Retail sales crumble (VOC, WBC)

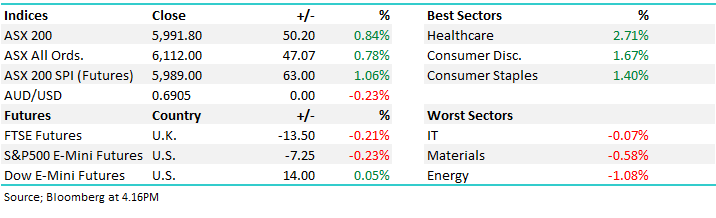

WHAT MATTERED TODAY

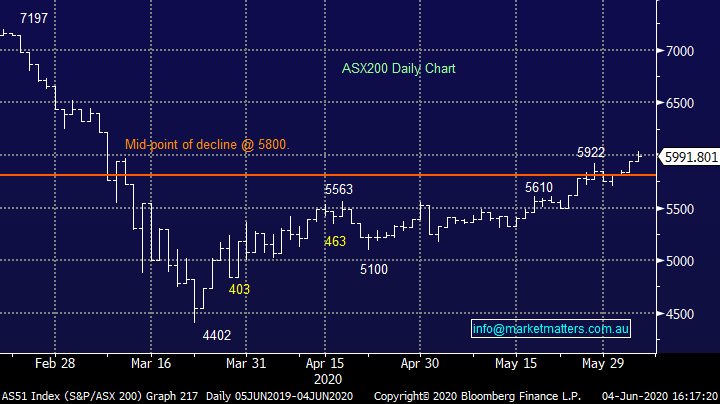

Piggy backing of the strength in the US, the ASX spent some time above 6000 today for the first time since the 9th of March. The bounce to that level tops 36% in a little over 10 weeks. Ultimately though, the index finished 50 points off its highs, giving back half of the sessions gains to close below the 6000 marker. Retail sales data printed prior to lunch, the -17.7% sounds awful, but it was slightly ahead of expectations despite still being the worst month on month print ever recorded. Commentators suggesting a large part of the drop came as a result of the big March print on the back of panic buying. Consumer names saw some strength despite the drop.

The travel names were back in focus today. Alan Joyce announced Qantas (QAN) would be adding more flights to the roster, edging towards 40% of their pre-COVD numbers. Corporate Travel (CTD) saw the best return as a result of the announcement, jumping 8.8%. Energy names came off the boil today despite brent prices moving over $US40/bbl overnight. The strength in energy prices could continue for a few sessions yet – OPEC+ are likely to extend production cuts while a storm in the Gulf of Mexico will likely curb US production into next week.

Overall, the ASX 200 added +50pts / +0.84% today to close at 5991 - Dow Futures are trading up +14pts/+0.05%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

Vocus (VOC) +2.88%: tightened guidance today for the full year result, lowering the top end of the EBITDA guidance for a range of $359-369m. The market was already looking for $365m, around the mid-point of the revised guidance so not too much to change for the analysts there. The telco also reworked their debt, moving out their maturity profile with an average term of 3.5 years providing a little more balance sheet flexibility. They also managed to ease debt covenant restrictions to a maximum of 3.25x net debt to EBITDA. Currently running at around 2.8x, Vocus is clearly heavily leveraged but it looks to be making the right moves in terms of de-risking while maintaining earnings growth. The new set up shows confidence from the lenders, giving the telco the set up to take on the next phase of growth. We like Vocus, potentially looking to add it to the growth portfolio.

Vocus (VOC) Chart

Westpac (WBC) +1.28%: the bank updated the market on the AUSTRAC saga that is currently playing out behind the scenes. A reminder, the bank has had action taken over its reporting obligations and customer due diligence as many suspect transfers were allowed to pass through. They set aside $1b earlier in the year to fund a fine, though the exact number AUSTRAC will hit them for is unknown. It was a pretty messy read, and from all reports a resolution is unlikely this year. With money for the fine set aside, Westpac’s capital position is pretty reasonable shape though a dividend at the full year isn’t quite penned in just yet.

Westpac (WBC) Chart

BROKER MOVES:

· United Malt Resumed Outperform at Macquarie; PT A$4.72

· Alumina Raised to Buy at UBS; PT A$2.10

· Nufarm Cut to Underperform at Macquarie; PT A$4.85

· Nufarm Cut to Underperform at Jefferies; PT A$4.90

· Stockland Raised to Overweight at Morgan Stanley; PT A$4.30

· Metcash Cut to Sell at Morningstar

· OZ Minerals Cut to Hold at Morningstar

· Medibank Private Cut to Hold at Morningstar

· GWA Group Raised to Neutral at Credit Suisse; PT A$3.15

· Nufarm Cut to Reduce at Morgans Financial Limited; PT A$4.76

· Iluka Raised to Buy at Goldman; PT A$10.10

OUR CALLS

No changes to the portfolios today

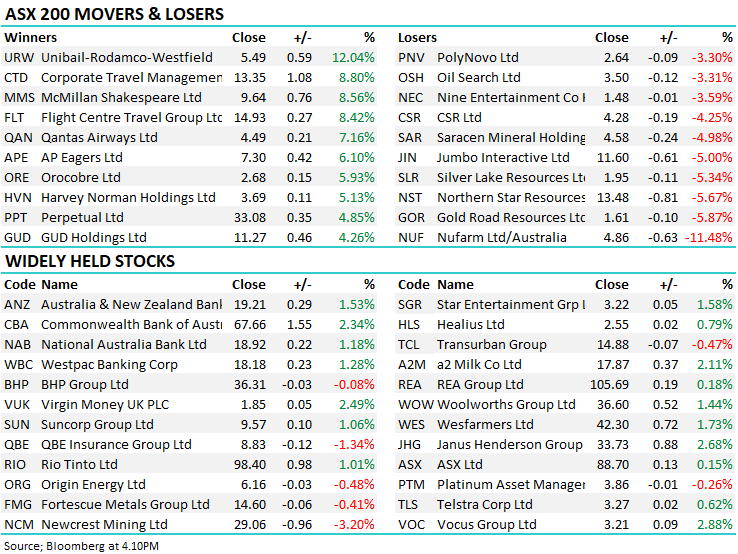

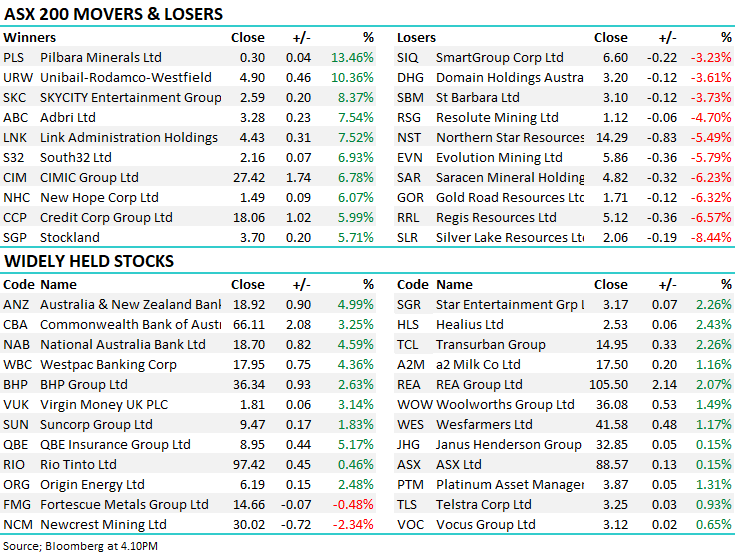

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.