Banks continue their run (EHL, MQG) **International Equities Portfolio Alert – Sell UNH US + Global ETF Portfolio Alert – Sell SLVP US**

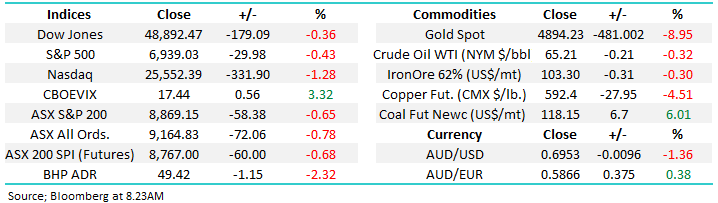

WHAT MATTERED TODAY

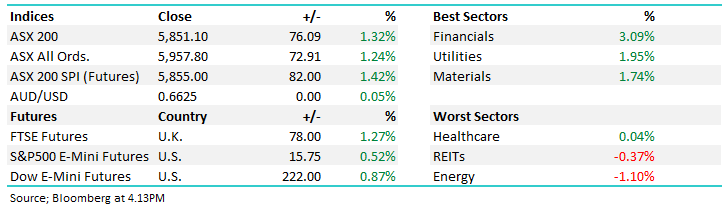

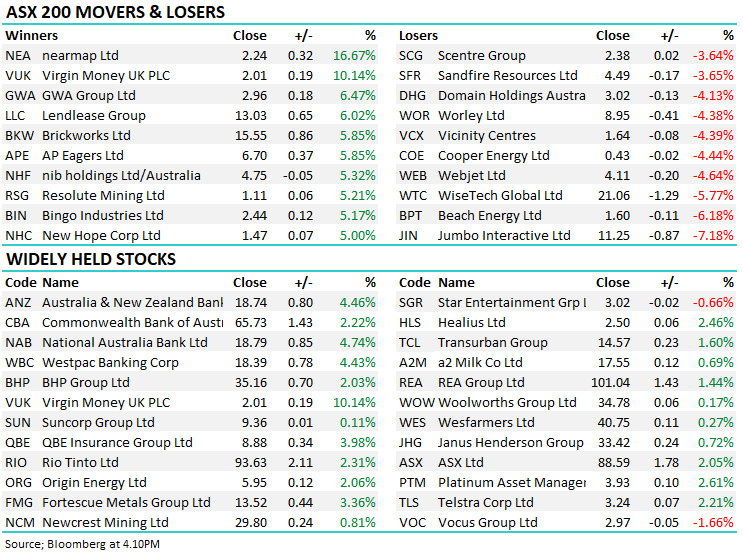

Another session of strong gains for the market, although it was up more early on as aggressive buying towards the banking stocks continued, NAB the best of them today adding another +4.74%. Contrary to yesterday, the resource stocks were also well bid today with both BHP and RIO up more than 2% however it was the stocks exposed to a rebound in construction that really shone, stocks we own in that sector include Lend Lease (LLC)+6%, Bingo (BIN) +5% & Reece (REH) +5%, we also own Emeco (EHL) which ended higher today after reconfirming guidance, a stock Harry covers below. On the flipside, healthcare continued to drag , CSL down a touch while Resmed (RMD) finished off more than 3% which dovetails nicely into the report we penned this morning on the sector – click here

The market looks tired here after a strong run, reiterating what we wrote in the AM note: MM remains bullish equities medium-term but we’re still adopting a more neutral stance short-term.

Overall, the ASX 200 added +76pts / +1.32% today to close at 5851 - Dow Futures are trading up 233pts/+0.94%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

VIDEO UPDATE: Last week I participated in ETF Securities Partner Series along with Peter Green from Lonsec hosted by Kanish Chugh, covering the topic of, what are the blue chips of the future? Blue chip is synonymous with quality and dividends in the mind of the Australian investor. The ability to generate a consistent dividend stream has been a mainstay of those companies we deem blue chip but in the wake of COVID-19 related dividend cuts, does the Australian view of blue chip? We discuss this in a 20 min recording.

