Stocks finally pullback from highs, lose 3% (JBH)

WHAT MATTERED TODAY

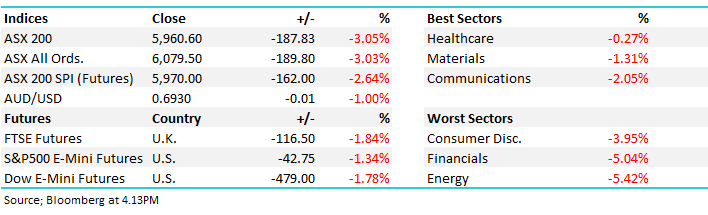

The local market saw broad based selling today and unlike yesterday’s session, the buyers didn’t step up to support the index into weakness. Gold stocks were spared from the hit, along with a few select healthcare names but for the most part there was little interest from the bulls. The banks were certainly in the firing line though they were an easy position for traders to flick given the rally over recent weeks. Lower for longer yields, and a drawn out economic recovery that was signalled by the Fed overnight means focus on margins, and bad debts to weigh on earnings in the medium term – not new news, but it seems traders had glossed over the issues causing much of the ~30% climb in the big 4. We remain in buy the pullback mode for the banks, but not yet.

Resources were also in the firing line, not a great day to be in front of cyclical global earnings. Iron ore names did perform a little better than most given these issues don’t seem to impact China for now. Oil wasn’t so lucky – inventories rose overnight and it seemed to have a delayed response in terms of energy prices. Traders had commented that oil’s rally was a little over blown and more tied to the general rally in risk on assets and not a true reflection of the rebound in demand and limits to supply.

Overall, the ASX 200 fell -187pts / 3.05% today to close at 5960 - Dow Futures are trading down -435pts/-1.62%.

ASX 200 Chart

ASX 200 Chart – nothing to get concerned about yet.

CATCHING MY EYE:

AUZBIZ: I was on this morning talking about JB Hi-Fi (JBH), Newcrest (NCM) and gold more generally. I need to get a few Market Matters logo’s in the background – coming soon!! Click Here

VIRUS: Signs that the virus may be remerging in pockets of the US seems to be raising alarms as new infections push the overall count past 2 million Americans. Bloomberg reporting that * Texas on Wednesday reported 2,504 new coronavirus cases, the

highest one-day total since the pandemic emerged. * A month into its reopening, Florida this week reported 8,553 new cases -- the most of any seven-day period and * California’s hospitalizations are at their highest since May 13 and have risen in nine of the past 10 days. Clearly, we need to keep a handle on the potential for a surge in cases – the market is certainly not priced for any real increase in numbers.

JB Hi-Fi (JBH) -4.24%: following Harvey Norman’s updated yesterday, competitor JB Hi FI updated the market after withdrawing guidance in late March. Now with a little more clarity, earnings locally were given a boost by the shutdowns with Australian JB Hi Fi stores seeing 2H sales growth of 20% on last year, and the Good Guys adding 23%. New Zealand’s more onerous shutdowns meant that sales fell 19% in stores across the ditch, though this is a far smaller segment for the group. The company now expects profit of $300-$305m for the full year, more than 20% higher than FY19, and around 3.5% above analyst expectations. JBH shares were lower today though, following the broader market, though the update was a good one, its clearly already priced in. Investors now look to FY21 – has the pandemic brought JBH sales forward, or will they be able to maintain some of the growth? We think its overcooked on the upside.

JB Hi Fi (JBH) Chart

BROKER MOVES:

· Aurelia Cut to Accumulate at Ord Minnett

· JB Hi-Fi Cut to Neutral at UBS; PT A$44

· Computershare Cut to Sell at Citi; PT A$12

· Evolution Raised to Outperform at Credit Suisse; PT A$5.65

· Northern Star Raised to Outperform at Credit Suisse; PT A$14.70

· Alacer Gold GDRs Raised to Outperform at Credit Suisse

· South32 Cut to Underperform at Macquarie; PT A$1.90

· Worley Cut to Hold at Jefferies; PT A$11

· Integral Diagnostics Cut to Neutral at Credit Suisse; PT A$4.30

· Harvey Norman Raised to Buy at Jefferies; PT A$4.30

· Worley Cut to Underweight at Morgan Stanley

· GrainCorp Cut to Hold at Bell Potter; PT A$4.85

· IPH Raised to Add at Morgans Financial Limited; PT A$8.69

· MFG AU Rated New Positive at Evans & Partners Pty Ltd

· Amcor GDRs Cut to Neutral at Credit Suisse; PT A$15.65

OUR CALLS

No changes today

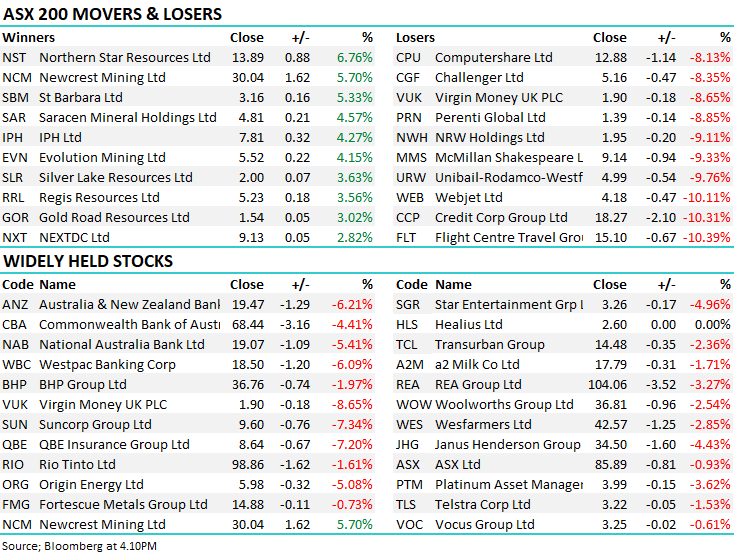

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.