Banks underpin strong gains for the ASX (GPT, ADH)

WHAT MATTERED TODAY

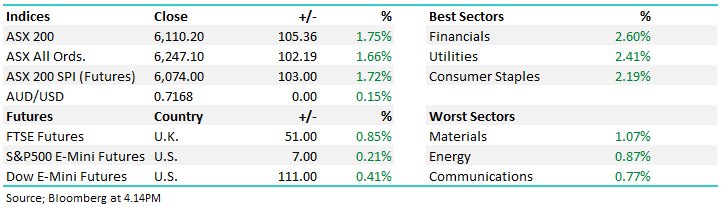

The bulls re-emerged today thanks largely to a resurgence in the banking space although the buying was broad based with 165 companies in the ASX 200 finishing higher on the day. In the banks, most love was seen in CBA / +3.44% followed by Westpac / +3.34% with the big 4 accounting for 30% of the index gain. On the weekend we wrote: When I cast me eyes over how stocks performed in both July and last week some banks jumped out at me including Commonwealth Bank (CBA) which initially looks headed another 5% higher while Bank of America (BAC US) looks to potentially have 40% upside, hence the question can the likes of Google (GOOGL) and Amazon (AMZN US) add 40% in the next 12-months, probably not is our thoughts after the last few years. MM feels the Financials are poised to outperform – a major contrarian call.

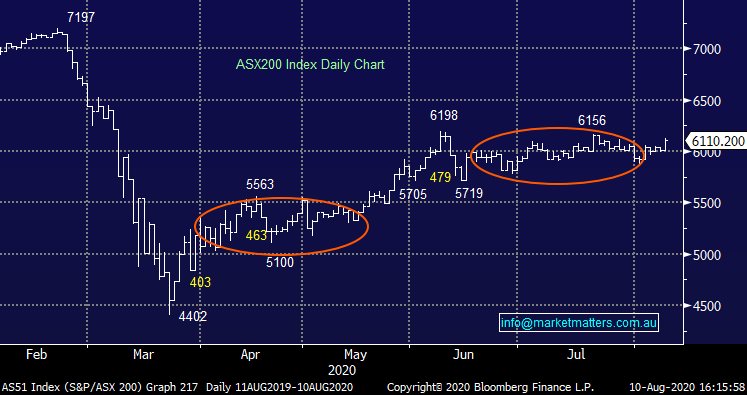

That trend started today and while one day certainly doesn’t make a summer, it feels like we need the banks to go on with it if we’re to break the current trading range which has been capped at 6200 for nearly 3 months now.

Asian markets failed to join the Aussie bulls today, the bulk of Asia trading lower while US Futures edged higher throughout our time zone.

Overall, the ASX 200 added +105pts / +1.76% to close at 6110. Dow Futures are trading up +101pts / +0.37%

In terms of reporting today, we saw CLW which we covered this morning – (click here) report full year numbers as did Adairs (ADH) which Harry covers off below – a great result with earnings per share (eps) for the year coming in at 21cps, a big number when we consider the stock traded at 44cps in March. We’ve given GPT a decent amount of airtime below as it provides a good insight into the broader property complex – they reported a mixed 1H20 result.

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

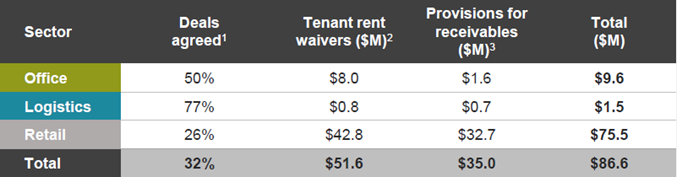

GPT Group +0.52%: the diversified property manager was out with half year results that confirmed the big separation in performance between classes of property through the first half of the year. GPT manage office, retail and industrial space making it a great bell weather for reporting season across the REIT space.

Office: Leasing held up reasonably well in the first half with the portfolio value cut by a slim 1.7%, while 94% of the rent was collected in the second quarter. GPT’s office exposure is high quality, though it currently sits at 94.4% occupied which is on the lower end of expectations.

Logistics: the key winner from COVID related changes to property owners, saw 98% of rents collected while valuations improved +2.3%. over the half. Demand for space remains strong here, with nearly 100% of the portfolio occupied and strong inbound demand for 2 current developments in Western Sydney.

Retail: Where the issues start to pop up with rental collections down significantly to 36% in the 2nd quarter, down from an already weak 90% print the quarter prior. 45% of GPT’s retail book is located in Melbourne so that while the company was heralding its 91% of stores open at 30 June, this number has since slipped considerably. As a result of the confluence of changes, the retail book value was downgraded 10.5% through the period.

