Banks surge, CSL stalls (WBC, CSL, BKL, STA)

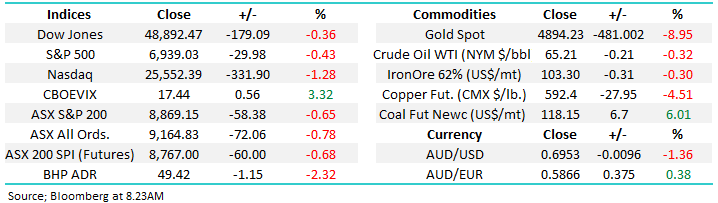

WHAT MATTERED TODAY

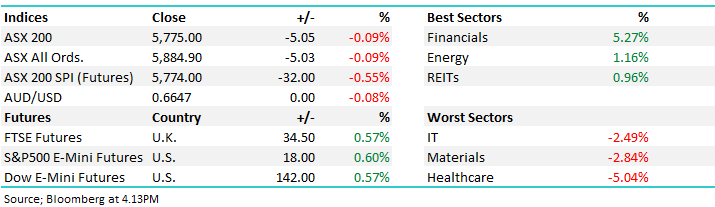

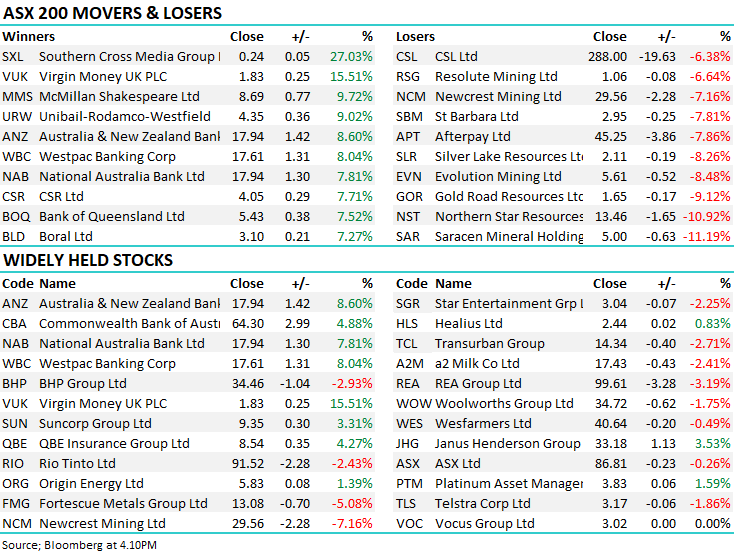

We talk a lot about sector rotation at MM and today there was no clearer example as investors sold into the sectors that have been working well and bought into the beaten up banks, ANZ +8.6%, WBC +8.04%, NAB +7.81%, CBA +4.88% leading a 5% rally in the sector. The big 4 alone added +58points to the index today while on the flipside healthcare lost 5% thanks to a decent sell off in CSL which showed how influential that stock now is detracting -28pts from the index.

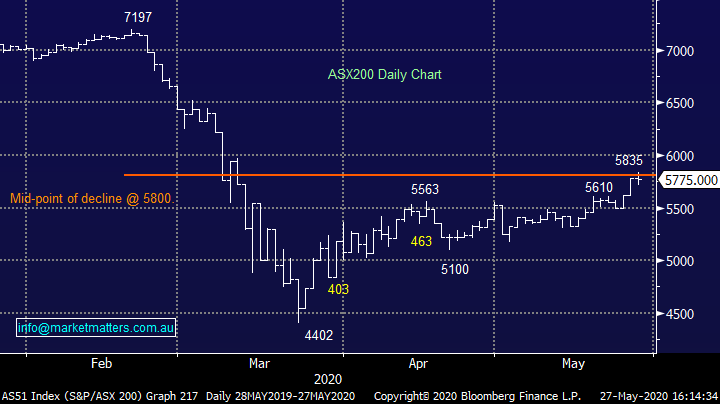

Overall the market was down early however fought back admirably – banks the main catalyst however by the close we ended marginally down. It seems like the market is due a rest here which makes sense around the 5800 level / 50% retracement of the recent decline.

Overall, the ASX 200 fell -5pts / -0.09% today to close at 5775 - Dow Futures are trading up 142pts/+0.57%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

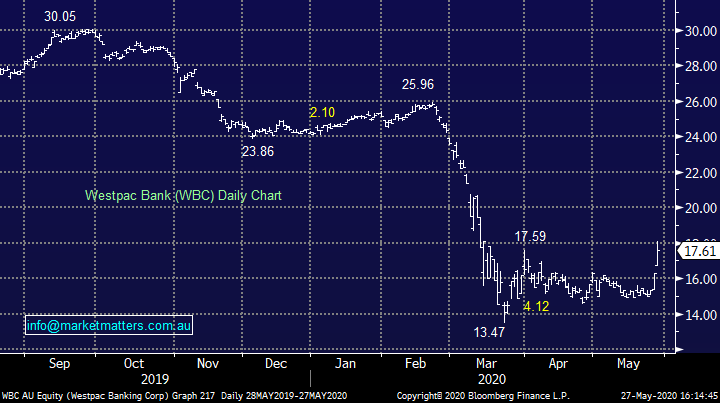

Banks go bang!: A strong session today for the sector which rallied between +8.6% (ANZ) & +4.88% (CBA). While there was no new news out today the trend of better economic outcomes post the virus has finally trickled through to the banks today. We continue to hear that Institutions remain underweight the sector and if we actually start seeing the economic recovery that is being priced in by other stocks / sectors, then banks have further upside, however it’s also a likely reflection of how mature the current recovery is. i.e. no net buying, just rotation out of strength into weakness.

