Stocks end month up 2.2%, Temple & Webster soars, IOOF makes big play on MLC (TPW, OPY, IFL)

WHAT MATTERED TODAY

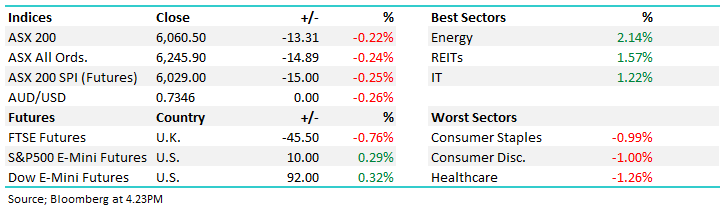

The end of August reporting today and it’s been a solid month overall with the index adding more than 2%, not the result that many were predicting leading in, however with expectations so low it seemed the hurdle to jump over wasn’t exceptionally demanding - we cover the various sectors / stocks below.

Livewire Markets Videos: Last week I filmed some Buy Hold Sell videos for Livewire Markets. I was on with Henry Jennings from our arch rivals at Marcus Today. I actually worked with Henry about 10 years ago, he’s a good guy.

Buy Hold Sell – 4 Outstanding Results (and 2 shockers) – click here

Buy Hold Sell – 5 Comeback Kings – click here

Asian markets were mostly lower today (bar Japan) while US Futures are trading higher.

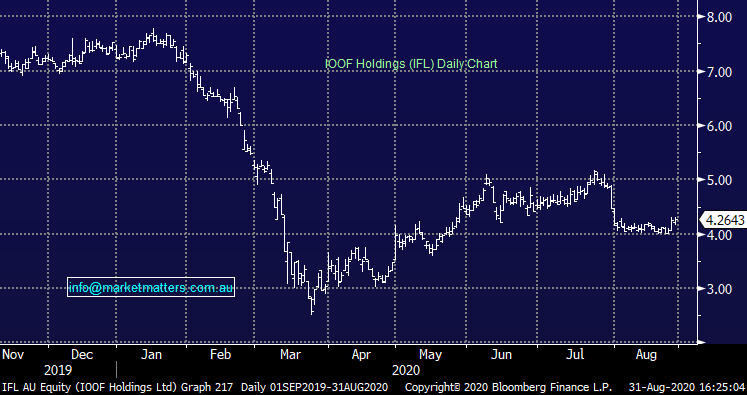

By the close, the ASX 200 fell by -13pts / -0.22% to 6060.

ASX 200 Chart

ASX 200 Chart

x

x

CATCHING MY EYE

Monthly Stats: Always interesting particularly around reporting season: The ASX200 added +2.24% for the month with the IT sector the standout adding 15.26%, followed by consumer discretionary (retailers) +7.78% and Real-Estate +7.31%. Financials & Materials finished pretty flat for the month. The biggest drag came from utilities which fell by -5.86%.

From a stock perspective, the vaccine trade saw a kick with Corporate Travel (CTM) the leader in the ASX 200 – Webjet (WEB) also made the cut. On the other side of the ledger, Whitehaven Coal (WHC) was a disaster.

Source: Bloomberg

Temple & Webster (TPW) +18.03%: Another phenomenal result from TPW both in terms of their FY20 numbers, but also in terms of their trading update for the first part of FY21. Firstly for FY20, revenue was in line with expectations at $176m however net profit was a strong beat coming in at $13.9m v $8.35m expected, although there was a big tax benefit of $5.9m in there. The real kicker that drove the SP today was the run rate currently in FY21. Top line sales are up 161% on this time last year which they say will drop to EBITDA for July and August (alone) of ~$6m - to put that number into context, they did EBITDA of $8.5m for FY20 (entirely). There is a lot of optimism built into the SP of this company at current levels, however they continue to deliver and now importantly, have significant scale with more than 500k active customers.

Look out for a large national TV ad campaign starting soon while they’ve made a small investment into a start-up developing AI interior design tools, showing where the future could lie... All in all, it’s hard to fault todays update hence the big pop in share price.

Temple & Webster (TPW) Chart

Buy Now Pay Later: Another session where this space dominated news flow, with Openpay (OPY) and Sezzle (SZL) reporting full year earnings while we had Z1P management into Shaw to give some more colour around their results last week. The former two names have finished sharply lower today, SZL down -9.44% and Openpay (OPY) -8.09%, the latter (Z1P) up +3.15%.

