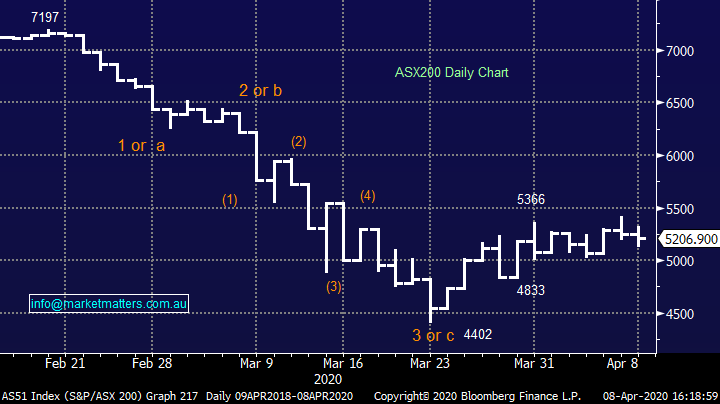

Property stocks best on ground for a change (BOQ, OSH)

WHAT MATTERED TODAY

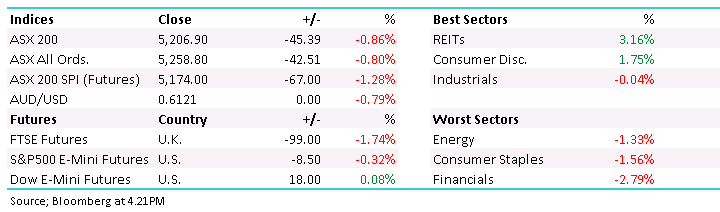

Stocks eventually ended lower today however they did fight hard early on, recouping a ~100pt morning decline to actually trade higher at one stage, before a large sell order hit the market late, the ASX 200 dropping ~100pts on the close to end marginally down. The biggest drag was the banks today, a combination of a Fitch downgrade and noise from APRA around bank dividends weighed on the sector – we focussed on this in the Income Note – click here – today.

Property stocks had a day in the sun today, Stockland (SGP) did well adding nearly 7.5% while Unibail Rudamco (URW) recovered a slight fraction of recent losses closing up more than 11%, although it’s still less than half where it was trading a few months ago. The other positive sector today was consumer discretionary, with the likes of JB Hi-Fi (JBH) which we added to the portfolio yesterday up +3.3% today while Super Retail (SUL) which is firmly on our radar for the income portfolio adding 5.74%.

Today the ASX 200 fell -45pts /-0.86% to close at 5206 - Dow Futures are trading up +18pts/+0.08%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

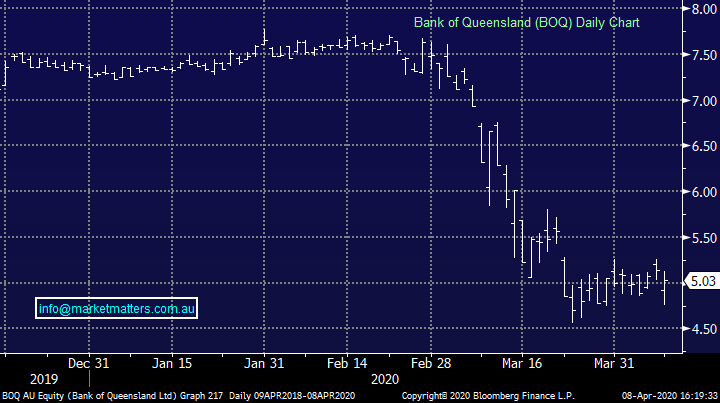

Bank of QLD (BOQ) -2.14%: Released their 1H20 results today while they took APRA’s advice and deferred a decision on their dividend. In terms of the result itself they delivered cash profit of $151M for the half which was 1% lower than 2H19. Lower income and higher expenses were largely offset by a lower bad debt charge. In terms of tier 1 capital, that sits at 9.9% of risk weighted assets which compares with the guidance range of 9% to 9.5%. As we said, the interim dividend was deferred because APRA wants to understand their capital position in a yet-to-be-determined stressed scenario.

Interestingly, BOQ did provide a scenario of stress under COVID-19 that included:

1. 3% decline in GDP in 2020 followed by a recovery in 2021.

2. 8.5% unemployment in 2020 reducing to 6.5% in 2021; and

3. 5% decline in property prices.

This is not a scenario they have discussed with APRA – it actually seems a bit optimistic to me - and BOQ does not yet know what stressed scenario APRA would require for the purpose of determining future dividend payments, but they will soon no doubt. In terms of outlook the main aspect to catch my attention was a large increase in the bad debt charge. The forecast is 60 bps of loans in 2H20, giving a 2H20 bad debt charge of $141M, which far exceeds the outcome from BOQ’s stress test.

We remain neutral BOQ and see better opportunity towards the higher quality members of the sector

Bank of QLD (BOQ) Chart

Oil Search (OSH) -3.39%: Back online after raising US$683m of new capital to boost liquidity and lower gearing. Funds were raised at $2.10, by way of an Institutional placement and 1:8 non-renounceable entitlement offer. The issue price is at an 18% discount to TERP and 23% discount to last close. The main reason for the raise is to reduce gearing from 35% to 28% and increase liquidity to protect against an extended period of low oil prices. Raising equity at a steep discount at the bottom of an oil price cycle is not ideal but necessary to reduce the balance sheet risk.

In terms of the other energy players, Beach (BPT) has no debt, Woodside (WPL) has gearing around 13% while Santos (STO) is around 27%, however they have a better break-even point than Oil Search.

We like the energy sector into current weakness and own STO & BPT in the Growth Portfolio, & Woodside (WPL) in the Income Portfolio.

Oil Search (OSH) Chart

BROKER MOVES:

- Oil Search Raised to Add at Morgans Financial Limited

- Computershare Raised to Neutral at Macquarie; PT A$10.90

- IGO Cut to Hold at Morningstar

- Newcrest Rated New Hold at Jefferies; PT A$28

- Saracen Mineral Rated New Buy at Jefferies; PT A$4.75

- Evolution Rated New Buy at Jefferies; PT A$5

- Downer EDI Raised to Outperform at Credit Suisse; PT A$4

- Flight Centre Raised to Add at Morgans Financial Limited

- Computershare Raised to Positive at Evans & Partners Pty Ltd

- BHP Group PLC Raised to Outperform at Credit Suisse

- Rio Tinto Assumed Underperform at Credit Suisse

- Hub24 Reinstated Buy at Shaw and Partners; PT A$12

- Oil Search Raised to Overweight at JPMorgan; PT A$3.40

OUR CALLS

No changes

Major Movers Today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.