ASX muted as reporting kicks up a gear (MFG, CPU, CBA)

WHAT MATTERED TODAY

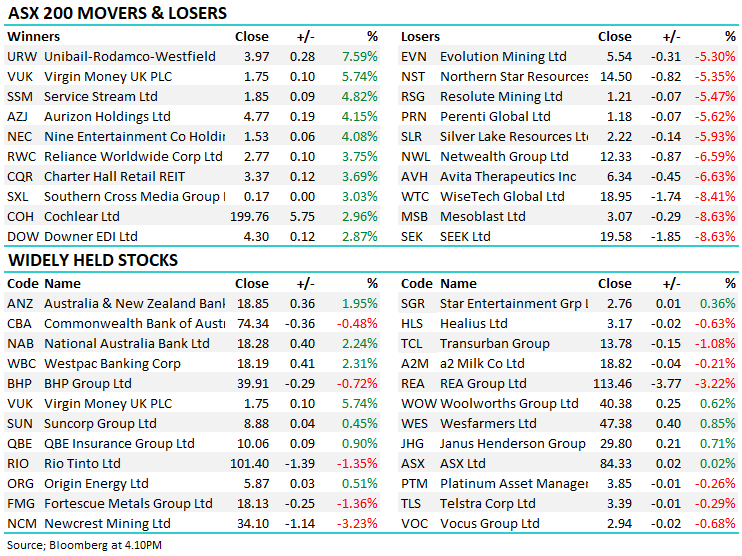

A mixed session in Australia today with slightly more stocks down than up with some big moves at the individual stock level. On the positive side the financials were well supported as we flagged they might be in the AM note while the property stocks again did ok, defying the media gloom – the top performer today being Unibail-Rodamco-Westfield which added nearly 8% followed closely by the beaten up Virgin Money (VUK) which put on 5.74%.

Gold stocks fell hard, although the worst was seen early as buyers emerged (sort of) into the decline – MM included. Newcrest (NCM) finish down 3.23% at $34.10

Asian markets a mixed bag today while US Futures were stronger than our market implied.

Overall, the ASX 200 lost -6pts / -0.11% to close at 6132. Dow Futures are trading up +172pts / +0.63%

Reporting today dominated proceedings and the same will be true for the rest of the week and next. Today we had CBA (okay), CPU (inline/ weak outlook), Seek (inline, poor outlook), Magellan (slight beat / no guidance), Transurban (slight miss, no real guidance) – more on some of these below.

LOCAL REPORTING CALENDAR: **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

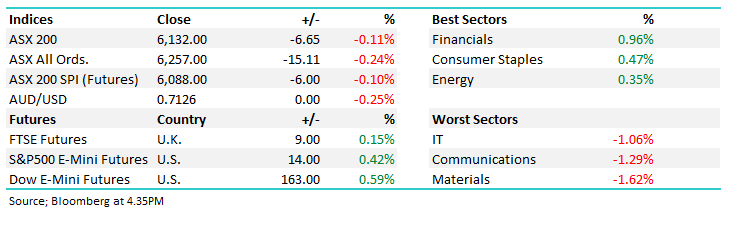

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

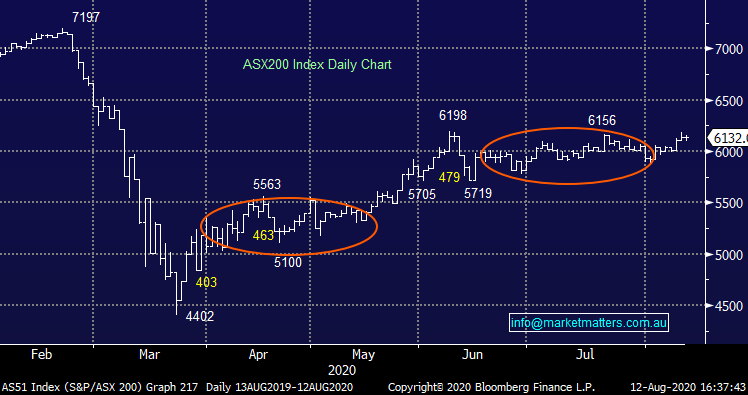

Magellan (MFG) +2.8%: full year results came in ahead of expectations with Adj. NPAT of $438.3m beating analyst expectations by 2% and 5% above last year’s result. The beat came despite a drop in performance fees for the group, being driven by management fees outpacing expense growth. This comes despite Magellan pushing on with bonus payments for FY20 given that the company continued to perform well despite the impacts from COVID. Each of the company’s funds continue to perform well with the Global, Infrastructure and new acquired Airlie funds beating out the relative benchmark, and the High Conviction fund posting +6.1% return for the year. We like MFG into weakness.

Magellan (MFG) Chart

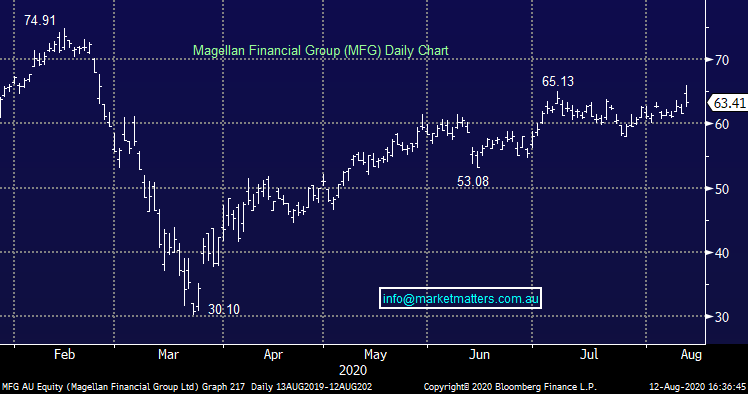

Computershare (CPU) -3.29%: downgraded multiple times through the year, Computershare actually came in marginally ahead of expectations for FY20 in the end, printing management EPS of 56.34c, down nearly 20% on last year but ~2% above the market. The registry has seen further margin squeeze as both average balances and interest rates fall globally. This weighed on the company’s outlook, with EPS expected to fall a further 11% next year, missing expectations by 4.5%. Without margin income, EBIT would be expected to see 10% growth, so Computershare are executing in the thing they can control, however the main earnings driver faces a headwind.

