IT stocks lead the charge as Cochlear completes successful raise (COH, AMP)

WHAT MATTERED TODAY

The ASX rallied for a 3rd straight session today supported by news overnight that the US Senate had passed the biggest stimulus package in history at $US2.2 trillion - it now goes to the Democratic-controlled House, which will most likely pass it Friday. The market has been focussed on 1. Central Banks which have now acted to provide the financial system with liquidity 2. Governments with fiscal measures to support individuals and businesses through this and 3. Stats around the virus which are still very alarming and suggest the worst is still to come on that front. We've had positive news from 1&2, but 3 is still likely to rattle investors further at some point.

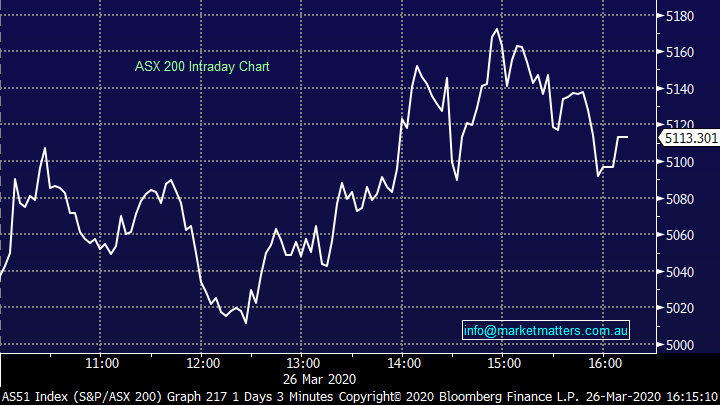

The ASX 200 hit a peak at the end of February of 7197, crashed to a 4402 low in the quickest bear market in history, a drop of nearly 40% before closing today at 5113, +711pts / +16% from the depths of despair. While the mkt ended more than 2% higher, we wouldn’t be surprised to see the market cool from here, the question being - what's it now got to look forward to since the US fiscal package has been announced?

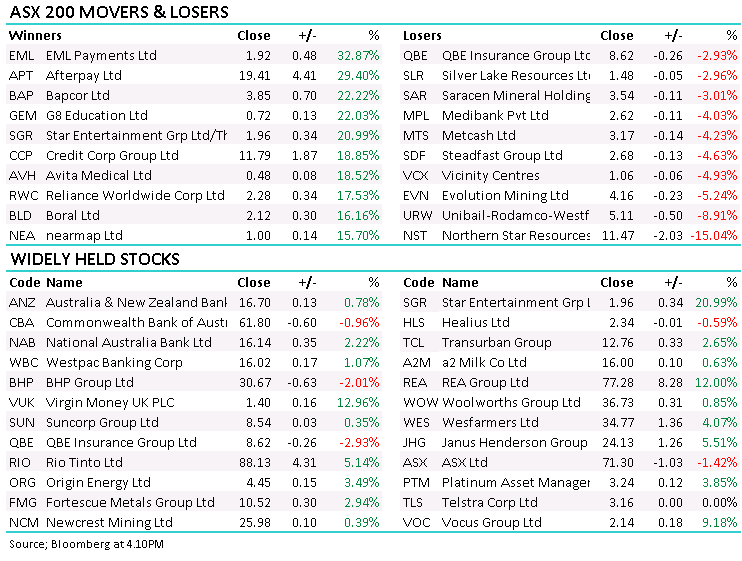

Today there was a decent move out of gold stocks, Northern Star (NST) hit hardest while we saw continued buying in some of the more edgy IT names. EML Payments (EML) had fallen hard, from a high of $5.70 to todays close of $1.92. This is an interesting business and it looks like the sellers are now exhausted, ditto for Afterpay (WPT) which is grinding up from their $8 low.