Source; Company

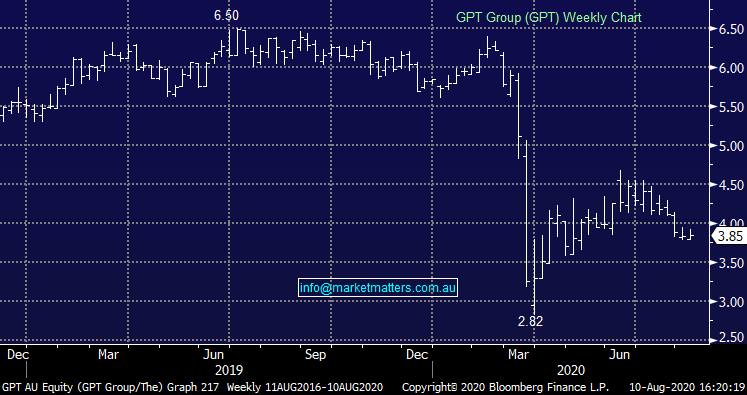

GPT are in the mist of re-negotiating a large portion of its leases with a total of 81% of rent collected over the book, the landlord expects to receive an additional 3% only with the remainder either provisioned for, or lost to new agreements. They announced funds from operations (FFO) of 12.55cps, down 23% on last year despite growth in leasable space. The interim dividend of 9.3cps was nearly a 30% cut to last year. Concerningly, GPT blamed a 25% increase in incentives on successful lease deals, though this is often a leading indicator of further cuts to rent. Despite the dire read, the market was reasonably supportive of the stock today – it currently trades on a steep discount to NTA which came in at $5.52 at the end of the financial year.

GPT Group (GPT) Chart

Adairs (ADH) +11.31%:one of the winners of lockdowns appears to be homewares retailer Adairs which saw EBIT rise 24% in its main brand, while the contribution of the online only company Mocka helped total group EPS rise 17% to 21c, a 9% beat to estimates. Online sales were the main driver with a meteoric 110.5% rise, making up 31.9% of total sales. Despite the up to 8 weeks’ worth of lockdowns, in store LFL sales also comped positively to the tune of +3.9%. Clearly spending that would otherwise have been directed to tourism or activities that were restricted was redirected towards spending on home comforts. Despite the online growth explosion Adairs was not looking to significantly reduce the store footprint noting the collective strategy was far more effective than a singular focus. i.e. the omni channel approach I spoke about with Danny Younis recently.

A key differentiator to the competition is the Linen Lover membership Adairs offers which now has over 800k paid customers – a network that is invaluable in terms of repeatable business. While lockdowns may not last forever, Adairs looks to have leveraged the impact to create lasting value in the business. While no guidance was provided, the momentum had continued into the first 5 weeks of the new financial year.

Adairs (ADH) Chart

BROKER MOVES:

· Mineral Resources Cut to Underweight at JPMorgan; PT A$21.40

· Nick Scali Cut to Market-Weight at Wilsons; PT A$8.10

· Super Retail Cut to Sell at Morningstar

· Coronado Global GDRs Rated New Hold at Benchmark

· REA Group Cut to Neutral at JPMorgan; PT A$104

· Sonic Healthcare Raised to Buy at Jefferies; PT A$38

OUR CALLS

No changes today

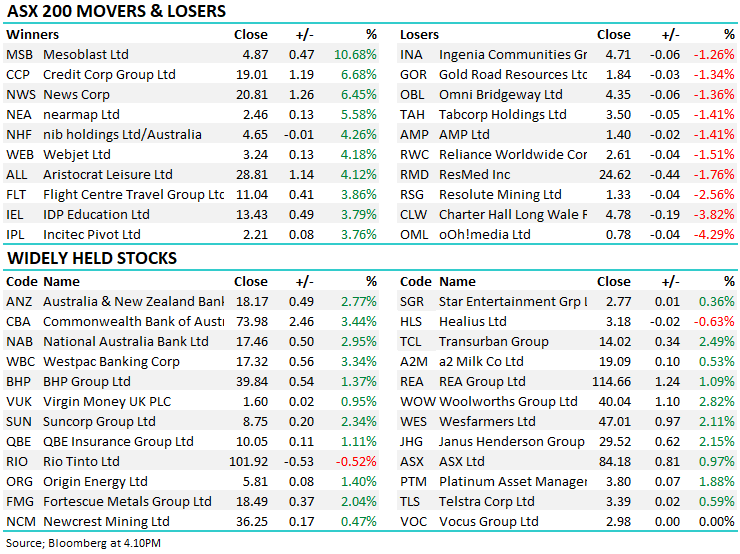

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.