Westpac discloses bad debt charge (WES, WBC, WZR, NST)

WHAT MATTERED TODAY

A more subdued session today with the market consolidating yesterday’s run higher. The banks remained in focus with NAB recommencing trade post equity raise, they closed today at $15.32 after raising capital at $14.15, although new shares do not pick up the 30cps dividend, while Westpac pre-released its bad debt charge for the half and the stock ended higher – more on that one below from Harry. The retailers were strong today, all this talk of relaxing current restrictions has investors becoming more positive on the space, even Flight Centre (+4%) and Corporate Travel (+8%) had good sessions as we now start to see the risker end of the market attract some attention.

Energy stocks lagged thanks to weakness in Oil overnight, large ETFs in the US amending the way they provide exposure to Oil the main catalyst there (selling front month to go longer out the curve) – Santos (STO) down -1.85% while Beach Energy (BPT) was off 1.89% (more early) as they defend a legal stoush with a drilling contractor.

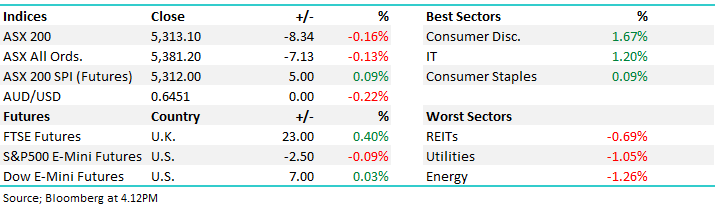

Today the ASX 200 fell -8pts /-0.16% to close at 5313 - Dow Futures are trading up +7pts/+0.03%

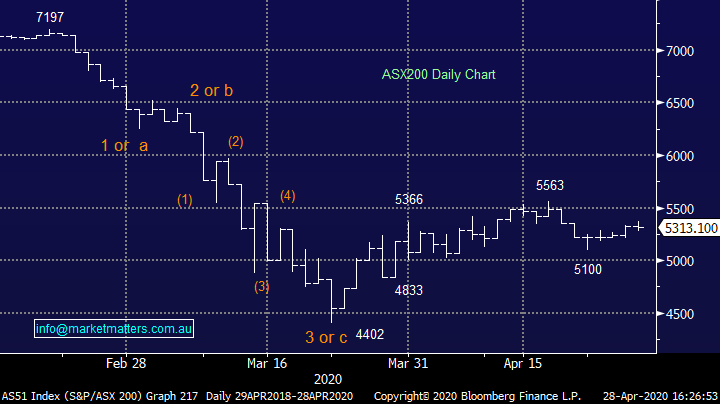

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

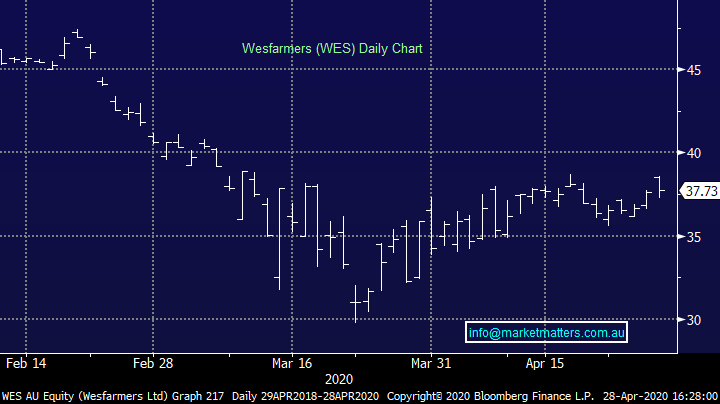

Wesfarmers (WES) +0.29%: Provided a trading update this morning which showed sales at Bunning’s up +5% for 3Q20, while Officeworks was up by 8%. Bunning’s is the key driver for WES accounting for more than 50% of their earnings and clearly the sales momentum has continued through this period of disruption. Kmart and Target sales growth for the quarter was also in line with 1H20 (i.e. +1.0% and +0.3% respectively) – however, in recent weeks sales have moderated for Kmart and “declined significantly” for Target (weak apparel sector, lower foot traffic into shopping centres etc.) – Target now looks like it’s on the chopping block, although hard to identify a buyer for it.