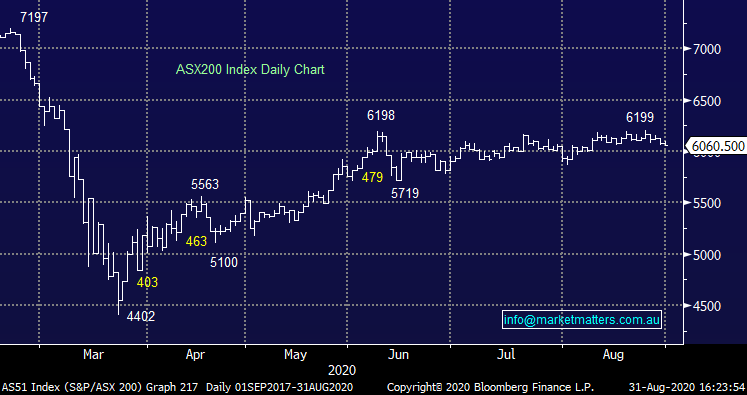

In terms of the OPY result it was at the lower end of their February trading update which had guidance for an EBIT loss of ($35-$40m) - lower end = better when talking losses, however all metrics had largely been pre-announced in more recent updates. Growth remains strong with active customers +145% from 139k in pcp to 340k (APT has 9.9m & Z1P 4.1m as means of context) while total transaction value was +114% from $11.2m in pcp to $24.0m – comprising 27% online and 73% in-store in Australia. All up, a decent result, but nothing new and the stock has enjoyed a strong run into it. Also important to note there are ~30m shares being released from escrow shortly and given the run in the SP, we’d assume these could hit the market.

Source: OPY prospectus

In terms of Sezzle (SZL) they reported results + gave a July trading update. Overall, a decent run rate although like OPY, it had mostly been pre-released. Most important was the July update which showed the sector continues to accelerate and it seems momentum right across the space remains solid. We haven’t had much to do with SZL in the space however they’re coming in later in the week – more detail to come then.

Openpay (OPY) Chart

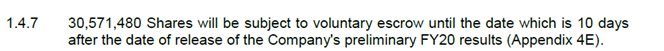

IOOF (IFL) halt: didn’t trade today as it looks to raise around $1b to fund the acquisition of MLC – i.e. a very big bite at the cherry with the total cost around $1.44b for the advice and platform arm of NAB. The raise will be completed through an entitlement offer of 1 for 2.09 shares held and a placement which is underwritten at $3.50 a share, 22.5% below last traded. The steep discount comes given a total of 297m new shares will be issued, around 85% of the current number of shares on issue. It’s a big raise, but it is also a transformative acquisition for the company. MLC is the number 1 retail wealth manager by funds with $510b across 1,884 advisers. IOOF expects $150m of synergies by the third year, 20% EPS accretive for FY21.

The NAB deal comes as IOOF progress with the integration of the ANZ P&I business with that acquisition only completed 6 months ago. It will be a tumultuous task to combine the behemoths that are these three businesses but if done right, the outcome could be exceptional for shareholders as scale drives earnings. IFL also released their FY20 results alongside the capital raise, with underlying NPAT of $128m in line with market expectations.

IOOF (IFL) Chart

Service Stream (SSM) +5.79%: was a slow starter today but saw momentum build through the session after it announced a new partnership with the NBN. Service Stream has been contracted to NBN throughout the build of the network and today’s announcement extends the relationship for another 4 years, with 2 additional 2-year options attached with Service Stream working across the eastern mainland states. The contract will generate around $60m in its first year and is expected to increase as the contract progresses and further activities are included. We have a small weighting in the MM Growth Portfolio, although it’s been a challenging position.

BROKER MOVES

· Aurelia Raised to Buy at Ord Minnett; PT 75 Australian cents

· Silver Lake Raised to Hold at EL & C Baillieu; PT A$2.22

· GTN Ltd Raised to Speculative Buy at Canaccord

· OceanaGold GDRs Cut to Neutral at UBS; PT A$3.40

· Autosports Raised to Outperform at Macquarie; PT A$1.65

· Ampol Raised to Buy at Morningstar

· PointsBet Cut to Underperform at Credit Suisse; PT A$6.50

· NextDC Raised to Overweight at JPMorgan; PT A$13

· Costa Rated New Hold at Jefferies; PT A$3.10

· Link Administration Cut to Hold at Morgans Financial Limited

OUR CALLS

No changes today

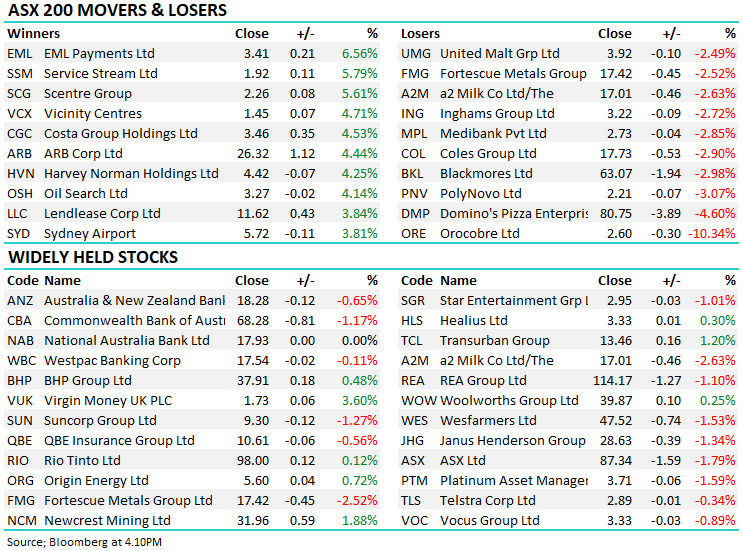

Major Movers Today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.