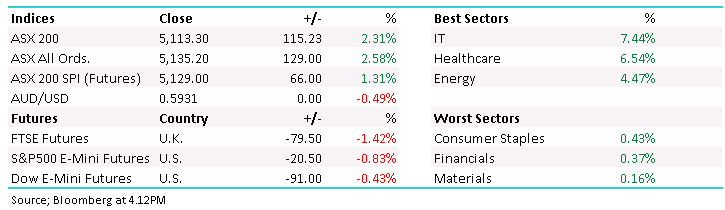

Source: Bloomberg

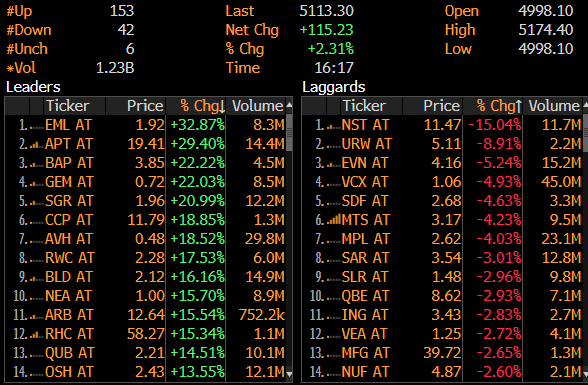

Today the ASX 200 added +115pts /+2.3% to close at 5113 - Dow Futures are trading down -187pts/-0.89%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

Raising Capital: Webjet has now failed to raise equity capital so it looks like they'll turn to private equity which is never a good sign - they'll likely pay a big price in the long run for doing some type of convertible note combined with a smaller deeply discounted equity offer - the total of which would be around $250m. It seems they couldn't get anyone to underwrite the retail side of an equity raise and given they're retail shareholder base is large - about 50%, they couldn't take the risk.

Cochlear (COH) on the other hand had little trouble raising $880m at $140 per share through institutions. JP Morgan ran the deal, we bid into the institutional book however didn’t get an allocation, absolutely donut! The stock went to existing institutional shareholders which is fair but it would have been nice to pick COH up at $140. The stock actually rallied today closing +8% at $182.17. They are seeing pain across their business with a significant number of deferrals in elective surgeries hurting their earnings, but a quality company at such a discount is a no brainer.

Retail investors who own the stock will get a chance to buy up to 30k worth at the $140 level - well worth doing.

Cochlear (COH) Chart

AMP Ltd (AMP) +8.33%: had a choppy day today, but came in with a wet sail to close strongly higher. The financial services company walked away from guidance due to the "uncertain environment and resultant challenges in providing accurate forecasts" as a result of the COVID-19. Now one of many to pull guidance for the current year, AMP's announcement was largely expected by the market though with the market already sitting below the guidance given at the half year result 6 weeks ago of "broadly flat on FY19."

Investors did enjoy the update on the sale of the Life business. It was feared that the deal would be another victim of the pandemic, already weakened by regulatory hurdles. Today though, AMP said the sale is on track for a 30 June completion. Certainly a relief for the market. Though still facing a number of issues, completing the deal may help build a bit of momentum in AMP, so one to keep an eye on in to the end of financial year. Their Hybrids AMPPB are worth buying in anticipation of the life sale.

AMP Ltd (AMP) Chart

BROKER MOVES: Citi turned more positive on the casino stocks today

- G8 Education Cut to Underperform at Macquarie

- Eclipx Cut to Neutral at Macquarie; PT 49 Australian cents

- Star Entertainment Raised to Buy at Citi; PT A$2.40

- Crown Resorts Raised to Buy at Citi; PT A$8.20

- Transurban Cut to Hold at Morningstar

- Cromwell Property Cut to Hold at Morningstar

- REA Group Raised to Overweight at JPMorgan; PT A$88

- Cochlear Raised to Positive at Evans & Partners Pty Ltd

- Bendigo & Adelaide Raised to Hold at Jefferies; PT A$5.25

- Sigma Healthcare Raised to Neutral at Credit Suisse

- Star Entertainment Raised to Outperform at Credit Suisse

- Botanix Pharmaceuticals Cut to Speculative Hold at Bell Potter

- Perenti Cut to Speculative Buy at Hartleys Ltd; PT A$1.53

OUR CALLS

No changes to the portoflios today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence