Gold stocks shine as ASX grinds higher (EHL, PPT)

WHAT MATTERED TODAY

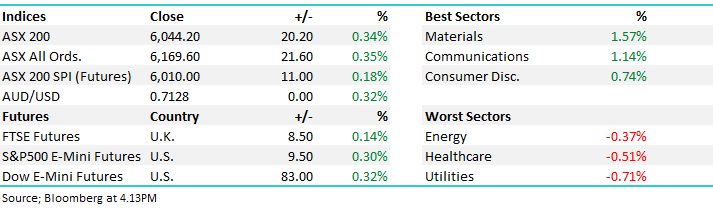

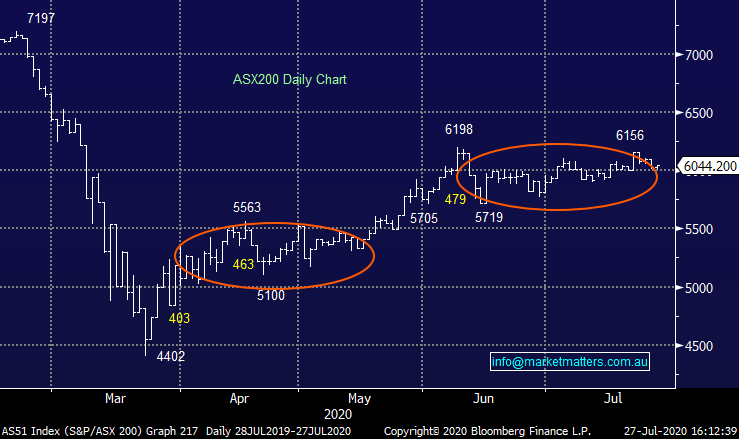

A tepid start to the week although perhaps more resilient again than the weekend headlines would imply, plus of course another worrying number out of Victoria as 532 new COVID-19 cases were reported. 17 new cases were reported in NSW with all being linked to existing sources. The worst of the market was seen early this morning, although it was down ~10pts at the lows and ended up trading in a very tight range +/-30pts throughout the day closing on its highs. The 6000 handle remains the sticking point for the market however the longer it saps up bad news and remains resilient, the more likely the break of the range will come on the upside.

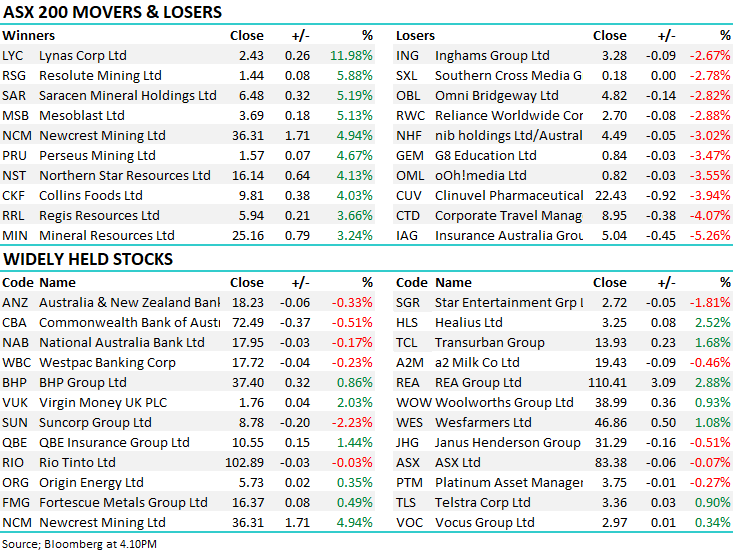

As a sector levels today, most love was seen in the Gold space with some impressive gains across the board – seems like the market is chasing Gold (US$1934) and Gold equities ahead of the FOMC meeting later in the week. On the flipside, the Utilities and Healthcare stocks lagged, the latter maily a function of CSL which grinded lower for most of the session – to MM, another leg lower in CSL would not surprise.

Overall, the ASX 200 added +20pts / +0.34% to close at 6044. Dow Futures are trading up +88pts / +0.33%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

Emeco Holdings (EHL) -4.81%: ended the session down today after initially rallying +7% on a good set of FY20 results. It looks to me like the stock rallied pre-result which smells a little but I’d also think that some large cap managers are taking this as a selling opportunity after EHL was removed from the ASX 200 at the last re-balance. Despite the mkt reaction, the result itself looked good with the highlights being:

- Operating EBITDA came in at $246.1m which was an increase of 15% on FY19, although that does include 4 months’ worth of Pit N Portal which they acquired in the period. They’d previously guided to EBITDA of between $244-247m so todays result hit the upper end of the band

- They’d targeted a net leverage ratio of 1.5x and got to 1.46x which is positive. Leverage has been an issue in this business however they’ve been progressively working to reduce this – more work to do however the trend is positive

- The rest of the result looks good relative to the level the stock is trading at, their exposure to Coal has been clearly been a negative, and it still accounts for 49% of total revenue which is down from 65% but still high none-the-less and weak coal prices hurt.

- They are expanding their resource base with Gold mining a clear opportunity for them.

EHL is our weakest position in the MM Growth Portfolio, it’s been frustrating stock and however the reason for owning still holds true (in our view).

Emeco Holdings (EHL)

Perpetual (PPT) unch: moved to raise $270m today as it looks to buy a controlling stake in US fund manager Barrow Hanley. The Aussie fundie will pay $US319m for the 75% stake, with around half of the price coming from existing cash and a new debt facility along with today’s equity raise. New shares will be issued at $30.30, a little under a 10% discount to Friday’s close with $225m placed to institutional investors and retail holders given the opportunity to take up shares in the SPP to come.

The Perpetual CEO Rob Adams was a key executive at Henderson during the merger with Janus a few years ago and has evidently taken a different direction on this deal. Barrow Hanley will add 21 strategies and more than triple the FUM under the Perpetual banner while the price comes at a steep discount to the earnings multiple Perpetual trades om (17x v 12x). The remaining 25% of Barrow Hanley will be held by the fund managers who elected to hold on to stock despite being given the option to sell down. Fund managers perform better when they hold equity upside, so I imagine Adams was happy to see the money managers holding tight.

We like the deal, though it does add some new outcomes to consider given we hold PPT in the income portfolio. For now there is no expected change the company’s policy of paying out between 80-100% of earnings, but they did flag changes to come looking to “strike a balance between maximising returns… retaining cash to fund operations and repay debt” while franking will also be impacted given the international portion of earnings. For now though, PPT expect to announced underlying earnings for the full year of $93.5m which would lead to a dividend of up to 88cps, inline with current market expectations. A big acquisition for PPT that will be ~20% earnings accretive in year 1.

Perpetual (PPT) Chart

BROKER MOVES:

· Mineral Resources Cut to Hold at Bell Potter; PT A$23.55

· CSR Raised to Buy at Citi; PT A$4.30

· Boral Cut to Neutral at Citi; PT A$4.22

· Monadelphous Rated New Equal-Weight at Morgan Stanley

· Downer EDI Rated New Equal-Weight at Morgan Stanley; PT A$4.60

· ALS Rated New Overweight at Morgan Stanley; PT A$8.80

· Gold Road Cut to Underperform at Macquarie; PT A$1.80

· Insurance Australia Cut to Hold at Bell Potter; PT A$5.85

· AGL Energy Cut to Underweight at Morgan Stanley; PT A$15.68

· GUD Holdings Raised to Hold at Morningstar

· Insurance Australia Raised to Buy at Morningstar

· Tabcorp Cut to Hold at Morningstar

· Premier Investments Cut to Sell at Morningstar

OUR CALLS

No changes today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.