Market falls as 200k jobs lost (FMG, SSG, SPT)

WHAT MATTERED TODAY

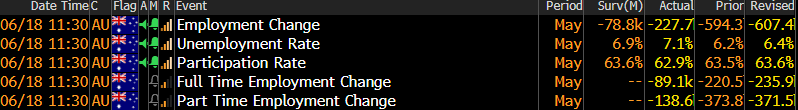

It was index expiry this morning for June and true to form, the market stayed resilient into settlement then rolled over, a pretty dire (although not unexpected) read on employment through at 11.30am the catalyst for the bears, however buyers soon emerged and the market improved into the close. A low of 5888 / -103pts before a close of 5936 highlighting 1. The early weakness & 2 buying of the dip i.e. selling that does happen is not aggressive and buyers’ step in fairly quickly.

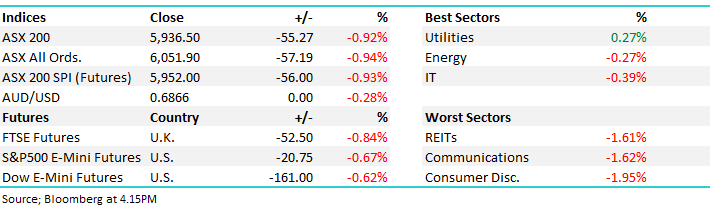

In terms of the employment data, 227k jobs were lost in May with the unemployment rate ticking up to 7.2%, obviously an alarming print however it was taken at the depths of the pandemic + of course, it’s better than original government forecasting which had the rate ticking to 10% before settling nearer 9% by year end.

Employment Data

Source: Bloomberg

I was in a couple of company presentations today and aside from talk about the business operations themselves, most chat was about the shape of the economy come September i.e. when the Government support packages roll off. The obvious conclusion is that the economic stats will deteriorate and that’s the catalyst for another leg down in stocks, however it does seem like the obvious assumption to make - it doesn’t necessarily mean that’s wrong, it’s just a degree will progressively get priced into stocks.

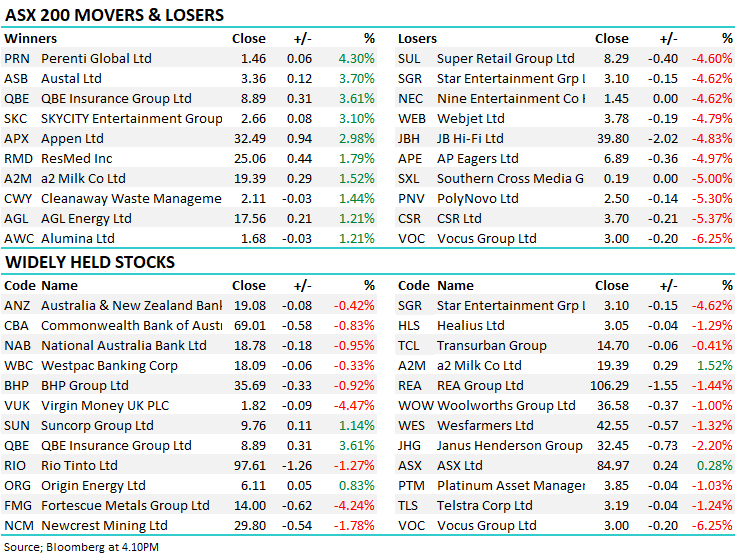

At a sector level, we saw profit taking in the retail names, which I think is smart given the strong rally we’ve seen in the sector as sales have improved (Harry covers Shaver Shop below), while the defensive utilities were the only sector to finish in the green.

Overall, the ASX 200 lost -55pts / 0.92% today to close at 5936 - Dow Futures are trading down

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

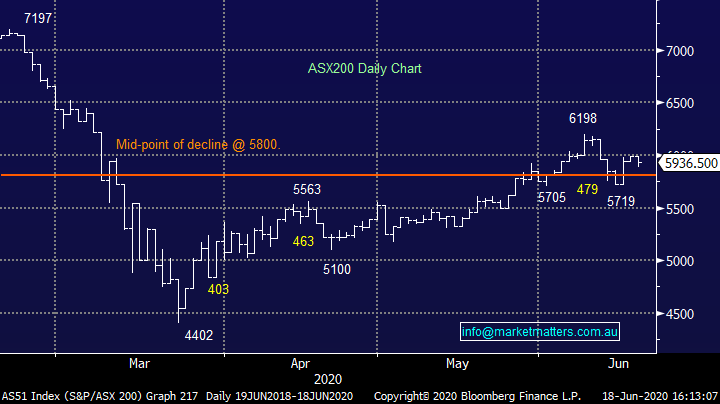

IRON ORE: The material stocks sold off today with Iron Ore front and centre following news that Vale ( a coy we own in the International Portfolio) won’t trim back full year production guidance as many in the market thought was likely. Iron Ore prices have been bullish post CV-19 shutdowns given reduced production coming from Africa, Canada, Asia & Brazil at a time when demand from China (70% of global demand) has been strong. This latest Vale supply update should take some of the sting out of the iron ore market in the short term, which could present us with an opportunity to get long Fortescue Metals (FMG). Ultimately, we think Iron Ore is more comfortable around the ~$80-100/t (with some spikes!) and we’ll look to position accordingly. ~$12 downside target.