Westpac (WBC) Chart

CSL -6.38%: Hit hard today as one of its competitors (NASDAQ listed Argenx Therapeutics) announced positive topline data from their Phase III ADAPT trial assessing Efgartigimod in patients with Myasthenia Gravis (MG) – a mouthful. The product is a potential threat to CSL’s IVIG segment in the Myasthenia Gravis, Primary Immune Thrombocytopenia (ITP), and Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) indications in the future. Without going into further specifics, this sort of announcement + reaction from the share price today shows the susceptibility of CSL to ‘less positive’ developments. The move also highlights a shift away from growth into deeper value stocks, a move we’ve been discussing in recent notes.

CSL Chart

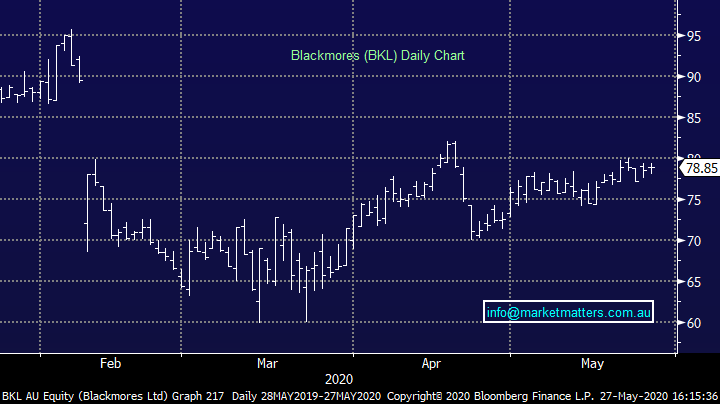

Blackmores (BKL) Halted-: kept in a trading halt today as they try to raise around $115m to “accelerate growth initiatives” in an effort to produce more sustainable and profitable growth according to the announcement. The raise comes 3 months after a disappointing half year result where expectations were reset despite seemingly receiving a boost in demand on immunity products. This demand has continued, while other parts of the business has been held back by “lower shopping traffic and supply chain constraints.”

Probably most disappointing was that Marcus Blackmore, who owns around 18.5% of the shares of issue, stated he would not participate in the capital raise. With such a large holder on the sidelines, it doesn’t instill a great deal of confidence in the capital raise. The institutional placement of $92m is underwritten, getting the SPP up to size may be a harder task. New shares will be issued at $72.50/share, around 8% below the last traded price. BKL presented to us a few weeks ago and I left the presentation unimpressed. Certainly not one we want to own.

Blackmores (BKL) Chart

Strandline Resources (STA) +6.67%: down the smaller end of the resources spectrum, Strandline is working to develop mineral sands projects in WA and Tanzania. The company presented today at a junior miners conference, particularly talking up their Coburn site in WA. Shaw & Partners’ Head of Research Andrew Hines is pretty keen on the stock, talking up the offtake agreements in place which secures around two thirds of revenue over the first 5 years, providing a great deal of surety to the project in order to get funding in place.. The final feasibility study is just around the corner, while Strandline is working to secure $100m in grants through the Northern Australia Infrastructure Facility. The site is expected to produce 230kt of heavy metal concentrate a year for over 22 years, so with the grant, some debt finance and a small capital raise, Strandline will look cheap once operations are up and running, though still 2 years from turning a dollar. A speccy that might have legs!

Strandline Resources (STA) Chart

BROKER MOVES:

· GrainCorp Reinstated Neutral at Goldman; PT A$4.02

· Newcrest Raised to Neutral at UBS; PT A$33

· Metcash Raised to Buy at UBS; PT A$2.85

· Navigator Global Raised to Outperform at Macquarie; PT A$1.65

· Coca-Cola Amatil Cut to Neutral at Macquarie; PT A$9.30

· Insurance Australia Cut to Hold at Morningstar

· BHP Cut to Sell at Morningstar

· Cleanaway Cut to Sell at Morningstar

· Qantas Cut to Hold at Morningstar

· Sydney Airport Cut to Hold at Morningstar

· Seven Group Cut to Hold at Morningstar

· Scentre Group Cut to Hold at Morningstar

· Coca-Cola Amatil Raised to Neutral at Goldman

· Accent Group Raised to Add at Morgans Financial Limited

· SeaLink Cut to Hold at EL & C Baillieu; PT A$4.30

OUR CALLS

No changes to portfolios today.

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.