Webjet back after 16 day hiatus (WEB, GEM)

WHAT MATTERED TODAY

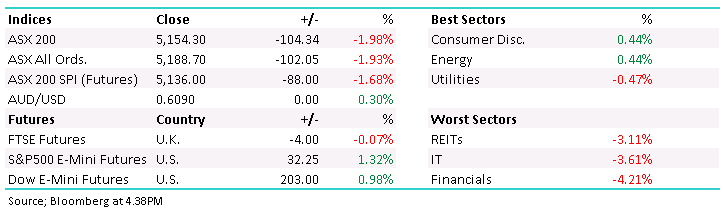

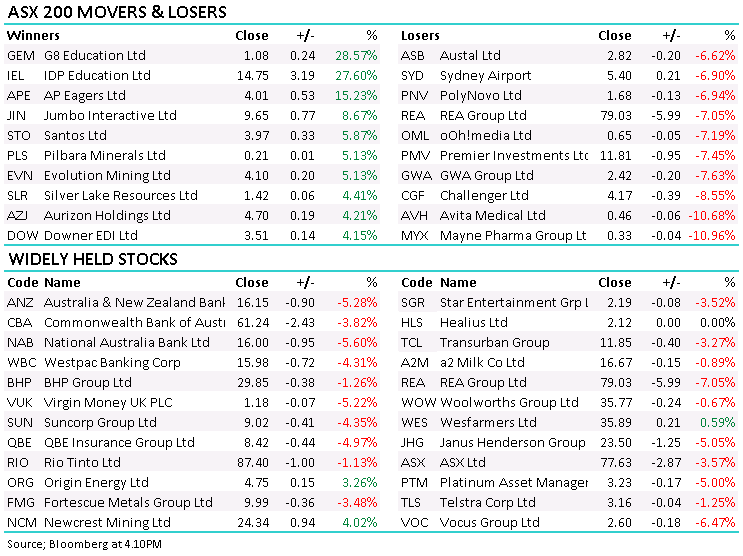

Despite the market closing down 100pts today it was a reasonable session considering the weakness from the US overnight + the 4% decline from our very influential finance sector. Banks were all lower after the Reserve Bank of New Zealand ordered banks to stop paying dividends to conserve capital – The NZ banks are owned largely by the Australian institutions so the Aussie banks won’t get a dividend out of their NZ operations, NAB and ANZ the most to lose here and as a consequence they saw most selling, down 5.6% & 5.28% respectively, while CBA and WBC were down 3.82% and 4.31% a piece. It’s unlikely they we’ll go down that path in Australia however there is that chance, APRA saying today…"For the time being, decisions on dividends and variable remuneration remain matters for boards to determine in line with their obligations under APRA’s prudential framework."

Elsewhere, there was noticeable performers in Webjet (WEB) which came back online post a big capital raise – Harry covers below, while G8 Education (GEM) rallied on the back of Federal Government support for the sector before entering a trading halt. IDP Education (IEL) also came back online strongly, after raising capital in a well bid institutional placement. Companies that can raise capital here, and most are being able to are actually rallying as a result. Energy stocks had another decent session, the sector looks v’good here for a continuing bounce.

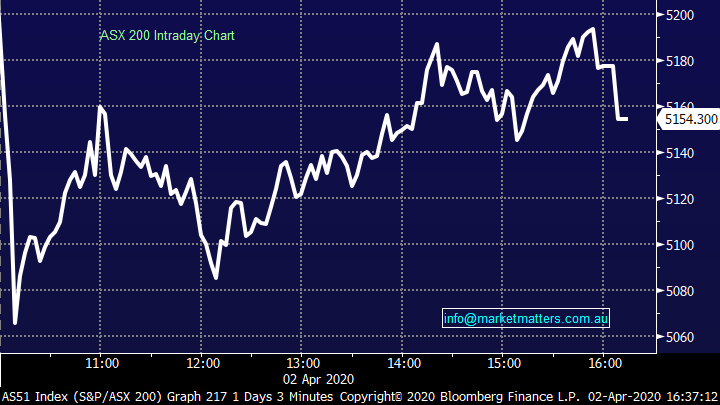

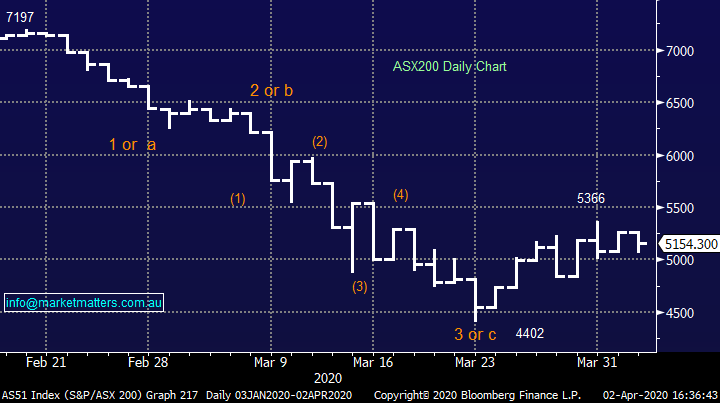

Today the ASX 200 fell -104pts /-1.98% to close at 5154 - Dow Futures are trading up +203pts/+0.98%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

