Market rallies as economies open up (TYR, WES, SYD)

WHAT MATTERED TODAY

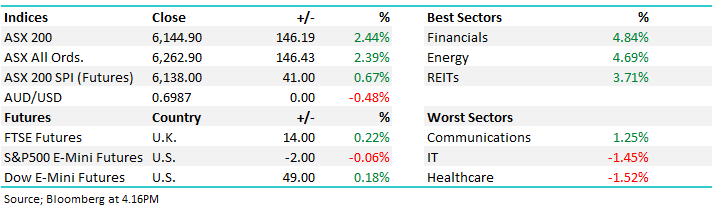

The market came back online after two sessions off and rallied strongly from the outset pricing in 2 bullish days overseas in one go. Financials and other cyclical areas of the market leading the charge while the higher value areas of IT and healthcare lagged. It was another session where the two heavyweights CBA +5.05% versus CSL -2.39% had divergent paths however when banks and resources do well its hard for the market not to look bullish.

Asian markets were also well bid today, Hong Kong up ~1.50% while China edged higher, Japan the only index finishing lower. US Futures were flattish during our time zone.

Overall, the ASX 200 added +146pts / +2.39% today to close at 6262 - Dow Futures are trading up +49pts/+0.18%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

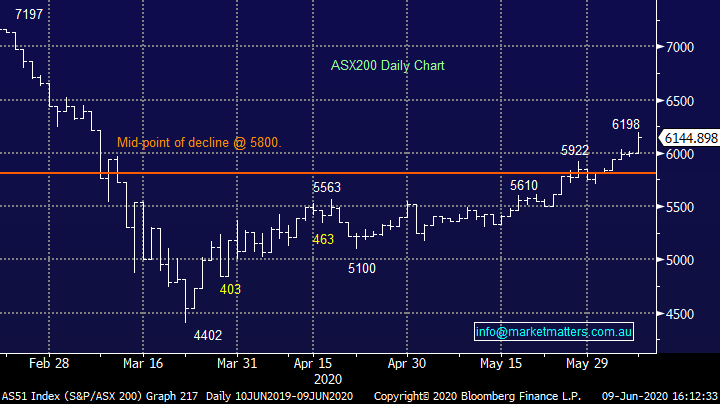

Tyro Payments (TYR) +1.99%: As you know, we’ve been using the helpful weekly updates from Tyro Payments as a guide on how the economy is bouncing back post COVID-19. This is a high level summary as TYR was/is the fastest growing terminal provider in Australia with a heavy exposure in tourism / hospitality. Even my friendly Thai takeaway has had to install a Tyro system during CV-19 given they only took cash before. In any case, this week’s transactional value results point to a steady increase in volumes and economic activity. TYR volumes could be back to pre-COVID levels by August based on a large step change and jump in the past week (weeks).

Key takeout’s

· Weekly TV to June 5th was $52m a day. This is up 19% on the prior week, a significant increase to the prior weeks (~3-4% WoW) and continues weekly improvements;

· Transaction Value (TV) per day bottomed in Mid-April (week of 17th) at $27.8m.

· On current TV recovery run-rate Tyro volumes are on track to recover to pre-COVID levels in ~8-9 weeks or by August 2020.

Overall TYR is a strong bellwether for the domestic recovery, particularly in offline and retail/hospitality.

Transaction value chart (source: Shaw & Partners)

Wesfarmers (WES) +0.14%: the retail side of the business provided an update to the market today, part of which highlights why they recently bit the bullet on Target with some decent write-downs. For the 2nd half to the end of May, Target sales fell 2% while Kmart saw 4% growth compared to the same period last year. While sales were strong, they did flag that higher costs and temporary closure of NZ stores would impact the full year result. The same goes for Bunnings and Officeworks too though sales were a for stronger given the rush to buy both home improvement gear and home office equipment. Bunnings second half saw total sales growth of 19.2% while Officeworks added 27.8% for the first 5 months of the second half. Bunnings alone saw cleaning & security costs of $20m, while the shut down in NZ and a few small format store closures will also take $70m worth of gloss off the full year result.