As we covered in last week’s income note, the WES balance sheet remains strong post Coles sell-down (+$1.1b) and extension of available debt facilities (+$2.0b) – sounds like WES is warming up for a major acquisition or two. Coles will report 3Q20 numbers tomorrow while Woollies will report 3Q20 numbers on Thursday

Wesfarmers (WES) Chart

Westpac (WBC) +1.77%: outperformed peers today after pre-releasing their bad debt expectations ahead of their half year result. The bank will recognize a $2.2b bad debt charge in the result caused by the COVID-19 impact. The sizeable impairment is around 6.5x that of the first half result last year but despite that, they said capital will be okay – in other words, they won’t need to raise capital like NAB did yesterday. Still though, the result may be without a dividend given current tier 1 capital of sub 11%.

Westpac (WBC) Chart

Wisr (WZR) +8.33%: A smaller speculative company we’ve written about in the past – I own a few shares as do some clients – spoke today at a conference. They had given a trading update 2 weeks ago so not a lot of new news, however they did shine some light on funding. This is a fintech / marketplace lending business so access to capital is key. They said they have total funding available of $78m, which equals 18 quarters of funding available given 3Q20 net cash outflows of -$4.3m (-$10.5M YTD). They have net cash of +37m + unused facilities of $41m. This is a good little speculative stock in my view that’s been hit hard.

Wisr (WZR) Chart

Northern Star (NST) -2.14%: the gold miner had their March quarter update today moving through their third quarter of the year. The numbers were light on expectations but for the most part the misses had been pre-released. The impact from the virus forced Northern Star to pull guidance back in late March though, but today’s numbers suggest that they may still sneak into the lower end of the 920koz to 1,040koz guidance range.

Costs have crept higher, up to $1,590/oz for the quarter gone and now tipping $1,500 for the year to date. The company has a handle on debt, with net debt sitting around $150m despite the purchase of the Super Pit mine this year. All in all, not a bad place to be for gold exposure.

Northern Star (NST) Chart

BROKER MOVES:

- NAB Raised to Add at Morgans Financial Limited; PT A$16.50

- Newcrest Cut to Underperform at Macquarie; PT A$23

- New Hope Cut to Underperform at Macquarie; PT A$1.30

- Alumina Cut to Underperform at Macquarie; PT A$1.40

- Charter Hall Retail Raised to Neutral at Citi; PT A$2.99

- Silver Lake Cut to Neutral at Macquarie; PT A$2.10

- St Barbara Cut to Neutral at Macquarie; PT A$2.60

- Regis Resources Cut to Neutral at Macquarie; PT A$4.60

- GrainCorp Cut to Hold at Morningstar

- AusNet Cut to Sell at Morningstar

- United Malt Raised to Buy at Morningstar

- Regis Resources Cut to Sell at Morningstar

- Metcash Raised to Overweight at JPMorgan; PT A$3

- Charter Hall Retail Raised to Outperform at Credit Suisse

- Westpac Cut to Neutral at JPMorgan

- NAB Cut to Hold at Jefferies; PT A$15.35

- United Malt Rated New Hold at Morgans Financial Limited

- Charter Hall Retail Cut to Hold at Jefferies; PT A$3.23

- Domain Holdings Raised to Hold at Morgans Financial Limited

- South32 Cut to Underperform at Jefferies; PT A$1.54

- Altium Rated New Overweight at Morgan Stanley; PT A$40

OUR CALLS

No changes today

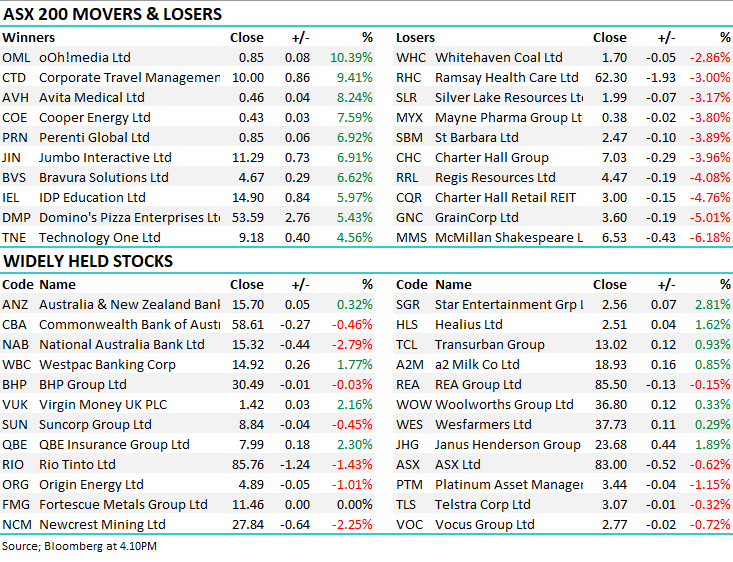

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.