Computershare (CPU) chart

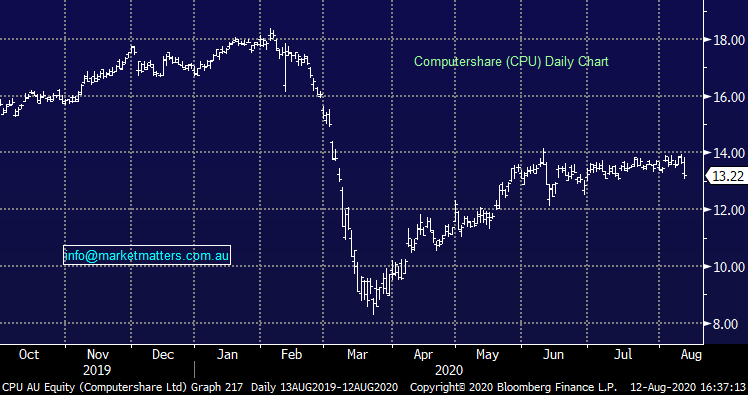

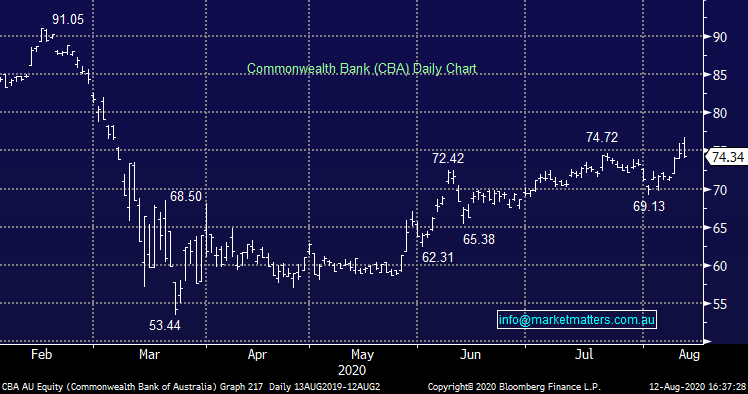

Commonwealth Bank (CBA) -0.48%: Released FY20 results this morning and I said on the recording this (click here) that it was a good result and it was with CBA showing why it’s the No 1 bank in Australia. Reading through initial analyst commentary some are suggesting that cash profit was a decent miss ~7%, however a number of analysts (including ours) had earnings from Colonial in as a continuing operation which was not the case – CBA left that out. In any case there was some swings and roundabouts in the overall result, however following the conference call, I’m comfortable with our large position in the stock.

The dividend of 98cps for the half takes the full year payout to $2.98 fully franked, that’s obviously down sharply on last year but well ahead of what had been expected following APRA’s insistence of paying no more than 50% of earnings out in dividends. CBA paid out 49.95%! That move had a strong impact on capital which is sector leading with tier 1 at 11.6%. The nuts and bolts were as follows:

· Cash EPS was $4.13 for FY20 the dividend was $2.98, which included a final dividend of 98 cps.

· Capital is the strongest of the major banks with the common equity tier 1 (CET1) ratio at 11.6%.

· Income was down 2% from 1H20 to 2H20 on a cash earnings basis which included a 1% decline in net interest income. Average loan growth of 2% was offset by net interest margin (NIM) decline.

· NIM declined from 2.11% in 1H20 to 2.04% in 2H20 with half the decline due to a 12% increase in liquids.

· Commissions declined by 6% from 1H20 to 2H20 and there was a $108M impairment of aircraft assets in 2H20, which resulted in other banking income declining by $249M or 10% over the period.

· Expenses increased by 9% from 1H20 to 2H20 as a result of a $454M increase in the cost of the customer remediation program.

· The bad debt charge was $1.2B higher in 2H20 compared to 1H20 due to higher COVID-19 provisions. New impaired assets fell slightly from 1H20 to 2H20. The only area of notable increase in arrears was in credit cards.

All up: while there were areas of disappointment, there were also areas of pleasant surprise (being dividends, capital and credit quality).

Commonwealth Bank (CBA) Chart

BROKER MOVES:

- SCA Property Raised to Hold at Moelis & Company; PT A$2.44

- Challenger Raised to Outperform at Macquarie; PT A$4.50

- James Hardie GDRs Cut to Neutral at Citi; PT A$33.10

- Aristocrat Cut to Neutral at Evans & Partners Pty Ltd; PT A$31

- WiseTech Cut to Sell at Citi; PT A$18.40

- Sydney Airport Raised to Neutral at Citi; PT A$5.61

- Adairs Raised to Overweight at Wilsons; PT A$3.85

- Qantas Cut to Hold at Morningstar

- Origin Energy Cut to Hold at Morningstar

- Sydney Airport Cut to Hold at Morningstar

- Sydney Airport Raised to Neutral at JPMorgan; PT A$5

- Cleanaway Cut to Neutral at Goldman; PT A$2.33

- BC Minerals Rated New Buy at Bell Potter

OUR CALLS

No changes today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.