ETF Securities Partners Series

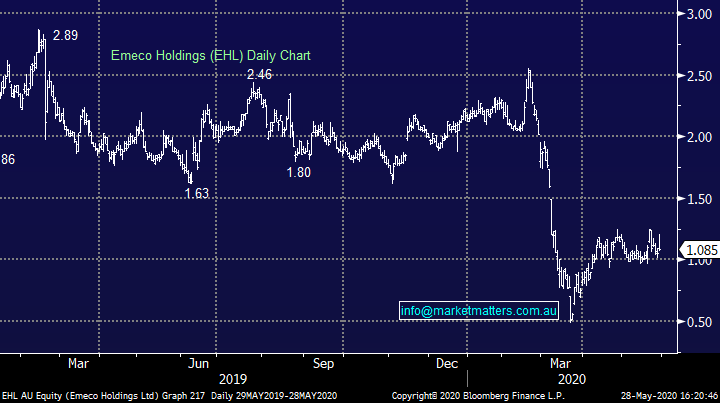

Emeco Holdings (EHL) +2.84%: the contractor was higher today on updated guidance and a new contract win. Newly acquired subsidiary Pit N Portal secured a 5 year contract with Mincor (MCR) to develop the underground mining contract at the Kambalda Nickel site in WA – Mincor itself is an interesting smaller cap nickel name with some interest from BHP as well as Andrew ‘Twiggy’ Forest. Emeco also gave FY20 guidance of operating EBITDA at $244-247m, a tight spread with the analyst expectations at the top end of the range.

Despite this, the guidance was seen as a positive by the market, with EHL smacked around with COVID-19 on growing concerns that their earnings would take a hit. Today’s announcement shows nothing has changed, particularly on the leverage side with the company targeting 1.5x net debt to operating EBITDA, unchanged from the half year result. We like EHL.

Emeco Holdings (EHL) Chart

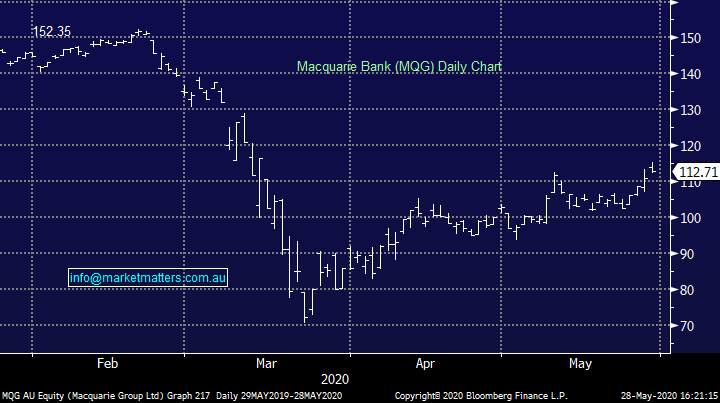

Macquarie Group (MGQ) +1.59%: traded higher with the market, or it could be that the market traded higher with Macquarie today. Overnight the investment bank managed to secure $US750m of tier 2 debt against the bank side of the business, at a margin of 295bps over Treasuries – a pretty tight number. They started marketing the deal at a margin of 350bps, but tightened the spread given that it was 10x oversubscribed. The deal is around equivalent to 326bps over the BBSW, which makes the recent MBLPB deal look particularly cheap priced at 470bps over swap – these start trading next week and if the news overnight is anything to go by, we would expect these to open higher than the $100 face value.

The raise is the second debt deal completed by Macquarie in recent weeks, and begs the question of what they are up to here. The tier 2 deal was also a driver of the market itself - it highlights the health of debt markets at the minute with increasing liquidity. A company that can access money is much safer than those that can’t implying investors are happy to take on risk in this environment.

Macquarie Group (MQG) Chart

BROKER MOVES:

· Beach Energy Cut to Neutral at Macquarie; PT A$1.60

· Brickworks Raised to Outperform at Macquarie; PT A$16.30

· Blackmores Raised to Neutral at Macquarie; PT A$73

· Webjet Cut to Neutral at Credit Suisse; PT A$4.50

· Corporate Travel Cut to Neutral at Credit Suisse; PT A$12

· Sezzle GDRs Rated New Outperform at RBC; PT A$3

· CSR Cut to Sell at Morningstar

· Technology One Raised to Hold at Morningstar

· Magellan Financial Cut to Sell at Morningstar

· Domino's Pizza Enterprises Cut to Sell at Morningstar

· Cromwell Property Cut to Hold at Morningstar

· Origin Energy Cut to Hold at Morningstar

· CSL Raised to Buy at Citi

· Tabcorp Cut to Neutral at Evans & Partners Pty Ltd; PT A$3.60

· Jumbo Interactive Cut to Negative at Evans & Partners Pty Ltd

· Beach Energy Cut to Hold at Morgans Financial Limited

· Metcash Raised to Buy at Jefferies; PT A$3.20

· Virgin Money UK GDRs Cut to Hold at Bell Potter; PT A$1.90

· City Chic Collective Ltd Cut to Hold at EL & C Baillieu

OUR CALLS

International Equities Portfolio: We are taking profit on UnitedHealth (UNH US) in the international portfolio

UnitedHealth Group (UNH US) Chart

Global ETF Portfolio: We are also cutting the Silver ETF for a profit in the ETF portfolio. We’ll likely recycle this capital into a GOLD ETF in time.

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.