ASX bounces back 6% in April (QUB, ANZ, FMG)

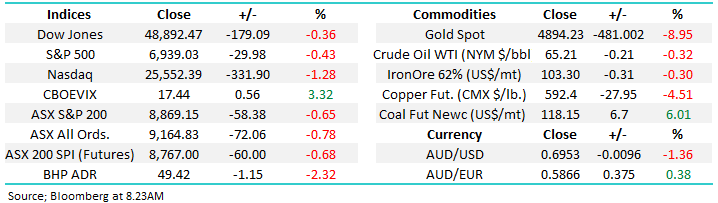

WHAT MATTERED TODAY

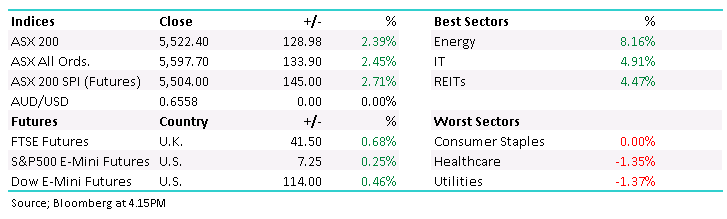

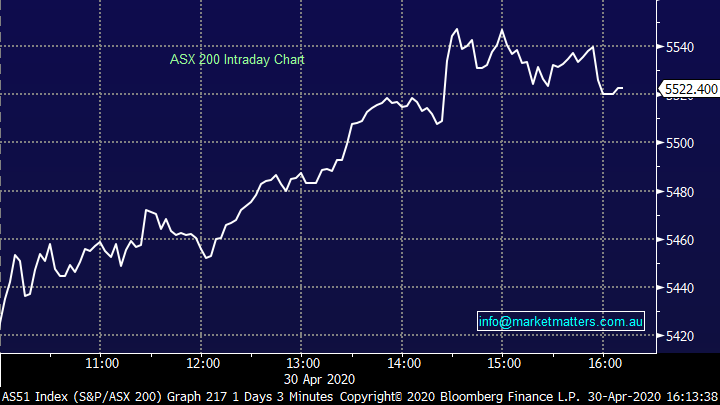

A solid way to end the month with stocks rallying fairly hard, pretty much all day as the smell of FOMO wafted through the market. The edgier sectors did best today, Energy the standout while it was supported again by the financials which enjoyed strong buying from recent lows. On the flipside the defensive areas struggled, the supermarkets under pressure as Woollies printed strong quarterly sales growth, but echoed Coles yesterday by saying things had calmed down, while healthcare and utilities lagged. More on Woollies below.

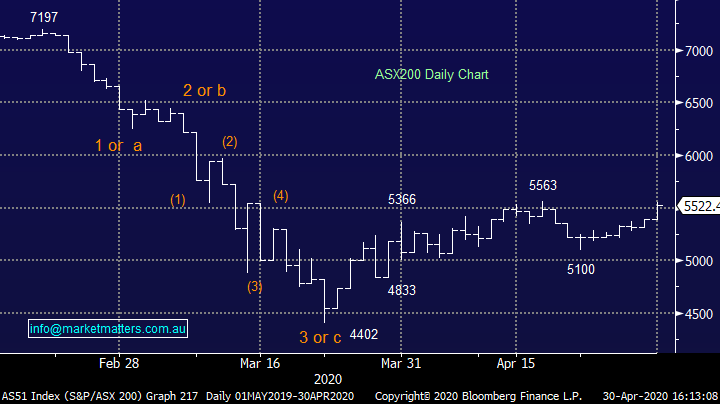

For the month of April the ASX 200 bounced back +6.58% after dropping 20% in March – a solid effort really given the raft of equity raises that have come across our screens, particularly in the last few days.

Today the ASX 200 added +129pts /+2.39% to close at 5522 - Dow Futures are trading up +114pts/+0.46%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

Monthly Performance: Sector performances for April – Energy & IT the standouts.

Source: Bloomberg

In terms of stocks in April, a large number of gainers came from the laggards in March and vice-versa. Some very big moves.

Stocks during April

Source: Bloomberg

Cap raises plenty of stocks looking to raise capital at the moment, with a few big names calling large amounts of cash from institutional investors. NAB and Lendlease didn’t have too much trouble getting their big deals away, and today three new stocks were cap in hand. Newcrest seeking $1b to increase exposure to the Furta del Norte gold mine in Ecuador. They already own 32% of the mine but have acquired an offtake agreement which means they will be first paid in the tier 1 mine, and purchased at less than book value. An interesting deal here, and Newcrest using strength in their equity to fund. Rocky, our analyst on the stock likes it.

Retirement village owner & manger Ingenia is tapping the market for $150m to cash up ahead of a potential fire sale season in aged care, expecting to spend up in the next 12-18 months – an example of listed companies having such an advantage over non-listed operators.

Trade logistics and transportation company Qube (QUB) was the third in the top 200 seeking more money today. They are after $500m to increase their balance sheet liquidity with a recent winning streak of new contracts forcing capex to rise while potential acquisitions could also be on the horizon. We like this deal priced at $1.95.