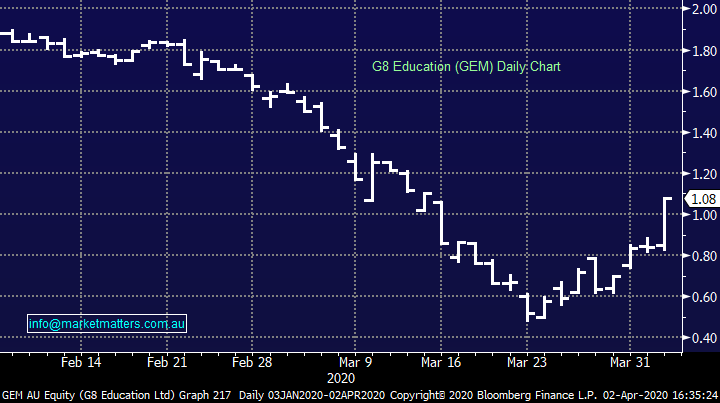

G8 Education (GEM) +28.57%: the childcare operator rallied hard today (before going into a trading halt) on the back of the Federal Governments decision to make childcare free for essential workers in "critical areas" such as those in healthcare and logistics. The plan works like this: The government will pay 50% of the sector’s fee revenue up to the existing hourly rate cap based on a point in time before parents started withdrawing their children in large numbers, but only so long as services remain open and do not charge families for care. The government will waive the fee gap until the payment is made and will also pay $453.2 million to preschools in 2021.

In short, this is a win for childcare operators however in the case of GEM, it remains in a very precarious position. GEM holds a lot of debt, about $420m in net debt putting it on a debt to EBITDA multiple of around 7x, which is scary. I would think that at the earliest possibility, GEM will look to raise capital to pay down debt. This is a business we’ve looked at numerous times for our income portfolio however a period of weak occupancy even before this crisis coupled with too much debt had us wary, and we remain that way. Maybe one worth buying after they recapitalise the balance sheet.

G8 Education (GEM) Chart

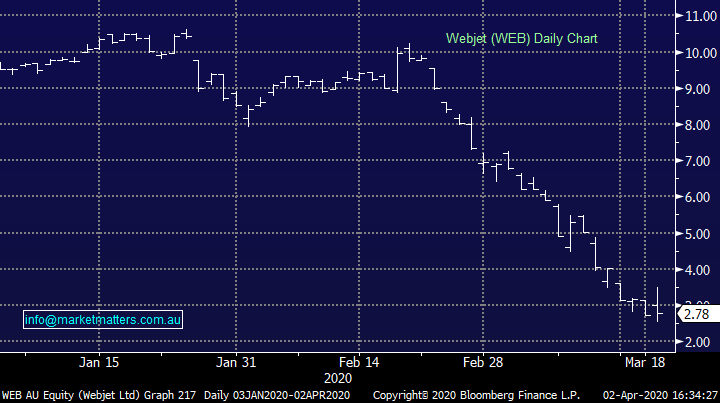

Webjet (WEB) -26.06%: after spending 16 days in a trading halt, online travel agency Webjet finally saw it’s shares trade again today after institutional investors covered a much needed capital raise. The deal was completed at $1.70 – more than a 50% discount to where it closed prior to the halt, the discount representing the risk that remains in the business despite the capital injection as travel bookings dry up in the wake of COVID-19. Institutions completed $231m and the company expects a further $115m to come from retail investors who have been invited into a share purchase plan. In some comfort for shareholders, US based private equity firm Bain Capital joined the register, committing $25m in the offer, and saving an additional $65m of dry powder if Webjet needs. Bain has been threatening to do a big deal in Australia for some time – Healius was on their radar, as was BWX for some time. They are also the major shareholder of Retail Zoo – franchisee of 4 Australian brands including Boost Juice which failed to complete an IPO last year.

For now though Webjet has secured its balance sheet despite the pressing times. With some room to move, it looks much more likely to survive in this trying time for travel related stocks. Earnings will take a hit, but Webjet will look a better business on the other side as a result of the measures being put in place now. We like the recapitalised Webjet, a good stock to own to leverage the COVID-19 rebound when it eventually comes

Webjet (WEB) Chart

BROKER MOVES:

- AGL Energy Raised to Neutral at UBS; PT A$18

- Transurban Raised to Buy at UBS; PT A$13.85

- JIN AU Raised to Positive at Evans & Partners Pty Ltd

- Brambles Raised to Outperform at Macquarie; PT A$12.90

- Perpetual Raised to Neutral at Macquarie; PT A$27.50

- Pendal Group Raised to Outperform at Macquarie; PT A$6

- Magellan Financial Raised to Neutral at Macquarie; PT A$50

- IDP Education Raised to Add at Morgans Financial Limited

- JB Hi-Fi Cut to Sell at Morningstar

- Monadelphous Cut to Hold at Morningstar

- Pendal Group Raised to Neutral at Credit Suisse; PT A$4.90

- Brambles Cut to Hold at Morningstar

- Mayne Pharma Cut to Hold at Morningstar

- APA Group Cut to Sell at Morningstar

- Sonic Healthcare Cut to Neutral at JPMorgan; PT A$27.50

- Viva Energy Group Cut to Neutral at JPMorgan; PT A$1.40

- Caltex Australia Raised to Overweight at JPMorgan; PT A$26.50

- Bingo Industries Cut to Neutral at Goldman; PT A$2.35

- AGL Energy Cut to Hold at Morgans Financial Limited; PT A$17.39

- Dexus Raised to Positive at Evans & Partners Pty Ltd

- Redbubble Cut to Reduce at Morgans Financial Limited

- Technology One Cut to Hold at Bell Potter; PT A$8.50

OUR CALLS

In the Growth Portfolio we bought Xero (XRO) and Aristocrat Leisure (ALL)

In the Income Portfolio we bought Transurban (TCL)

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.