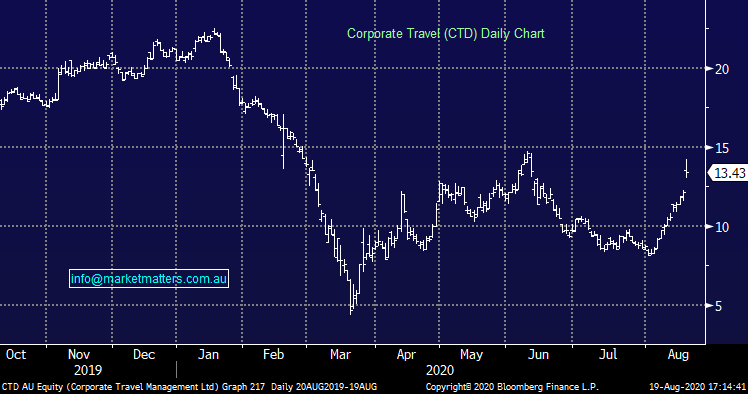

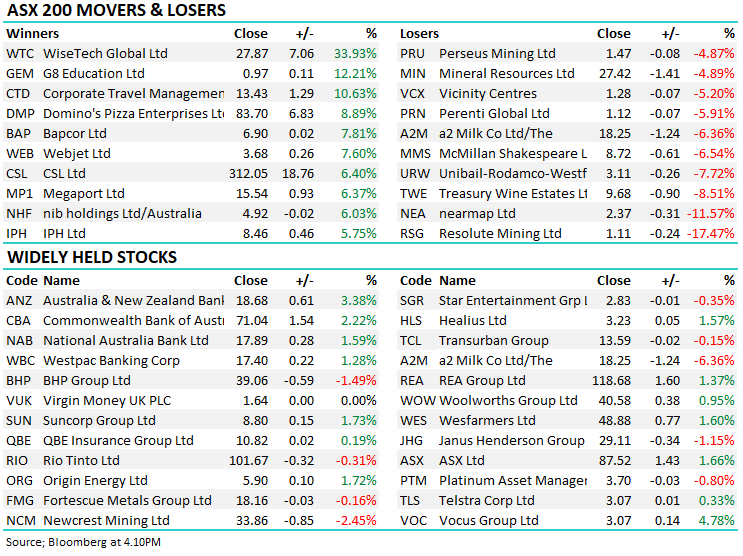

Reporting underpinned some big moves today, generally positive (NWH, CSL, CTD, OZL, SSM, BAP, CAR, DMP, PGH)

WHAT MATTERED TODAY

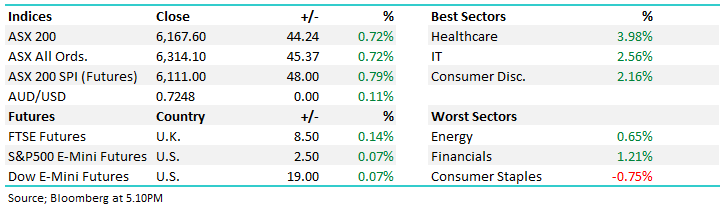

There was a point today that the ASX 200 looked like it was going to break out of its stubborn 3 month trading range, it traded within 2pts of the high, but again, it failed. CSL was the main driver at the index level today with the 6% gain on the stock adding +26pts to the 200, but alas, it just wasn’t enough. There was standout performances today from companies that reported numbers, the majority of which we cover off below.

Again, healthcare the standout, 2 days on the trot now which the defensive areas lagged.

Overall, the ASX 200 added +44pts / +0.72% to close at 6167. Dow Futures are flat

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

NRW Holdings (NWH) +5.67%: FY20 numbers out today and they were largely as per programmed, which seems to be somewhat of a relief by the market. They delivered FY20 revenue of $2.03b inline with expectations while profit was a slight beat coming in at $89.7m v $86.9m the street was thinking. They had pre-guided in terms of revenue so the result shouldn’t have come as too much of a surprise however the commentary was upbeat and they’re well positioned for a strong FY21 - we added to our position today in the growth portfolio.

NRW Holdings (NWH) Chart

CSL Limited (CSL) +6.4%: When I covered CSL this morning in the recording they’d delivered an inline result plus guided to profit for FY21 of $2.1bn-$2.26bn which implies only small growth on the $2.11bn delivered in FY20 + was a ~5% miss to current market consensus, yet the stock still put on +6.4% - why? The market was concerned about plasma collections during lockdowns however CSL spoke to that on the conference call saying collections were down 20-30%, not the 60-70% some were expecting + they talked up higher inventory levels. They also said that collections had bounced back strongly since then and that’s the key to today’s performance. Also helping is the expectation that CSL will produce the locally manufactured COVID-19 vaccine (when it comes) and of course, they’re one of very few companies that have provided concrete guidance, although it was a miss, it still shows a degree of confidence.