Fortescue Metals (FMG) Chart

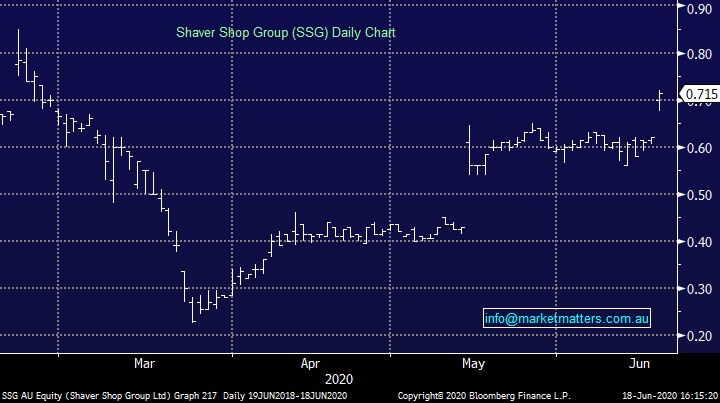

Shaver Shop (SSG) +15.32%: one of the retailers that has managed to see some benefit from the COVID era has been Shaver Shop which today announced full year guidance. With just 2 weeks left in the year, sales are 1% higher through the same period last year, with online sales more than doubling. The company expected EBITDA to come in at $17.25-$18.25m which was ahead of current exp. They also announced a special dividend of 2.1c to make up for the interim dividend cancelled earlier this year – a theme we’re starting to see, while shareholders can be expecting another dividend at the full year result.

The EBITDA guidance was around $3m ahead of guidance pulled at the peak of the crisis, with the market expecting a figure around $15m, around a 20% beat to expectations. The performance has come largely as a result of the investments made into the online offering, with very little impact seen as shoppers were forced online. With foot traffic returning to stores, online continues to see decent growth. A good number from the group, with momentum clearly on their side.

Shaver Shop (SSG) Chart

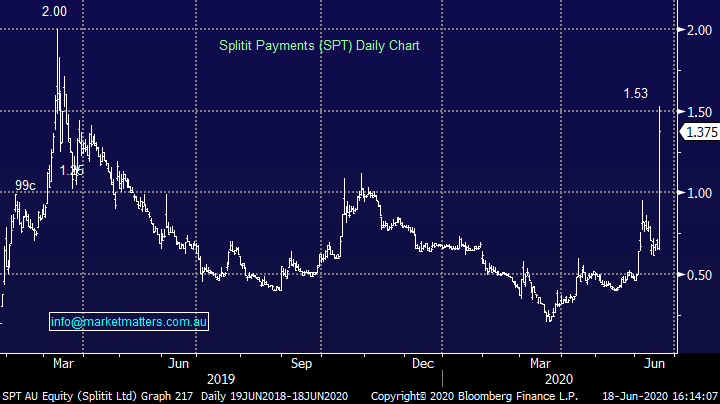

Splitit (SPT) +108.33%: the latest BNPL player to charge higher today, with shares in SPT more than doubling in the session after they announced a partnership with Mastercard. Clearly access to customers and merchants is key in the BNPL space, and the deal could potentially see Splitit capture a wide audience in just a short space of time and easily manoeuvre into new markets – it also sets them apart from the other names in the space. The network partnership bypasses the need to build relationships with each individual merchant – the path that other operators have gone down. There was no financial figure put to the market, but the story ran wild, as did the stock, which more than doubled, though it still trades at a discount to its all time high set soon after IPO early last year. A hot space for the traders. We like OPY & Z1P in the space, looking for a pullback in both to get on board again.

Splitit (SPT) Chart

BROKER MOVES:

· Ansell Cut to Neutral at Citi; PT A$35

· Carsales.com Cut to Neutral at Macquarie; PT A$18

· ResMed GDRs Raised to Overweight at Morgan Stanley; PT A$25.50

· SkyCity Entertainment Raised to Buy at Morningstar; PT A$3.10

· Galaxy Resources Cut to Neutral at JPMorgan

· Western Areas Cut to Neutral at JPMorgan; PT A$2.20

· Mineral Resources Cut to Neutral at JPMorgan; PT A$17.80

· Regis Resources Cut to Underweight at JPMorgan; PT A$4.10

· Fortescue Cut to Neutral at JPMorgan; PT A$14.60

· Carsales.com Cut to Neutral at JPMorgan; PT A$18

OUR CALLS

No changes today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.