM note today (below), however they fell another 33% today and went into a trading halt, not good. They’ll update market shortly on their response to COVID-19 however I would suspect they’ll need to tap markets for equity. They’ve got cash but a big store network and no real near-term revenue potential, lowest prices guaranteed almost an understatement.

From the AM Report today… Retail travel agency Flight Centre is at the centre of lifestyle disruption but its trading at an almost 65% discount to its historical book value while carrying net cash on its balance sheet. Since the GFC, FLT have prepared for downturns like this by carrying a large cash balance and this is proving to be a good move. Obviously, FLT is going to struggle for income in the months ahead, but this business should be well positioned for a rebound if the shutdown does not continue for an extended period of time. The main concern here is the potential liability of closing stores, they’ve already announced the closure of 100 underperforming stores, with more likely.

In the longer term, this shock will put FLT in a better position for the future, however in the short term, more pain is likely.

MM is negative FLT short term however there will be a time to step up and buy this, just not yet

Flight Centre (FLT) Chart

BROKER MOVES:

· Premier Investments Cut to Neutral at Macquarie; PT A$11.71

· Lovisa Cut to Neutral at Macquarie; PT A$5.80

· Breville Raised to Outperform at Macquarie; PT A$16

· Super Retail Cut to Hold at Morgans Financial Limited

· Coca-Cola Amatil Raised to Hold at Morningstar

· Cleanaway Raised to Hold at Morningstar

· Ramsay Health Raised to Buy at Morningstar

· Charter Hall Retail Raised to Buy at Morningstar

· Breville Raised to Buy at Morningstar

· JB Hi-Fi Raised to Hold at Morningstar

· Afterpay Raised to Buy at Morningstar

· Growthpoint Raised to Buy at Morningstar

· Dexus Raised to Hold at Morningstar

· REA Group Raised to Outperform at Credit Suisse; PT A$94.80

· Domain Holdings Raised to Outperform at Credit Suisse

· Appen Raised to Outperform at Credit Suisse; PT A$22

· Mirvac Group Raised to Outperform at Credit Suisse; PT A$2.76

· Qube Raised to Buy at Jefferies; PT A$2.39

· Brambles Raised to Hold at Jefferies; PT A$9.57

· Transurban Raised to Buy at Jefferies; PT A$15.41

· Sydney Airport Raised to Buy at Jefferies; PT A$7.99

· Ramsay Health Raised to Overweight at JPMorgan; PT A$63

· Iress Raised to Overweight at JPMorgan; PT A$12

· Oil Search Cut to Underperform at Credit Suisse; PT A$2.23

· Pro Medicus Raised to Positive at Evans & Partners Pty Ltd

· REA Group Raised to Hold at Morgans Financial Limited

· Iluka Raised to Outperform at Credit Suisse; PT A$10

· Oil Search Cut to Equal-Weight at Morgan Stanley; PT A$3.10

· Beach Energy Raised to Equal-Weight at Morgan Stanley

· CBA Raised to Hold at Morgans Financial Limited; PT A$67

OUR CALLS

No changes to the portoflios today

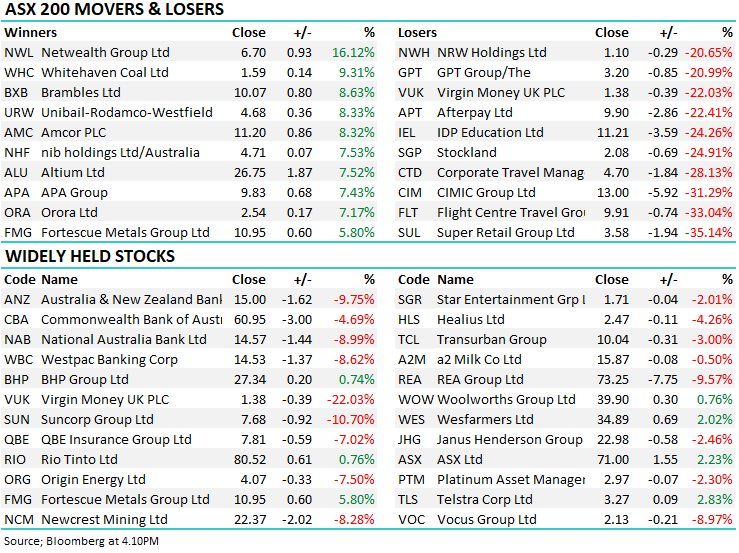

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.