Shorts are for the beach! (SUL, WZR, VEA)

WHAT MATTERED TODAY

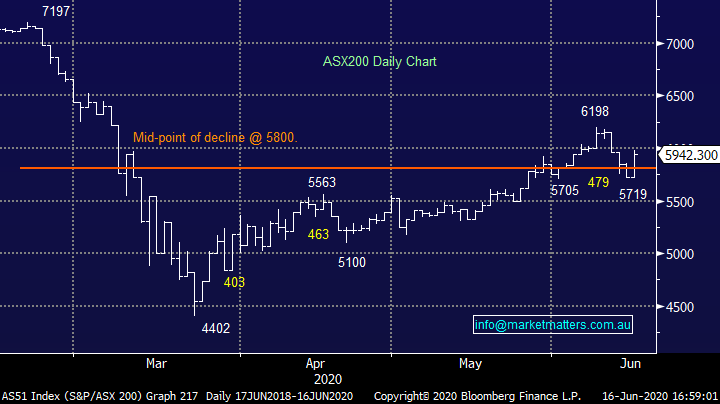

99% of companies in the ASX 200 closed higher today speaking to the broad based nature of today’s move, a complete about turn from yesterday thanks to US Federal Reserve intervention overnight, the phrase ‘don’t fight the Fed’ ringing throughout the office today along with ‘this move is ridiculous’! While it might be hard to reconcile the market moves in the short term, market positioning is important, and the market remains decidedly bearish looking for more downside to play out. We’ve said it before and remain of the view that the direction of most pain remains up despite the plethora of negative slants one can place on this market., dips are likely to be bought hence our bullish view in the medium term.

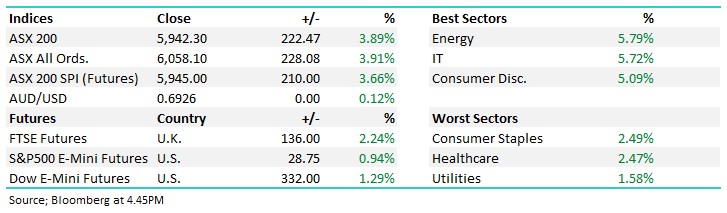

Today’s +3.9% move was the best in 10 weeks led by the Energy stocks but ably supported by Tech and Retail coming off the back of a very week session yesterday, volatility is certainly high however 3 days down for a -7% decline, versus 1 day up for a +3.9% advance, rallies are now more aggressive plus it seems the Fed are comfortable for the market to correct, but not too far, 7-10% seems about it. They shot an arrow across the face of the shorts overnight hence the consistent and sustained grind higher through the US session, and that was replicated locally.

Overall, the ASX 200 added +222pts / 3.89% today to close at 5942 - Dow Futures are trading up +317pts/+1.25%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

AusBiz: I talk through WZR, FMG, & SUL this morning along with the market performance early on today. Still working on the MM logos / backdrop for these vids!

Super Retail (SUL) +10.96%: We’ll cover more on this in the Income Note tomorrow given we hold it in that portfolio, however the retailer came back online today after raising capital via an institutional placement, however there’s a retail component which we’ll participate in. While the stock rallied in a strong market, the move highlights the importance the market is placing on balance sheets. SUL carried higher gearing than the broader sector and the fact they’ve addressed that, at a good level is a win for the stock, hence the rally on the mkt today. We remain positive.

Super Retail Group (SUL)

