Stocks flat ahead of Fed Meeting (SIQ, HVN)

WHAT MATTERED TODAY

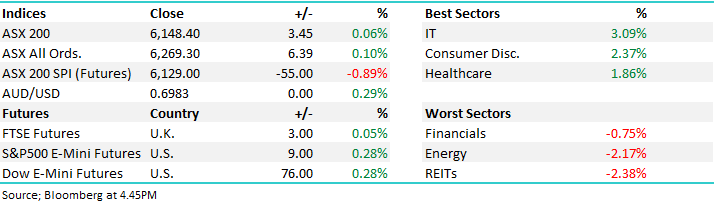

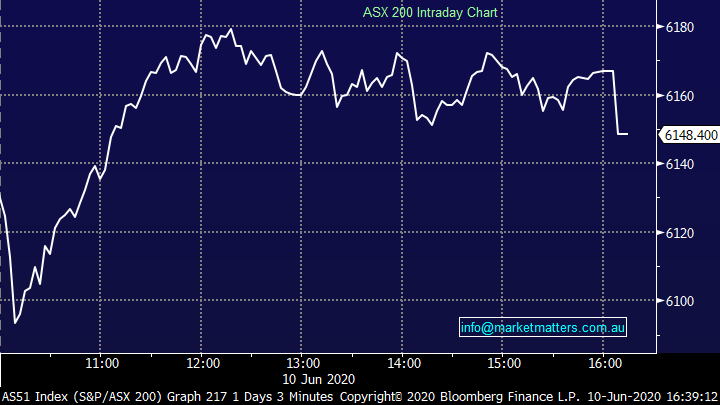

Another session that saw the market recover from early lows, today it was an +80pts gain from the early overseas induced sell off as buyers tipped into the early weakness. US markets pulled back overnight however futures were positive during our time zone which helped the local index tick higher. IT stocks bounced back after yesterday’s decline as did the healthcare names – rotation the play of the day.

The US Federal Reserve continue their two-day meeting tonight with Jerome Powell speaking early morning our time tomorrow. The key here is what the Fed does with its “forward guidance,” and that will determine whether the meeting is taken as dovish (and positive for stocks) or hawkish (and a negative for stocks).

Negative for stocks: Clearly the market has been running on the back of the ‘Fed Put’ or in other words, as a result of the Fed saying they’ll do whatever it takes. If that idea of the Fed Put is thrown into doubt, then stocks could see that pullback we’ve been talking about. While this is a low probability outcome, look for a change in dots that show a rate hike in 2022 – there’s pretty much no chance the Fed even hints at changes to its QE program, but if the dots show that the majority of FOMC officials see rates rising before the end of 2022, that will be taken as slightly hawkish and in a market that’s this stretched, that could cause a modest selloff.

Neutral for stocks:No change to interest rates or QE, with the Fed saying they’ll continue asset purchases “in the amounts necessary” and the dots show no rate hikes through 2022. This is broadly what’s expected by markets, and this outcome is largely priced in.

Positive for stocks: If the Fed surprises and introduces some official interest rate cap or pledge not to raise rates until a certain date – probably 2023 at earliest with a link to the inflation target of at least 2%., then that should be taken as a positive for stocks driving this rally further.

US S&P 500 Chart

Overall, the ASX 200 closed up +3pts or 0.06% to 6148. Dow Futures are trading up +76pts/-0.60%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE.