The fortunate timing of the Catch acquisition which was completed in August last year is another boost to Wesfarmers FY20. The online focus of Catch helped generate growth naturally as consumers were pushed for the internet bargain. Catch saw gross transaction volume rise a huge 68.7% for the first 5 months of the calendar year. Online sales was a driver of a large part of the sales growth in Wesfarmers in general, up 60% even before the inclusion of Catch. The business will be one of a handful to see growth in revenues despite the COVID impact. Combined with an exceptional balance sheet and a keen management team looking to bolster the business, it’s hard not to like WES. Trading today was disappointing with the stock finishing well off the day’s highs and only marginally ahead despite the broader market’s strength. We hold in the Income Portfolio

Wesfarmers (WES) Chart

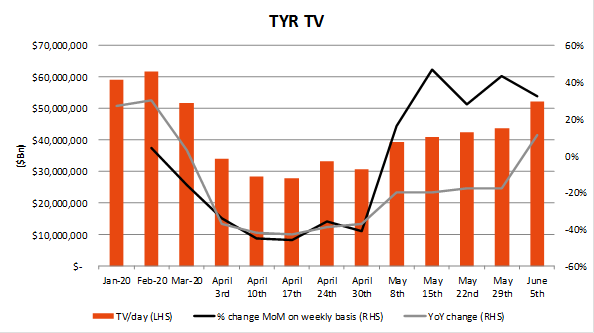

Banks: Rallied hard again today and are now starting to price in a better bad debt experience given the better health outcomes we’re experiencing in Australia, a topic we covered in last week’s income note. – click here The table below is courtesy of Brett Le Mesurier, our Banking Analyst at Shaw and I’ve circled his FY22 forecast PE’s for the banks. Two points worth making.

- On his forecast, bad debts don’t normalise until FY22 hence the impact on valuations at that point. I think this assumption is fairly conservative and those sort of P/E’s could well be a FY21 reality as banks realise they’ve over provisioned for this economic shock. Most other economic metrics have been better, surely the bank’s bad debt experience will follow suit?

- The improvement in valuations is a direct consequence of lower bad debts improving the ‘E’ rather than strong top line revenue growth. It implies banks have more room to move on the upside, however the upside is capped to the combined benefit of lower bad debts overlayed with the multiple the market is prepared to pay.

MM remains bullish the banks

Westpac Bank (WBC) Chart

Sydney Airports +8.80%: Hard not to mention the travel companies today after a really strong session. Flight Centre (FLT) putting on +13% while an 8% rally for Sydney Airports clearly catches ones eye. We hold in the income portfolio however this group is clearly typical of the optimism building throughout the market. I can’t help but think the market bottomed the day the lockdown was announced, hence we should be getting cautious as the market becomes more bullish, particularly in names that will actually see a financial impact for some time to come, like SYD.

Sydney Airports (SYD) Chart

BROKER MOVES:

- Zip Co. Cut to Neutral at UBS; PT A$5.60

- Fletcher Building Cut to Hold at Morningstar

- Bendigo & Adelaide Raised to Overweight at JPMorgan; PT A$8.10

- Bluescope Raised to Buy at Goldman; PT A$14.95

- CSR Reinstated Sell at Goldman; PT A$3.94

- James Hardie GDRs Reinstated Buy at Goldman; PT A$32.65

- GWA Group Reinstated Neutral at Goldman; PT A$3.35

- Boral Reinstated Neutral at Goldman; PT A$3.65

- Adbri Reinstated Neutral at Goldman; PT A$3.39

- Charter Hall Long WALE Raised to Overweight at JPMorgan

- BWP Trust Raised to Overweight at JPMorgan; PT A$4.40

- Infigen Cut to Sector Perform at RBC; PT 80 Australian cents

- Healius Raised to Outperform at Macquarie; PT A$3

- Kogan Cut to Sector Perform at RBC; PT A$11.50

- South32 Cut to Neutral at Exane; PT A$1.99

- Rio Tinto Cut to Neutral at Exane; PT 4,380 pence

- Worley Raised to Outperform at Credit Suisse; PT A$10.50

OUR CALLS

No changes today

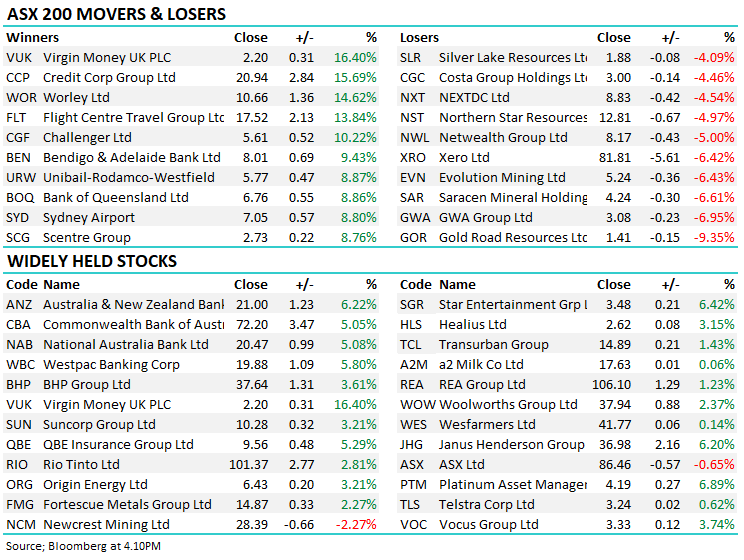

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.