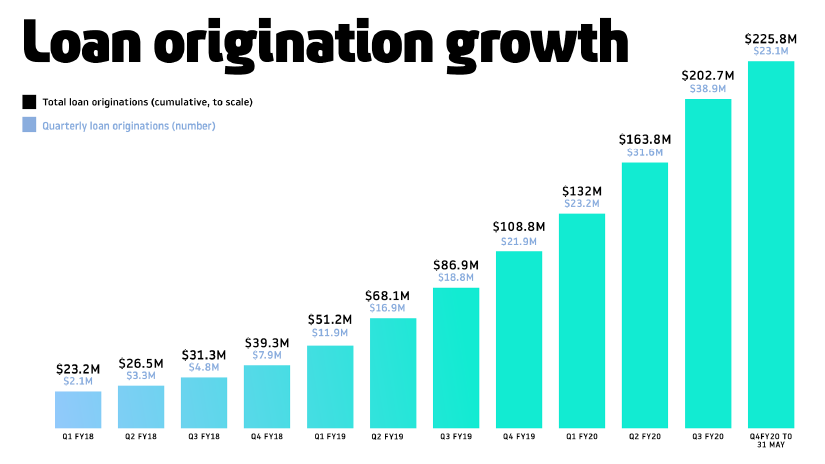

Wisr (WZR) +35.48%: A small cap fintech we like out with an update this morning and they delivered $23.1m in new loans in the 1st 2 months of 4Q20, comprising $9.3m in April and $13.8m in May (+48% growth), while they also tightened credit standards. There are a number of ways we can look at a business like this, however the simplest is looking at loan origination growth (below) whilst also maintaining credit quality i.e. ensuring discipline in lending standards while maintaining growth. Underpinning this is their cost of funding and if they can show good loan growth, low bad debts (and good credit scores for customers across their book) along with a good source of current and future funding, then they should do well. This is what WZR delivered today and the stock rallied as a consequence. We like it as a speculative play.

Source: company

Wisr (WZR) Chart

Viva Energy (VEA) +15.46%: was back challenging recent highs today on the back of a profit update heading into the end of the first half. Viva provided a wide range in their earnings guidance coming in between $20m-$50m on a replacement cost basis which compares to $50.9m for the first half of 2019. Though sales through the Shell petrol station network fell but margins were higher as petrol prices managed to hold better than oil through the slump.

The commercial business took a hit with aviation weighing on the segment, and it was jet fuel sales that sent the refining business into the red for the half as well. Total fuel sales took a big hit as the lockdowns set in for April. Across the book, a total of 833m litres were offloaded in the month, around 30% below April. While May did see a recovery, sales are stull subdued in all sectors. Capex has been reduced in order to help maintain margins with expectations cut in half for 2020, and maintenance on the refining side has been reduced by around 25%. Viva were keen to talk up their options with their assets, talking to an energy hub at their Geelong port. With the potential for LNG storage, battery farms and the like which sounds more deflective of the problem rather than a solidly thought out business plan. Still though the market liked the announcement with better than expected guidance. We’re 50/50 on this stock here.

Viva Energy (VEA) Chart

BROKER MOVES:

· Seek Raised to Hold at Jefferies; PT A$19.48

· Alumina Raised to Hold at Morningstar

· GPT Group Raised to Buy at Morningstar

· Aurizon Raised to Hold at Morningstar

· Star Entertainment Raised to Buy at Morningstar

· Bendigo & Adelaide Raised to Buy at Morningstar

· IOOF Holdings Raised to Buy at Morningstar

· Nine Entertainment Raised to Buy at Morningstar

· South32 Raised to Buy at Morningstar

· Scentre Group Raised to Buy at Morningstar

· Arena REIT Rated New Positive at Evans & Partners Pty Ltd

· CQE AU Rated New Positive at Evans & Partners Pty Ltd

· Healius Raised to Outperform at Credit Suisse; PT A$3.25

OUR CALLS

Today we added NAB and Woodside to the Growth Portfolio.

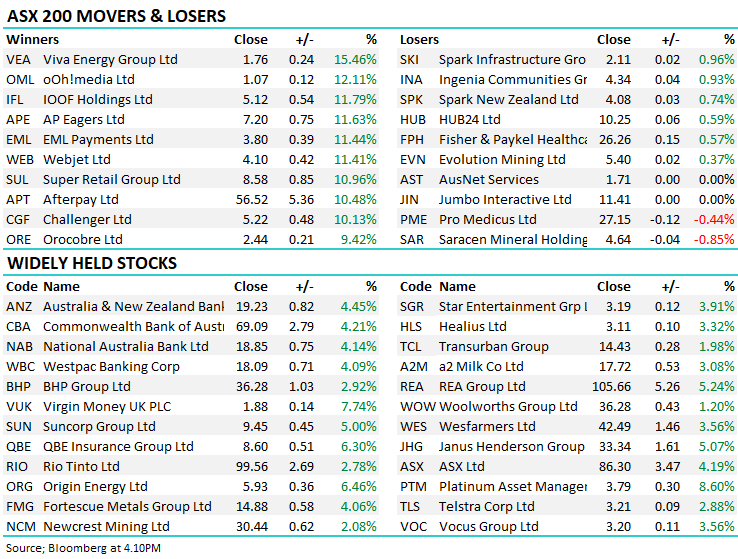

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.