CSL Limited (CSL) Chart

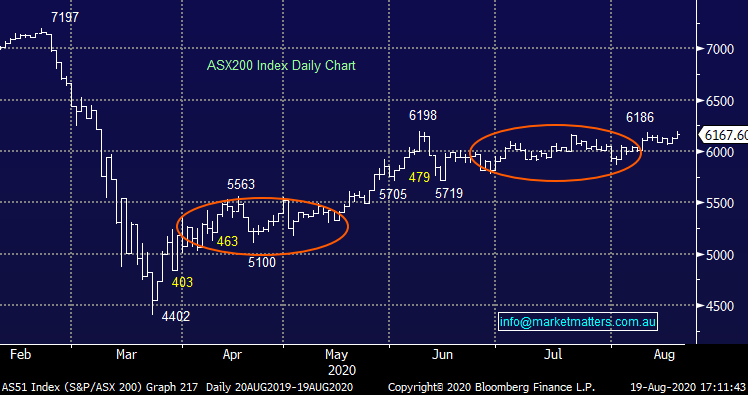

Corporate Travel (CTD) +10.63%: A stock we wrote about favourably earlier in the week as a leveraged play on a vaccine / economy reopening and today they delivered a better result than downbeat expectations. Revenue was $349.9m v $331m expected, underlying NPAT wad $32m v $31m expected and they talked to a strong level of client retention (97%) and winning of new business in all regions they operate in. 4Q20 performance was better than they guided to in May, they lost $3m a month on average v the $5-10m they were expecting with net cash sitting at $55m as at the 17th August v $60m at end of June. While a long road to recover awaits, we like CTD’s low fixed cost business model and exposure to essential business related travel, although conceded that we’re now in a new world where a combination of Zoom + face to face will be the future…

Corporate Travel (CTD) Chart

Oz Minerals (OZL) +3.90%:1H20 result this morning showing underlying NPAT of $80 million (up 82%) on higher volumes and a strong gold price, EBITDA of $251 million (up 55%) at a robust operating margin of 44%, strong operating cash flows of $151 million (up 49%), Fully franked interim dividend of 8 cps declared. In terms of production guidance, we saw upgrades across all operations following strong H1 performance – all in all, a hard result to fault.

Oz Minerals (OZL) Chart

Service Stream (SSM) +2.75%: Reported FY20 results aftermarket yesterday that were broadly inline with expectations. Revenue was a tad light however profitability was sound. The market didn’t have a lot baked in here in terms of FY21 numbers and while SSM didn’t provide specific guidance, they said earnings are expected to remain resilient, which I’ll take as a positive.

Service Stream (SSM) Chart

Bapcor (BAP) +7.81%: the vehicle parts retailer beat expectations despite a near 20% slide in earnings in FY20. NPAT on a pro-forma basis (including new acquistions) came in at $89m, around 3.5% ahead of expectations with the result driven by strong LFL sales across the Burson and AutoBarn brands as well as Online sales up 240% in the year. Momentum has continued into FY21 as well with the company pointing to falling spend on travel and entertainment as well as stimulus measures as key drivers. Today’s presentation also noted that there has been no change to the company’s 5 year plan as it targets growth through further acquisitions, tech investment and opening new sites. While its been given the tailwind through COVID, the best lies ahead for BAP if it can continue to expand – we like BAP, expecting a challenge of pre-COVID highs.

Carsales.com (CAR) +4.28%: the classified’s business rallied to a new all-time high today on the back of a 6% increase in profits. As we have noted in recent reports, the car industry has seen interest pick up as the population loos to avoid the use of public transport while instant asset write-off and early superannuation withdrawals has also bolstered demand. Carsales adjusted NPAT of $138m was ~17% ahead of the market with cost cutting measures key in helping boost margins and the result. While no specific guidance was given, they did note positive trends remain for the auto market, while there has been an obvious drag on the back of lockdowns in Victoria. The market is looking for low single digit growth in FY21. Crashes looks strong here on the breakout above $20.

Dominoes (DMP) +8.98%: Another stock to crack all-time highs today was the pizza chain which posted NPAT growth of 3% to $146m. This was a slight miss to expectations, though the market was more concerned with the company’s continued growth plans and strong sales momentum into the new financial year. The company brought forward CAPEX as it looked to further develop the online offering , while costs were higher on COVID support for impacted stores. Divisionally A&NZ saw same store sales (SSS) of +5.1%, Europe +2.8% and Japan of 18.4%. Sales have remained elevated into FY21 with lockdowns helping the eat-at-home trade while the medium term guidance targeting SSS growth of 3-6% and new store opening of 7-9% which is positive considering the complications with opening new sites in the current environment.

Pact Group (PGH) +2.11%: an old MM holding – closed better but sold well off the day’s high today. Profit was a 14% beat, adding 5% on the year to $73m despite a small fall in revenue. The market was also pleased with a balance sheet improvement though still running a reasonably high net debt to EBITDA ratio of 2.6x. They’re doing well in terms of turning the Australian business around and focussing on recyclable & reusable products, including the acquisition of Flight plastics. It has recommenced the sale process of the contract manufacturing business which was pulled as a result of COVID restrictions. There was no specific outlook given, though trading in current period was described as resilient.

BROKER MOVES

* Dexus Raised to Overweight at JPMorgan; PT A$9.65

* Cochlear Cut to Sell at Citi; PT A$184

* Saracen Mineral Raised to Buy at UBS; PT A$6.75

* Sims Raised to Outperform at Macquarie; PT A$9.50

* Monadelphous Raised to Outperform at Macquarie; PT

A$11.57

* GUD Holdings Cut to Sell at Morningstar

* Monadelphous Cut to Hold at Morningstar

* BWP Trust Cut to Sell at Morningstar

* Netwealth Raised to Neutral at Credit Suisse; PT A$14

* Sims Cut to Underperform at Jefferies; PT A$6

* Coles Group Cut to Neutral at JPMorgan; PT A$19

* Monadelphous Raised to Neutral at JPMorgan; PT A$10.80

* BHP Cut to Neutral at Goldman

* Monadelphous Cut to Hold at Jefferies; PT A$11

* Altium Raised to Hold at Ord Minnett; PT A$31.15

OUR CALLS

In the growth portfolio today, we cut RIO for a profit, added to NRW holdings (NWH) and bought Monadelphous (MND)

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.