Stocks succumb to virus headlines (QAN)

WHAT MATTERED TODAY

The market opened lower this morning, attempted to rally from the early sell-off before rolling over and sliding into the close The top losers told the risk off story with travel companies front and centre. Qantas dominated the news today (and I suspect that will be the case tonight) as they cut jobs and tapped the market for $1.9bn in fresh equity – Harry covers this below.

The news flow has clearly turned in the last 24 hours with the stats around the virus deteriorating, while more focus domestically is on the impact of reduced stimulus in September. Alan Joyce talked down the timing of the recovery while Wesfarmers CEO Rob Scott was vocal today on the need for further stimulus to fill the gap when Job Keeper etc rolls off in September.

Energy & growth-related stocks hardest hit today while CSL edged up, supporting the broader healthcare space as a result. One area catching my eye is the BNPL stocks, their strong recent run came to an end today with some decent selling kicking in, Z1P down ~7% to $5.49, starting to look interesting again while minnow Openpay (OPY) fell by 9%.

Overseas, US Futures traded down during our time zone while Asian markets were also soft.

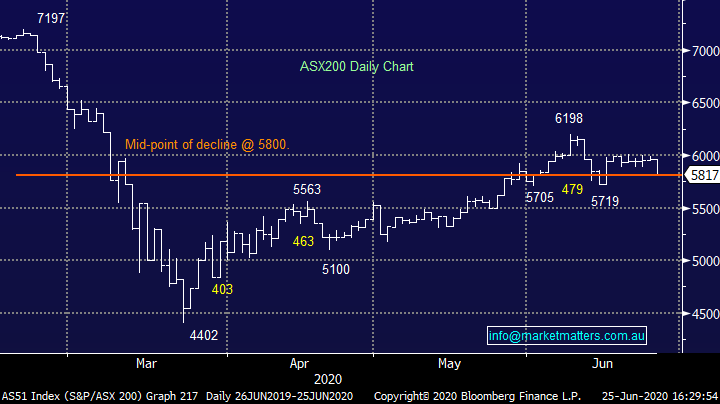

Overall, the ASX 200 fell -148pts / -2.48% today to close at 5817 - Dow Futures are trading down -142pts/-0.56%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

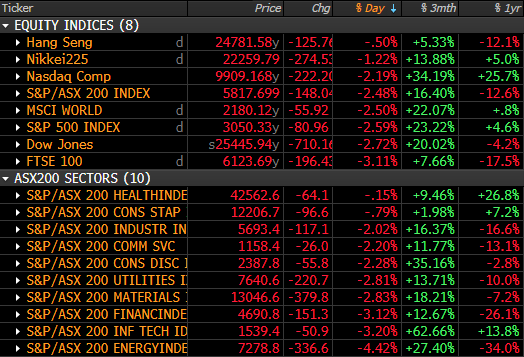

MOVES: The table here looks at moves for key markets over 1 day, 3 months & 1 year. The 3-month rally in the local tech index is a huge 62% hence the profit taking that came in today. Health stocks & consumer staples have lagged the 3-month rally however both sectors love a more risk off environment.

Market Moves

Source: Shaw and Partners

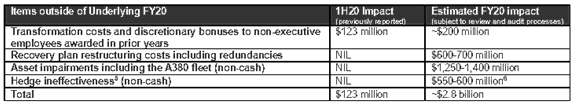

Qantas (QAN) unch: launch a chunky $1.4b institutional placement along with a $500m share purchase plan today with the airline bringing in sweeping changes to keep the businesses in operation and hopefully come out of the crisis in better shape. Institutions were offered stock at $3.65 a share, a healthy but not excessive 12.9% to yesterday’s close. The raise will add 25% to shares on issue with the cash being put to work to support the recovery plan and sure up the balance sheet. Ahead of the full year result, the flying kangaroo managed expectations at the result guiding the market to a small underlying profit for the full year while also releasing $2.8b worth of significant items as outlined below.

Source; Qantas

Qantas will sack 6,000 staff, with another 15,000 furloughed as it continues to operate on drastically reduced flight numbers. Domestic travel is starting to see more demand with flights now back to 15% of pre-COVID levels, however the company does not expect international flights to see any significant rebound for another 12 months. Alan Joyce is aiming fir $15b worth of savings in the business to be stripped in the next three years with the CEO committing to the roll through to FY23. The raise draws a line in the sand for Qantas as it is forced to become a drastically different business. The price looks on the full side for ours with the 13% discount on the tight side considering the number of unknowns still out there.

Qantas (QAN) Chart

BROKER MOVES:

· AusNet Raised to Sector Perform at RBC; PT A$1.75

· Qube Cut to Neutral at UBS; PT A$2.80

· Reliance Worldwide Cut to Sell at CCZ Statton Equities Pty Ltd.

· Adbri Cut to Hold at CCZ Statton Equities Pty Ltd.; PT A$3

· GWA Group Cut to Hold at CCZ Statton Equities Pty Ltd.; PT A$3

· IDP Education Cut to Neutral at Evans & Partners Pty Ltd

· IGO Reinstated Sell at Ord Minnett; PT A$3.70

· Mirvac Group Cut to Hold at Jefferies; PT A$2.58

· FlexiGroup Cut to Neutral at Credit Suisse; PT A$1.50

· Ramelius Cut to Sector Perform at RBC; PT A$2

· Qube Cut to Hold at Ord Minnett; PT A$2.95

· Sonic Healthcare Cut to Hold at Morgans Financial Limited

OUR CALLS

No changes today

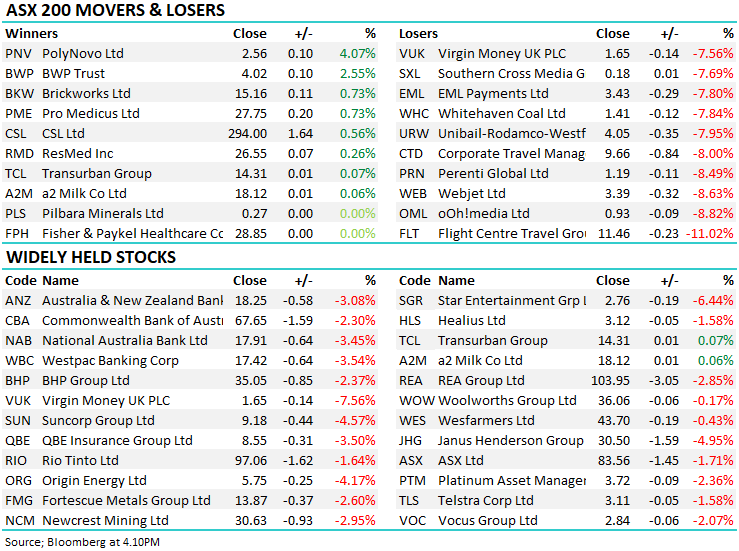

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.