Risk back on as money flows into the beaten-up sectors (IPL, COH)

WHAT MATTERED TODAY

Looking at the top movers today it was clearly risk back on, perhaps more so than the underlying +1.3% index gain would imply. The likes of Webjet (WEB) +20%, IVE Group (IGL) +20%, Katmandu (KMD) +15%, NRW Holdings (NWH) +12%, AP Eagers +10% versus Fisher & Paykel Health (FPH) -1.89%, Spark Infrastructure (SKI) -1.99%, Woolworths (WOW) +0.12% & CSL +0.32% - some clear rotation out of the relative performers up the risk curve into those names that were/are at the pointy end of the CV-19 shutdowns.

Banks underperformed today, CBA best +0.91%, NAB worst -0.62% while Macquarie (MQGH) was the clear standout adding more than +6% after they launched a new Hybrid Security Offer – more on that below.

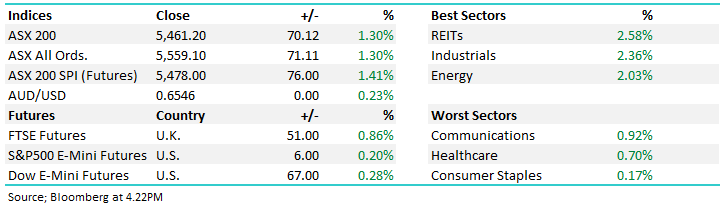

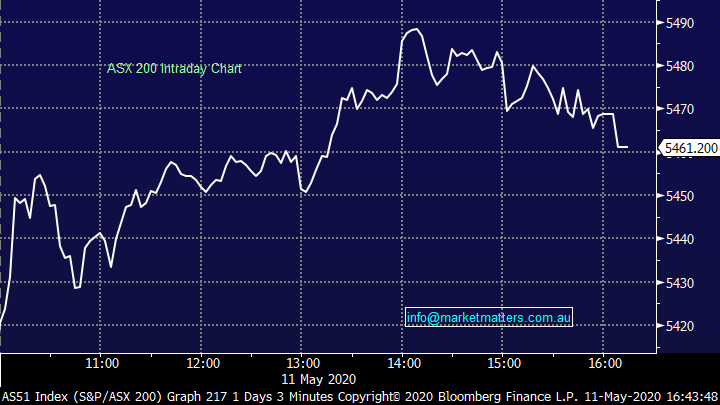

Today the ASX 200 added +70pts / 1.30% to close at 5461 - Dow Futures are trading up +67pts/+0.28%

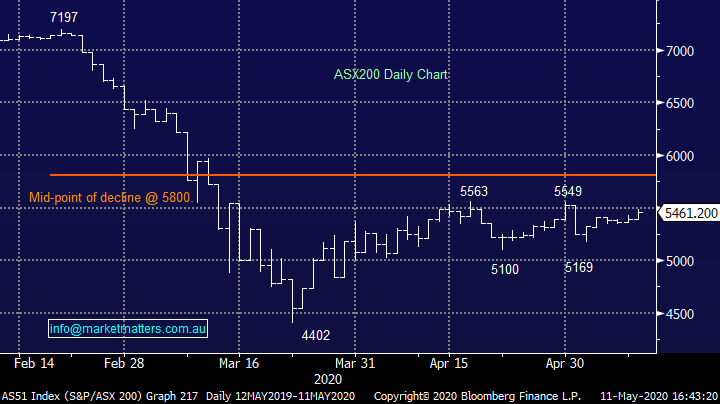

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

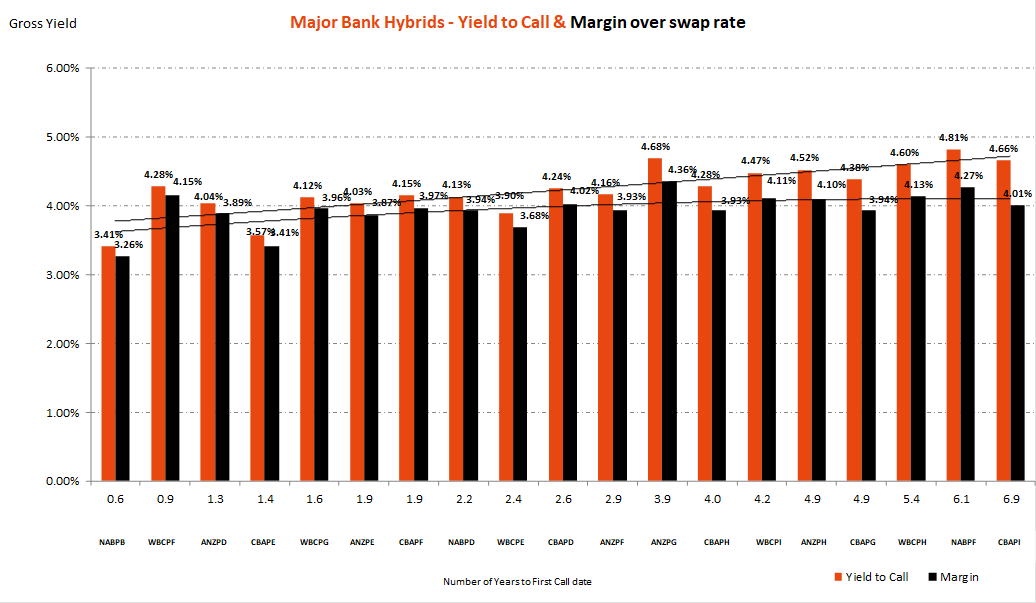

New Macquarie Hybrid: MQG this morning launched a new Hybrid offer to raise $400m, it’s a longer dated tier 1 security with first call in 8.5 years’ time. They’re offering a margin over the bank bill rate of 4.7-4.9% and we would assume the lower end of the range. The table here shows the current listed financial hybrids, the longest of which is the CBAPI paying 4.01% over bank bill for 6.9 years. Macquarie is obviously a slightly higher risk, and slightly longer tenor hence the higher yield, however it looks a good rate. The security was bid very well, and the book build opened and closed today only.