Qube (QUB) Chart

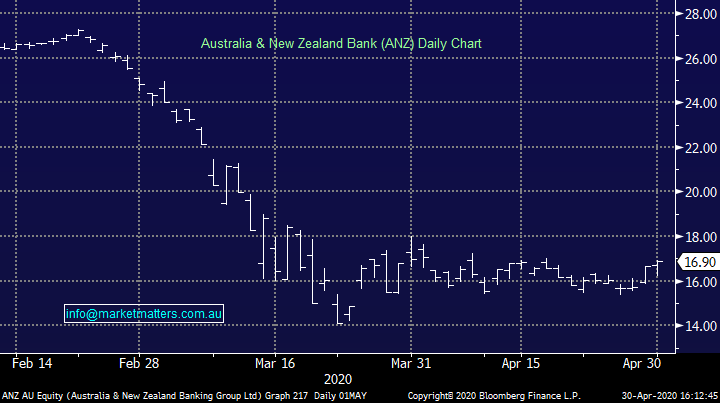

ANZ +1.44%: despite finishing the day higher, it was a tough slog for ANZ which trailed its Big 4 peers throughout the session. Their first half result was light on compared to NAB’s at the end of last week, and although the market wasn’t expecting much, it did feel like it fell short. Impaired assets topped $1.12b while the bank put aside a provision of around $1b for the impact of COVID-19 which looks light on and makes their CET1 level look a bit better than most would expect. Still though, with CET1 below 11% ANZ opted not to pay an interim dividend for now – deferring their decisaion. Strong trading income partially helped support the result, but it also came with an $815m impairment of their troublesome Asian investments. We prefer other banks

ANZ Chart

Fortescue Metals (FMG) +1.87%: Delivered a pretty faultless March quarter production report today, the stock rallying early to be within just 50c of its all-time high however it peeled off late in the day. They had record production for the quarter and are on track for their full year numbers, which they increased / tightened up slightly with Twiggy & Co looking for 175-177mtpa. There was a slight cost uptick given COVID related issues - should not have been a surprise really while FY earnings look on track to be at the higher end of expectations. Dividend expectations kept in the 50-80% FY range, they paid 65% in 1H20.

Hard not to like this stock – but we should have bought into recent weakness. Now not the time.

Fortescue Metals (FMG) Chart

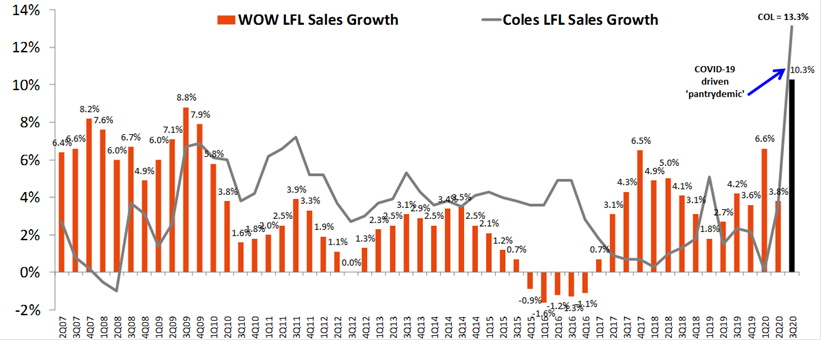

Woolworths (WOW) -0.78%: 3Q20 Australian Food (Supermarkets) LFL sales growth of +10.3% - pretty strong number as expected but not as strong as COL’s +13.1%. At the peak of the COVID-19 ‘pantrydemic’, comp sales were +40% in week ending 2 March 2020. Average prices increased by 2.1% in the quarter with increases across many Fresh categories and Grocery – again not as high as COL’s inflation of +2.6%.

Good chart here from Danny Younis at Shaw showing LFL sales growth trends, putting the CV-19 spike into context

Source: Shaw and Partners

BROKER MOVES:

- Lendlease Group Raised to Buy at UBS; PT A$15.50

- Coles Group Raised to Buy at Citi; PT A$17.40

- SkyCity Entertainment Raised to Outperform at Macquarie

- GrainCorp Cut to Underweight at Wilsons; PT A$3.11

- United Malt Rated New Overweight at Wilsons; PT A$5.17

- Vocus Cut to Hold at Morningstar

- GWA Group Cut to Hold at Morningstar

- Premier Investments Cut to Hold at Morningstar

- Domain Holdings Cut to Hold at Morningstar

- Lendlease Group Cut to Hold at Morningstar

- Tabcorp Cut to Neutral at Credit Suisse; PT A$3.20

- Credit Corp Raised to Add at Morgans Financial Limited

- Coles Group Raised to Hold at Morgans Financial Limited

- Coles Group Raised to Buy at Shaw and Partners; PT A$17

- Regis Resources Cut to Neutral at JPMorgan; PT A$4.20

- United Malt Cut to Hold at Bell Potter; PT A$4.80

OUR CALLS

No changes today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.