Tuesday’s sell off a world away as equities bounce again (SKC)

WHAT MATTERED TODAY

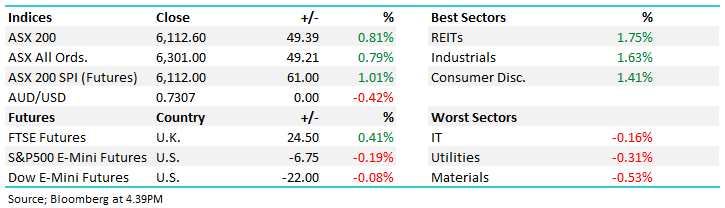

Financials, healthcare and REITs carried the index today as the resources and tech names gave back some of the outperformance – the same trend seen in the US overnight. Liquidity is still the key driver of markets with equities supported despite the continuing threat of the virus and the looming event risk of the US election. Tech also lagged last night as Trump made a push to have processes ready for a potential vaccine launch on November 1, just 2 days before the election is due. A classic Trump move – if the vaccine makes it before the election, he is heralded a winner for fast tracking the development whereas if it doesn’t arrive in time there are plenty of people to point the finger at in his bid for re-election. Tech names have benefitted from the stay-at-home trend, so the news took some shine off the shares prices.

Xero (XRO) further contributed to the tech weakness as founders sold down large blocks of stock, initially at $99 for 2m shares before the market opened, before a second line at $100 for 1m was stamped at 10.30am. REITs were better with Dexus leading. Murmurs of Blackstone sifting through the accounts of the property group fuelled buying today, lifting the broader sector. Some economic data out today – local PMI numbers improved, though remain contractionary below 50. Trade balance was softer though with imports rising and exports falling to miss expectations.

By the close, the ASX 200 was up 49pts / +0.81% to 6112. Dow Futures are trading down -22pts / -0.08%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

SkyCity Entertainment (SKC) +7.36%: one of the reporting season stragglers, SkyCity operate 3 casinos in NZ as well as one in Adelaide. Profit took a hit given its exposure to NZ where lockdowns were far more stringent than ours, falling nearly 60% in the year to $NZ66.3m, though this was 7.5% better than analysts had pencilled in. Even better was guidance – EBITDA for FY21 is expected to come in higher than FY20 which came in at $200.7m, already ahead of the markets expected FY21 print of $190.6m. Key to the forecast is the Adelaide casino which is running cashflow positive since re-opening in late June as well as an influx of users on the NZ online casino offering.

SkyCity Entertainment (SKC) Chart

BROKER MOVES

· Nufarm Raised to Neutral at Macquarie; PT A$4.26

· Evolution Raised to Neutral at Macquarie; PT A$5.60

· South32 Raised to Buy at HSBC; PT A$2.06

· Reliance Worldwide Cut to Hold at Morningstar

· Costa Cut to Sell at Morningstar

· PointsBet Cut to Hold at Ord Minnett; PT A$13.60

· IOOF Holdings Raised to Overweight at JPMorgan; PT A$4.15

· Nufarm Raised to Hold at Jefferies; PT A$4.50

OUR CALLS

No changes today

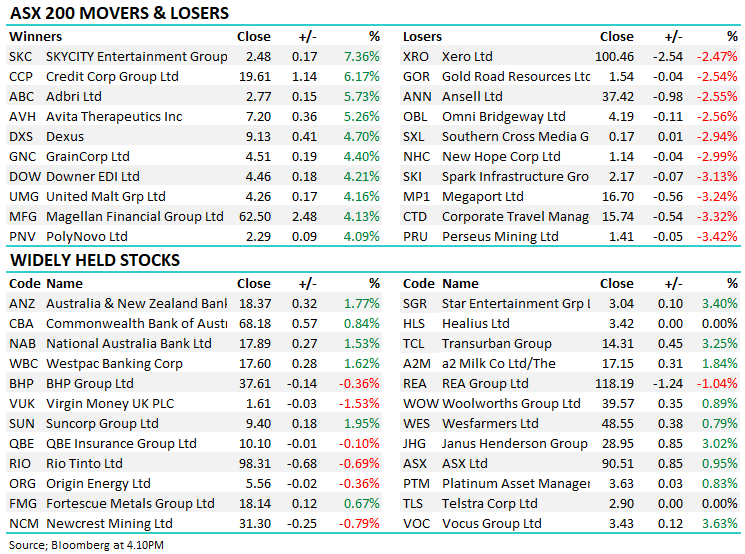

Major Movers Today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.