Existing Financial Hybrids on Issue

Source: Shaw and Partners

To read the full Listed Debt Hybrid Rate Sheet click here (5 pages)

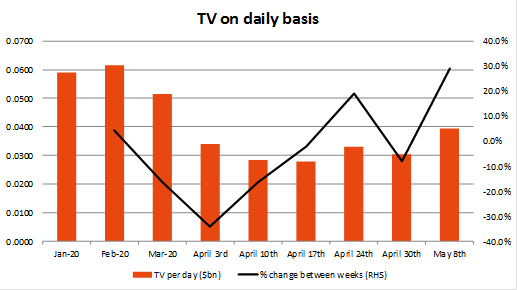

Tyro Payments (TYR) +8.85%: We’ve talked about Tyro Payments in notes through this pandemic as a proxy for spending and this morning they providedtheir latest weekly trading update. As a reminder, Tyro is/was one of the fastest growing payment terminal providers in Australia. As we flagged at the time, the turning point in terms of daily payments through their machines looks to have passed with transactions now on the up = bullish indicator.

Key takeout’s

· TV in May of $315m. This equates to $39.4m a day to start April and is up 29% on the last week of April for TYR and 16% more broadly for the month on last month;

· YoY growth rate now -20% and in April bottomed at -43%; and

· Expect this to continue comping higher as offline opens up (TYR has a bias towards).

Source: Shaw and Partners

Incitec Pivot (IPL) Trading Halt-: the fertilizer & mining explosives business raised capital alongside their half year report today. The report was better than expected with a ~7.5% beat to expectations on the EBIT line to $159m, up 34% on last year. The beat was driven by the decent growth in explosives in both Australia and the US while pressure from agriculture commodity prices weighed on that half of the business. The company is seeking to raise $600m through the institutional placement, and an additional $75m through an SPP for existing holders.

The raise has been called pre-emptive with IPL having substantial liquidity in the balance sheet in place. They trumpeted long term trends in both Ag and mining, though short-term hits to capex spend might choke earnings. The raise will take the net debt/EBITDA level to 1.9x, with $1.28b drawn of $3.45b available in facilities. At $2/share, the deal represents an 8.7% discount to Friday’s close, adding around 18.6% of shares on issue.

Incitec Pivot (IPL) Chart

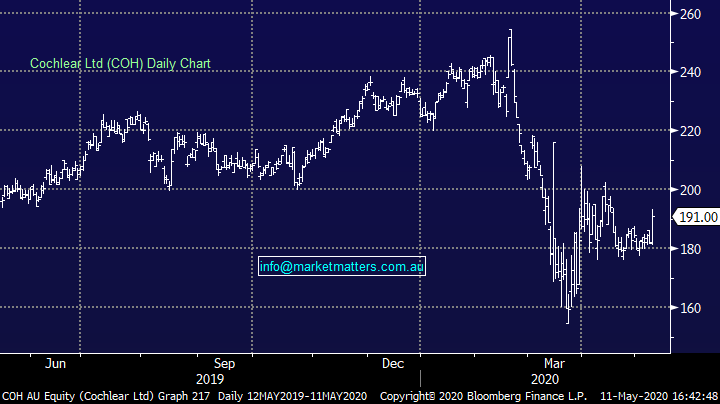

Cochlear (COH) +5.14%: was feared as one of the key losers to COVID with cutbacks on non-urgent procedures, Cochlear today confirmed the impact the various shut downs had on activity. They noted revenue had fallen 60% in April, while in developed markets it was down closer to 80% in the month. The impact appears to be short term, with the company noting a number of countries have recommenced hearing aid implant procedures as part of the reopening process. They have cut back on capex while the revenue run-rate recovers with China already at pre-COVID levels implying that it may be another 3-6 months before it full returns – better than some expected.

Cochlear (COH) Chart

BROKER MOVES:

- Reject Shop Raised to Buy at Goldman; PT A$4.75

- GUD Holdings Raised to Buy at Goldman; PT A$10.50

- Dacian Gold Raised to Outperform at Macquarie

- Macquarie Group Raised to Neutral at Citi; PT A$110

- CSR Cut to Neutral at Citi; PT A$3.45

- REA Group Cut to Neutral at Macquarie; PT A$95

- Monadelphous Cut to Hold at Morningstar

- REA Group Cut to Sell at Morningstar

- Appen Rated New Overweight at JPMorgan; PT A$33

- Macquarie Group Cut to Neutral at Credit Suisse; PT A$107.50

- REA Group Cut to Neutral at Credit Suisse; PT A$94.50

- Home Consortium Ltd Raised to Outperform at Credit Suisse

- APA Group Raised to Buy at Citi; PT A$12.51

OUR CALLS

No changes

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.