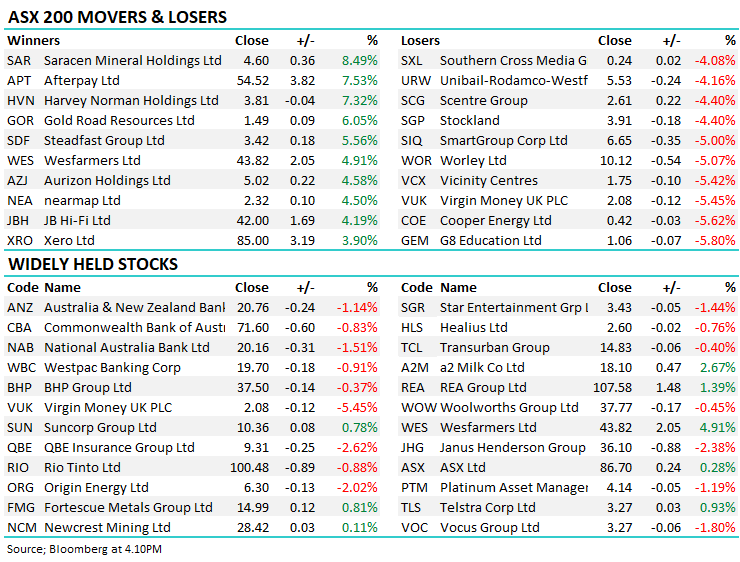

Smart Group (SIQ) -5%: AGM today for the salary packaging and novated leasing business with the stock coming off the boil during the session. Understandably, the business took a hit with COVID, and the first half NPAT is expected to come in around $32m, 5% below last year. The first quarter was largely unscathed by the pandemic, managing to grow earnings marginally on 1Q 2019, but a 25% hit to revenue across April & May weighed on expectations for the half. The markets expectations for a full year profit of $62m may come under pressure and explains part of the weakness today.

The company said that volumes remained below historical levels, but a rebound had been seen – vague, but suggests the sizable hit to revenues seen in the current quarter are unlikely to remain to the same extent for the rest of the year. We like the business and own it in the Income Portfolio. They have net debt of just $19m with cash around $81m so the balance sheet is in good shape, and earnings are still rolling in despite the slowdown. The sell off today likely comes as a result of some recent analyst upgrades for the full year, and the stock was strong heading into the AGM.

Smart Group (SIQ) Chart

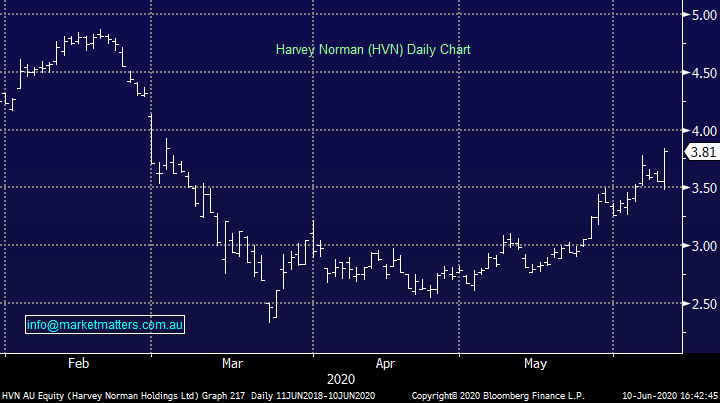

Harvey Norman (HVN) +4.79%: shareholders rejoiced today after news they would be getting a 6c special dividend, to offset some of the pain felt when Harvey Norman pulled their scheduled 12c interim payment at the height of the pandemic. The retailer saw local sales boom with the rush for electronics helping local sales rise 17.5% in the second half. Overseas trade wasn’t as fortunate, with many stores closed for extended periods weighing on performance, with many locations still closed. With 1 month left, HVN looks in pretty decent shape for the full year results. As an aside, I bought a new laptop on the weekend from the fine establishment (yes I still go into a shop to buy things) and the pimply lad that served me confirmed they’ve been very busy, although less so in the last few weeks.

Harvey Norman (HVN) Chart

BROKER MOVES;

· Sims Raised to Buy at UBS; PT A$10.20

· GPT Group Cut to Hold at Jefferies; PT A$4.78

· Bendigo & Adelaide Cut to Hold at Morningstar

· Sims Cut to Hold at Morningstar

· GPT Group Cut to Hold at Morningstar

· Treasury Wine Cut to Hold at Morningstar

· Stockland Cut to Sell at Morningstar

· Flight Centre Cut to Hold at Morningstar

· GWA Group Raised to Hold at Morningstar

· SCA Property Cut to Sell at Morningstar

· Nine Entertainment Cut to Hold at Morningstar

· Bank of Queensland Raised to Buy at Goldman; PT A$7.17

· ANZ Bank Cut to Neutral at Goldman; PT A$20.02

· Gold Road Rated New Overweight at JPMorgan; PT A$1.95

· DMP AU Cut to Hold at Morgans Financial Limited; PT A$63.22

· Charter Hall Retail Raised to Neutral at JPMorgan; PT A$3.40

· Flight Centre Cut to Hold at Bell Potter; PT A$17

OUR CALLS

No changes today

Major Movers Today

Have a great night

James and the Market Matters team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.