Some buying in the beaten-up end of town (APT, MFG)

WHAT MATTERED TODAY

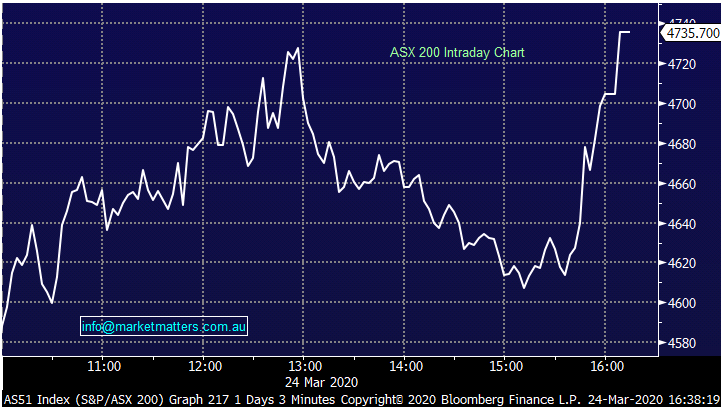

A better day for the ASX with stocks opening higher and grinding up from left to right throughout the day. It's been a while since buyers had control of things but today they did. Overnight the Fed launched another big program (s) and they'll be hopeful that this will settle down the bond market. As we covered in the AM report today, the spread for US high yield v US Treasuries blew out to ~10% which puts shivers down the spine of corporate borrowers - to put that into context, sub-investment grade borrowers just saw cost of debt increase 3 fold, hence the rush out of leveraged ASX companies. Best performers today were the fallen angels led by Corporate Travel (CTD) which put on 31%, it seems to be the only travel company not in a trading halt so was the natural destination for COVID-19 optimists.

We also saw the likes of Afterpay (APT) put on more than 20%, Smart Group (SIQ) which we own in the Income Portfolio added +16% however it was the beaten up debt collector Credit Corp (CCP) that was the real star, bouncing +40% after a torrid few weeks that saw its shares trade from ~$38 to ~$6, today it closed at $9.12. On the flipside, Graincorp traded 55.6% lower following the demerger of its United Malt business, which traded under the ticker code UMG from midday.

One obvious trend we saw today was money flowing into the bigger constituents of each sector, tech for instance saw APT & XRO rally but the likes of EML Payments (EML) continued to lag. As risk appetite stays subdued it will be the larger stocks that will enjoy the bounces as / when they come, not yet any real appetite to venture down the spectrum into the smaller companies’ space.

In terms of sectors today, Energy, REITS and IT bounced hard however there was green right across the board.

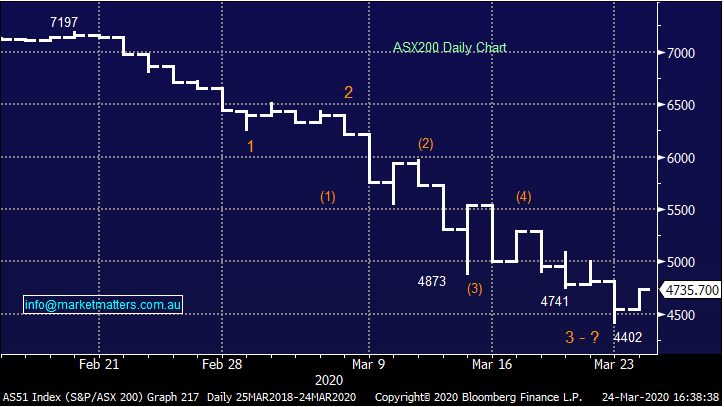

From the 7197-high set on the ASX 200 on the 20th Feb, the market fell 2795pts/39% to a low yesterday of 4402.

Today, the ASX 200 added +189pts / +4.17% to close at 4735 - Dow Futures are trading up +518pts/+2.8%.

Tonight, in the US the market is looking for the fiscal package to get up - something $2 trillion.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

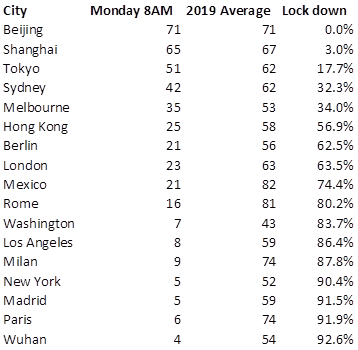

CONGESTION DATA: Supporting the view that China is “back to business” and that Australia is slow to react, the daily traffic congestion data from TomTom has been used to compare cities traffic congestion at 8AM Monday morning.

It also suggests Wuhan remains in lockdown.

Afterpay (APT) +25.96%: clawed back a portion of the savage sell off the stock has encountered over the past few weeks - it peaked on 20 Feb at $41.14, falling 80.5% to yesterday's low of $8.01 in just 23 sessions. Today's support was found on directors picking up a few shares into the weakness. Two directors bought a total of 14,790 shares on Friday - around $100k each, while one lucky director nabbed 19,300 at a little under $9 yesterday.

The inside guys tend to have a reasonable idea of how the business is going and throwing a few pennies at their own company signals to the market that the ship is steady. we discussed the pain being felt in the BNPL space last week - the gist being that their target market is the casually or part time employed, while funding will become increasing difficult to come by in the current environment. These three seem to have a different idea, and while defaults are inevitable, it may be A sign that the doomsday scenario currently being priced into the group is overshooting to the downside - at least for APT that is.

Afterpay (APT) Chart

Magellan (MFG) +11.58%:A decent bounce for the fund manager today after a tough month. Buying into weakness will gravitate towards the No 1 players in each sector, it’s the reason we switched from PDL into MFG recently and that was the theme that played out today, most of the other fund managers were down. We like MFG at these levels.

Magellan (MFG) Chart

BROKER MOVES:

- Imdex Cut to Hold at Bell Potter; PT 96 Australian cents

- Adairs Cut to Hold at Morgans Financial Limited; PT A$1.60

- Breville Raised to Outperform at Credit Suisse; PT A$16.16

- Magellan Financial Raised to Neutral at Goldman; PT A$33.26

- ANZ Bank Raised to Buy at Citi; PT A$24.75

- Westpac Raised to Buy at Citi; PT A$26

- CBA Raised to Buy at Citi; PT A$68.75

- Bendigo & Adelaide Raised to Buy at Citi; PT A$7.25

- Bank of Queensland Raised to Buy at Citi; PT A$6.50

- Insurance Australia Raised to Buy at Morningstar

- Harvey Norman Raised to Buy at Morningstar

- CSR Raised to Buy at Morningstar

- TPG Telecom Raised to Buy at Morningstar

- REA Group Raised to Buy at Morningstar

- Cleanaway Raised to Buy at Morningstar

- Dexus Raised to Buy at Morningstar

- JB Hi-Fi Raised to Neutral at Credit Suisse; PT A$26.98

- Wesfarmers Raised to Neutral at Credit Suisse; PT A$30.07

- Incitec Raised to Hold at Jefferies; PT A$1.80

- Austin Engineering Rated New Speculative Buy at Hartleys Ltd

- Cooper Energy Raised to Buy at Bell Potter

- Pacific Smiles Raised to Buy at Bell Potter; PT A$1.43

- Amcor GDRs Raised to Buy at Jefferies; PT A$13.10

OUR CALLS

No changes to the portoflios today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.